The reassessment notices have been quashed by the Bombay High Court and have been issued based on the data obtained via the Directorate General of GST.

The bench of Justice K. R. Shriram and Justice Neela Gokhale has marked that the AO is referring to the data obtained from the Directorate General of GST. Nothing to demonstrate that he independently applied his mind to the material obtained or that he has analyzed the response from the applicant with the material received, which shows the total non-application of mind.

A reassessment notice issued u/s 148A(b) of the Income Tax Act, 1961, the order passed under Section 148A(d) has been contested by the applicant.

All submissions have been dismissed by the AO quoting that simply providing copies of purchase invoices, E-way Bill, Transport Bills and payments made via banking channels are not adequate to substantiate that the transaction made by the taxpayer company with EMI Transmission Ltd. is real.

AO said that the Directorate General of GST, Mumbai has recognized one Curzen Infraprojects Pvt. Ltd. (formerly known as Blue Sea Commodities) was generating fake/bogus invoices for passing fraudulent Input Tax Credit (ITC) without supply of goods to various companies and EMI Transmission Ltd. was one of them, as Petitioner dealt with EMI Transmission Ltd. and the transaction is non-genuine.

If the order itself reveals the lack of reasoning by the Assessing Officer, then granting approval u/s 151 shows a complete lack of critical thinking. The products purchased from EMI Transmission Ltd. were actually sold to third parties, and we agree with the Petitioner that without a purchase, there cannot be a sale, the taxpayer argued.

The order has been quashed by the court and the case is for de- novo consideration, which will be regarded by the Jurisdictional Assessing Officer (JAO), who will be other than Lehandas Arjun Janbandhu, who passed the order. Therefore, under Section 148 the notice issued is quashed and set aside.

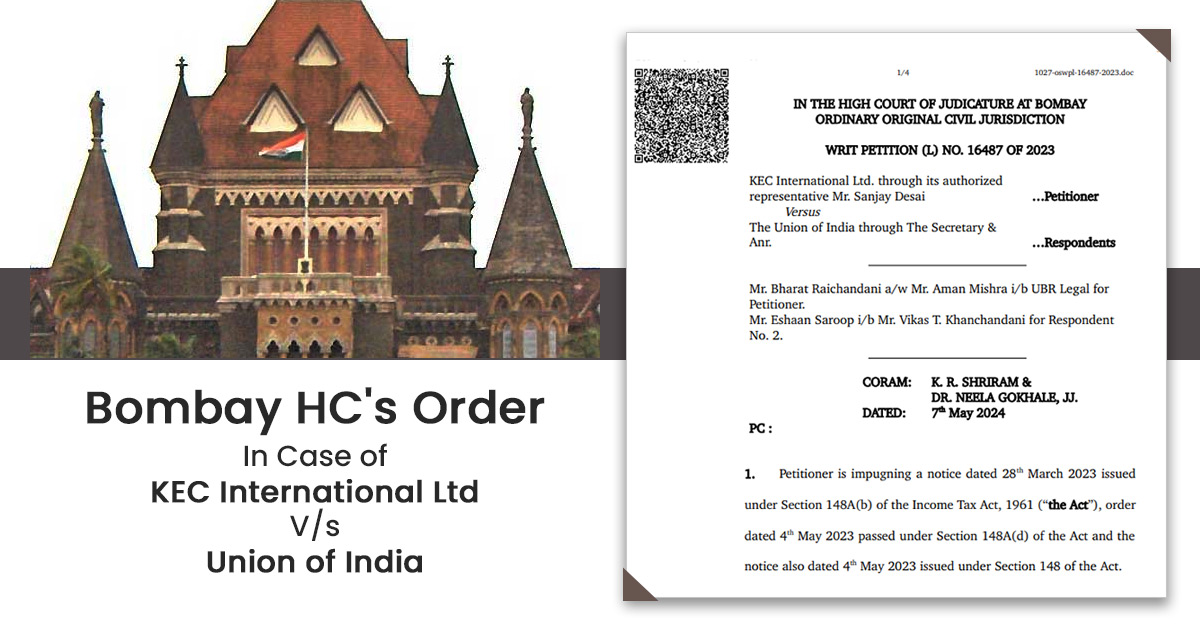

| Case Title | KEC International Ltd VS Union of India |

| WRIT PETITION (L) NO. | 16487 OF 2023 |

| Date | 07.05.2024 |

| Petitioner | Mr. Bharat Raichandani a/w Mr. Aman Mishra i/b UBR Legal |

| Respondent | Mr. Eshaan Saroop i/b Mr. Vikas T. Khanchandani |

| Bombay High Court | Read Order |