The notification issued under section 148 of the Central Goods and Services Tax Act, 2017 on 9th October 2019 made it optional to file Annual returns for the fiscal year 2017-18 and 2018-19, for the registered persons whose aggregate turnover in a financial year is not more than two crore rupees and who have not filed the annual return under sub-section (1) of section 44 of the CGST Act.

Clarifications in the notification by CBIC GST circular number 124/43/2019 have been issued to bring off uniformity in the operationalisation of the legal provisions across the nation.

Taxpayers executing tax liability u/s 10 has to furnish the annual return in FORM GSTR-9A, according to the provision of sub-rule (1) of rule 80 of the CGST Rules, however, the notification issued on 9th October 2019 made it optional for those registered persons whose aggregate turnover in a fiscal year is not more than two crore rupees, to furnish the annual return for FY 2017-18 and 2018-19.

Central Board of Indirect Taxes and Customs clarifies that the assessees under composition scheme, may also file FORM GSTR-9A for the FY 2017-18 and 2018-19, at their own choice but before the due date.

It should be noted that after the due date of filing the annual return for the FY 2017-18 and 2018-19, the common portal of return filing shall not allow the taxpayer to file FORM GSTR-9A

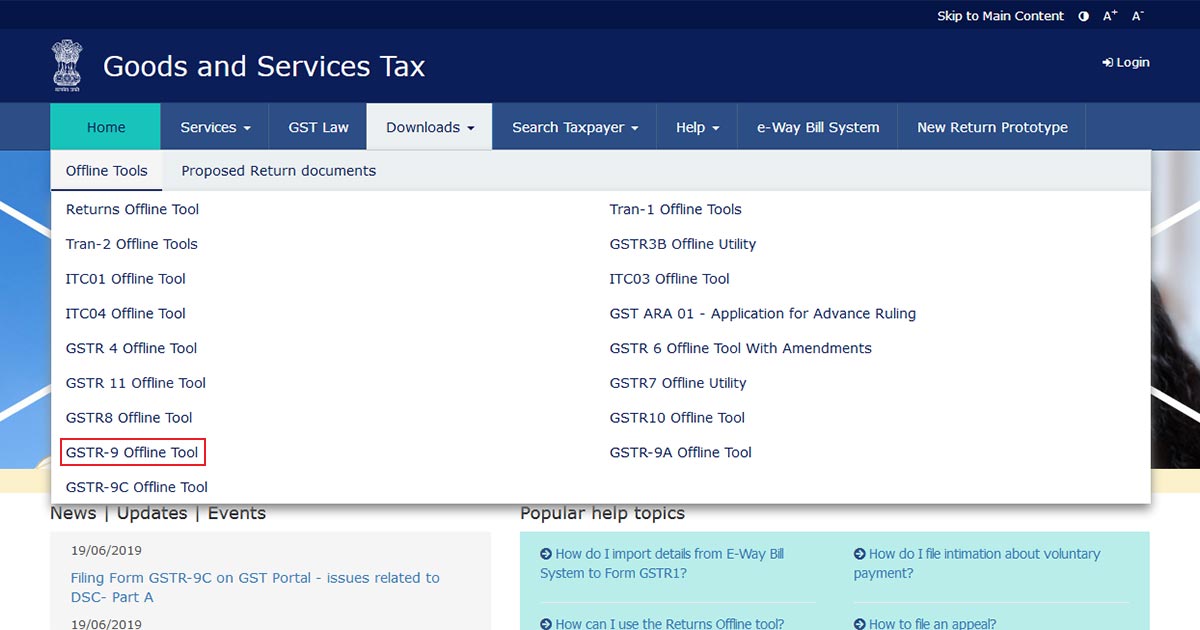

Similarly, according to the sub-rule (1) of rule 80 of the CGST Rules, every registered person shall furnish an annual return in FORM GSTR-9 in an electronic mode. The rule excludes an Input Service Distributor, an individual paying tax u/s 51 or 52, a non-resident taxable individual and a casual taxable person i.e. they are not required to file an annual return electronically in FORM GSTR-9.

The notification again had made this e-filing of FORM GSTR-9

Central Board of Indirect Taxes and Customs clarifies that such assessees may file FORM GSTR-9 for the FY 2017-18 and 2018-19 at their own choice but before the due date because after that common government portal shall not allow taxpayers to file FORM GSTR-9 for the said financial years.

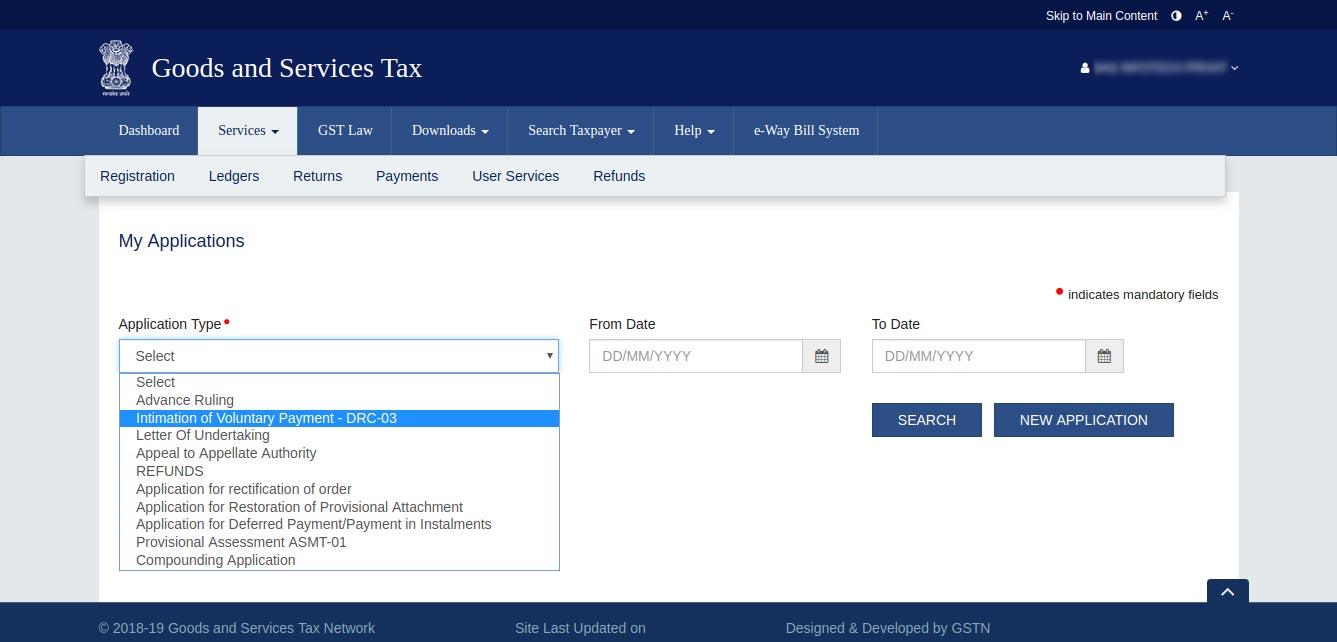

Section 73 of the CGST Act states that a taxpayer can pay the tax dues at any time through FORM GST DRC-03. Whenever a taxpayer realises that he has paid lesser tax than his actual tax liability or availed any wrong input tax credit, he can pay the remaining tax liability via FORM GST DRC-03