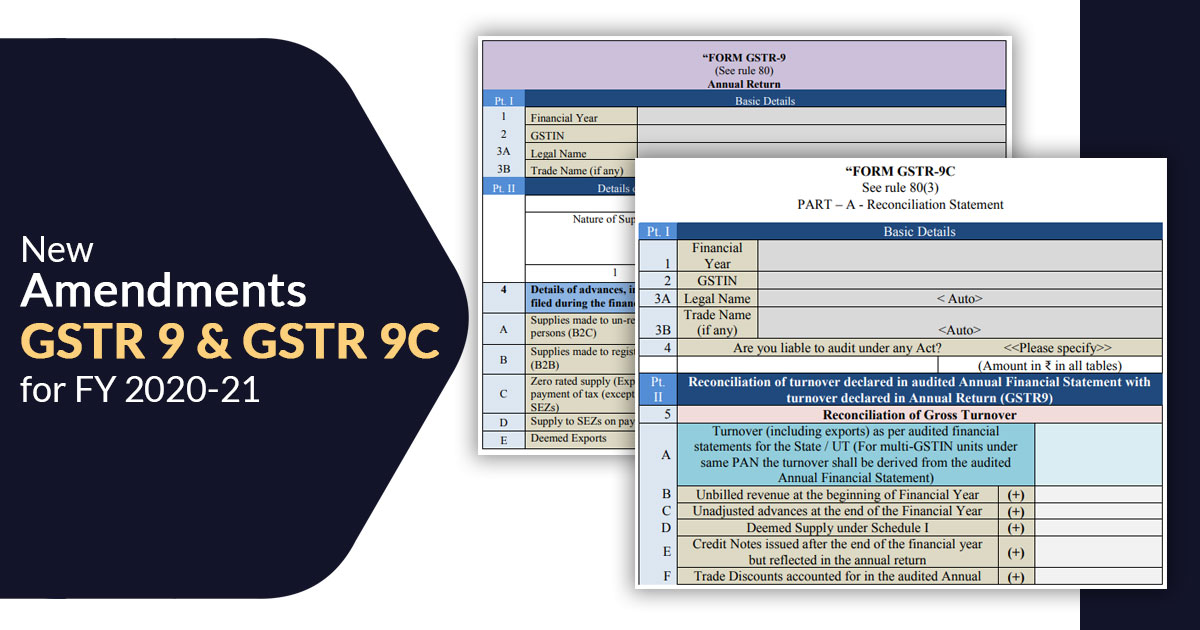

The government used to provide the notifications for the information to furnish the yearly return in Form GSTR-9 and the settlement statement in Form GSTR-9C for FY 2020-21. So as to diminish the burden on the small assessee the government on 30/07/2021 has provided Central Tax GST Notification No. 29/2021, 30/2021 and 31/2021. From these notifications, the government urged to diminish the yearly compliances burden upon the small assessee.

Notification No 29 /2021-Central Tax dated 30 July 2021 mentioned that closed hand providing the GST Goods and Services Tax Section 35(5) of CGST Act, 2017 thus eliminating the mandatory requirement of audit under GST by a CA or CMA. It also revises Section 44 of CGST Act, 2017 dealing with yearly return and settlement statements.

Try GST Software Demo with Latest Amendments

Notification No 30/2021-Central Tax dated 30th July 2021 amends Rule 80 of CGST Rules, 2017 and form GSTR-9 and form GSTR-9C. Moreover, the assessee who has the average turnover of Rs 5 cr needs to privilege from furnishing the settlement statement in GSTR-9C

Latest Changes & Amendments in GSTR-9 Annual Return for FY 2021-21

Outward Supply Details

- Information of advances inward and outward supplies made during the year on which tax is payable

| Table No of Form GSTR-9 | Table Details | Optional or Mandatory | Additional Remarks, if Any |

|---|---|---|---|

| 4A to 4G | Export (4C) and SEZ (4D) supplies on payment of tax, B2C (4A) and B2B (4B) supplies, deemed exports (4E), advances on which tax paid but invoice not issued (4F), inward supplies on which tax is paid on RCM basis (4G) | Essential, if Details Available | |

| 4I | Credit notes provided towards the transactions are mentioned in the table 4B to 4E. | Optional | The credit notes shall get mixed in detail in Table 4B to 4E rather than reporting here |

| 4J | Credit notes are provided towards transactions mentioned in Tables 4B to 4E. | Optional | The debit notes can be consolidated in detail reported Table 4B to 4E rather than reporting here separately. |

| 4K and 4L | Tax reduced through Amendments/Supplies/tax declared through Amendments & Supplies | Optional | The revisions can be adjusted with respect to the information reported in Table 4B to 4E rather than reporting here in a separate way. |

- The information of the outward supplies are built in the FY on which the tax shall not be payable

| Table No of Form GSTR-9 | Table Details | Optional or Mandatory | Additional Remarks, if Any |

|---|---|---|---|

| 5A, 5B and 5C | The supplies of Export (5A) and SEZ (5B) excluding any payment of tax supplies on which the tax is to get furnished through recipient on reverse charge basis 5(C). | Mandatory | |

| 5D, 5E, and 5F | Privileged, Nil Rated & Non-GST supply | Optional | The information for these supplies can be furnished in the exempt system inside table 5D on the consolidated grounds if the bifurcation of these supplies is unavailable. |

| 5H | The credit notes are rendered towards the transactions are mentioned in the table 5A to 5F. | Optional | The credit notes can be combined in the information reported in tables 5A to 5F rather than reporting here in a separate way. |

| 5I | The debit notes provided towards the transactions provided in Table 5A to 5F | Optional | The debit notes shall be combined in detail reported in Table 5A to 5F rather than reported here individually. |

| 5J and 5K | The supplies shown via revisions and the supplies has diminished via revisions | Optional | The changes shall be settled towards the information reported in Table 5A to 5F rather than reporting here in a separate way. |

ITC Information and Onwards Tables

- The information of Input Tax Credit

| Table No of Form GSTR-9 | Table Details | Optional or Mandatory | Additional Remarks, if Any |

|---|---|---|---|

| 6B | The inward supplies (rather than imports and inward supplies subject to reverse charge but consists of services obtained from SEZs) | Partly optional | The information of the capital goods is required to report individually. But the information of inputs and input services shall get reported on the combined grounds beneath the head inputs. |

| 6C | Inward supplies obtained from the unregistered individual subjected to reverse charge (other than 6B above) on which the tax is furnished and ITC | Optional | The information in Table 6C shall get reported on the consolidated grounds in Table 6D. Moreover, the information of the capital goods requires to be reported individually. But the information of inputs and input services can be reported on a consolidated basis under the head ‘Inputs’. |

| 6D | Inward supplies obtained through the enrolled individual subject to reverse charge (other than B above) on which the tax is to be furnished and ITC claimed. | Essential, if the information is available | |

| 6E | Import of goods engaged supplies from SEZ. | Mandatory | The information on capital goods wants to be reported in a separate way. But the information of the inputs and inputs services which shall be reported on the consolidates on the grounds beneath the head inputs. |

| 6F | Import of services (including inward supplies from SEZ) | Mandatory | – |

| 6G | ISD gives ITC | Mandatory | – |

| 6H | Amount of ITC reclaimed (Other than Table 6B) | Mandatory | – |

- Features of ITC Reversed and Ineligible ITC as published in returns furnished in the fiscal year

| Table No of Form GSTR-9 | Table Details | Optional or Mandatory | Additional Remarks, if Any |

|---|---|---|---|

| 7A, 7B, 7C, 7D, 7E, 7F, 7G and 7H | According to Rule 37, Rule 39, Rule 42, Rule 43, Section 17(5), Reversal of TRAN-I credit, Reversal of TRAN-II credit, Other reversals | Partly Optional | The collected amount of the reversal from 7A to 7E can be filled in 7H that is in ‘Other reversal’, but a reversal of Transitional credit fields is obligatory. |

| 8A | ITC from GSTR-2A | Auto-populated | The total credit available for inwards supplies (excluding imports and inwards supplies subjected to reverse charge consists of services collected via SEZs) pertaining to the FY 2020-21 and shown in Form GSTR-2A (table 3 and 5 only will get auto-populated in this table. |

| 8B | ITC as per Table 6B + 6H | Auto-populated | The table is auto-populated grounds the information filed in Tables 6B and Table 6H in the yearly return. |

| 8C | ITC on inward supplies (excluding imports and inward supplies subjected to reverse charge however it consists of services collected through SEZs) obtained in FY but claimed in the subsequent FY (2021-22) year up to September 2021. | Mandatory | The table consists of the information of ITC towards the inward supply invoices obtained in FY 2020-21 but claimed in FY 2021-22 for GSTR-3 to get furnished for September 2021. |

| 8E and 8F | ITC available but not claimed 8(E) and ITC available but ineligible (8F) | Mandatory | Ideally, if the value of Table 8D is positive then the sum total of 8E and 8F is the same for 8D |

| 8G | IGST furnished on import of goods consisting of supplies from SEZ | Mandatory | – |

| 9 | Information about tax furnished as declared in returns furnished in the Fiscal year | Mandatory | The table is important. It is needed to get furnished on the grounds of the tax payable and furnished in GSTR-1 and GSTR-3B |

| 10 and 11 | Supplies or tax declared via changes and supplies or tax reduced via revisions | Optional | Changes of invoices pertaining to FY 2020-21 build-in GSTR-1 furnished for the period amid April 2021 to September 2021 are shown here. |

| 12 | Reversal of ITC claimed in the previous FY | Optional | ITC for the FY 2020-21 reversed in GSTR-3B for the period amid April 2021 to September 2021 is needed to be declared. |

| 13 | ITC claimed for the last FY | Optional | ITC for the Fiscal year 2020-21 claimed in GSTR-3B furnished for the period amid April 2021 to September 2021 is to be declared here. ITC reversed in 2020-21 according to the provisions of section 16(2) but reclaimed in GSTR-3B for the period amid April 2021 to September 2021 shall not come in this table as this shall be filed in yearly return to be furnished for FY 2021-22 |

| 14 | Important if any is payable | Essential if any tax becomes payable | The table consists of tax payable as the result of declarations build in table 10 and Table 11. |

| 15A, 15B, 15C and 15D | The information of the refund availed for the year consists of sanctioned, rejected, or pending amounts. | Optional | It is not essential to give you a refund for the relevant information. |

| 15E, 15F, and 15G | It includes the total demand of the taxed furnished in the year amount furnished and pending amount. | Optional | In GSTR-9 it is not important to give the demand |

| 16A, 16B and 16C | Supplies obtained via composition assessee (16A), deemed supply beneath Section 143 (16B), goods sent on permission grounds but not returned (16C). | Optional | Table 16 is not important to fill |

| 17 and 18 | HSN Wise Summary of outward supplies and HSN Wise Summary of Inward supplies | Optional | It is not essential to furnish the HSN summary. |

| 19 | Late fee payable and paid | Obligatory, wherever applicable | If a yearly return is furnished late this table is needed to be furnished. |

Latest Amendments in GSTR-9C Form (Reconciliation Statement)

- Form GSTR-9C needs to be self-certified through the assessee rather than being certified through CA/CMA.

- The relaxations furnished in reporting of information for specific tables of Form GSTR-9C in the fiscal year 2020-21 shall need to get carryon for FY 2020-21.

- Verification table through CA/CMA inside part B of Form GSTR-9C is removed. But the only verification through the enrolled individual is needed in GSTR-9C for the relevant registered assessee.

Notification No 31/2021-Central Tax dated 30 July 2021 privileged the enrolled individual through an average turnover of Rs 2 cr in the financial year 2020-21 from the furnishing of Form GSTR-9 for FY 2020-21.

Last Date of Filing: The last date of filing GSTR-9 and GSTR-9C for FY 2020-21 is on or prior to 28th February 2022 (Revised). read more

Late Furnishing of Fee: Any enrolled individual who failed to file the GSTR-9 form

Via the above revisions, the government urged to diminish the compliance burden on the assessee besides that the same time putting the responsibility on the assessee to furnish the real details inside the yearly return and reconciliation statement.