The ITAT Ahmedabad bench set aside the taxpayer’s deduction claim for a donation made to an unapproved scientific authority in a recent ruling.

Parag Dave, the taxpayer, has the business of testing soil, building materials, conducting survey work, etc.

The taxpayer on 26.09.2017 has submitted his income return specifying a total income of Rs 56,55,070. In the scrutiny assessment, it was noted that he claimed a weighted deduction of Rs 54,25,000 u/s 35(1)(ii) of the Income Tax Act, 1961, for a donation of ₹31,00,000 made to Shri Arvindo Institute of Applied Scientific Research Trust.

An SCN has been issued by the AO for the donation, though the taxpayer did not answer. Thereafter, AO disallowed the claim mentioning that the approval of the trust under section 35(1)(ii) h has lapsed dated 31.03.2006, and no valid certificate is there for the related year.

The taxpayer, dissatisfied with the order, has approached the Commissioner of Income Tax (Appeal) (CIT(A)) and then the tribunal.

Taxpayers’ counsel Rachna Khandhar, the donation was for good faith as per the documents obtained from the trust. The taxpayer must not be penalised only for the reason that the Central Board of Direct Taxes (CBDT) didn’t issue a fresh certificate u/s 35(1)(ii) of the Act.

Read Also:- ITAT Ahmedabad Restores Reassessment Case, Citing AO’s Failure to Consider Evidence on Cash Deposits

The taxpayer’s claims are been objected to by the counsel of the department.

In 2006, the approval of the trust had lapsed, and the taxpayer for taken a weighted deduction advantage has made the donation without due diligence.

The bench including Dr. BRR Kumar (Vice President) and Suchitra Kamble (Judicial Member) after hearing both sides, recognized that the trust’s approval had lapsed on March 31, 2006, and is not qualified to raise donations for scientific research u/s 35(1)(ii) of the IT Act of 1961.

The taxpayer is a science graduate with financial knowledge and is unable to plead ignorance of these statutory cases cited under a lack of recognition letter from the Bureau of Scientific and Industrial Research (BSIR), the Tribunal said.

Recommended: Kerala HC Directs IT Dept to Decide Amrita Institute’s TDS Appeal Within 3 Months

The Tribunal concluded, the taxpayer, with an intent, had contributed to an unapproved institution and therefore proceeded to uphold the disallowance of the deduction of AO and CIT(A).

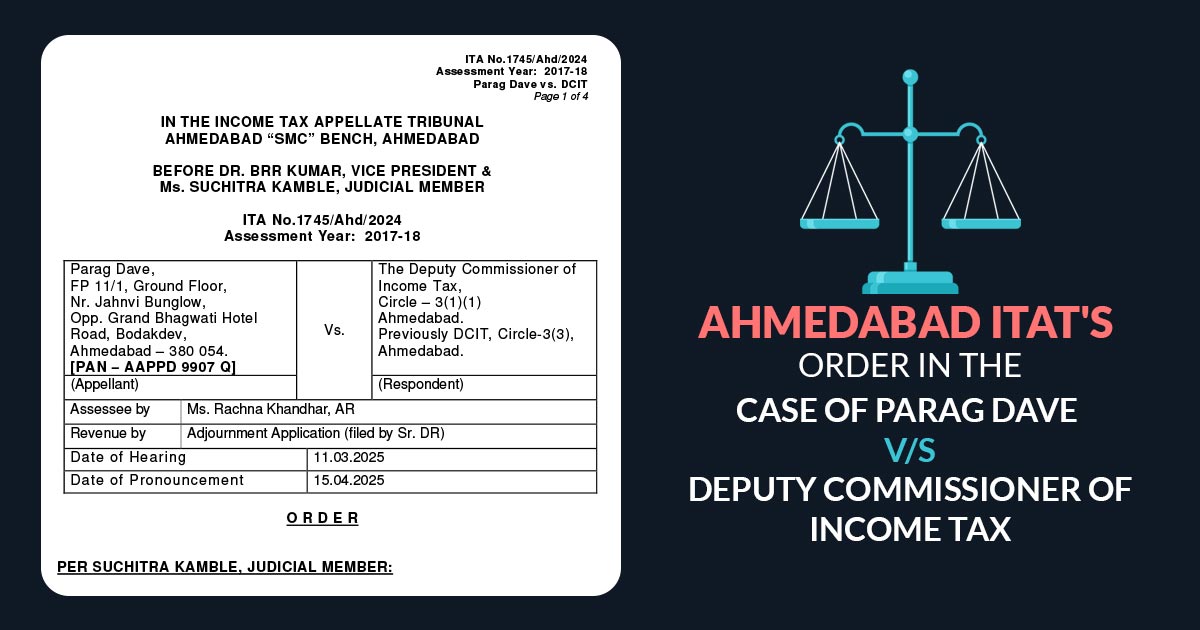

| Case Title | Parag Dave V/S Deputy Commissioner of Income Tax |

| ITA No. | ITA No.1745/Ahd/2024 |

| Counsel For Appellant | Ms. Rachna Khandhar, AR |

| Counsel For Respondent | Adjournment Application (filed by Sr. DR) |

| Ahmedabad ITAT | Read Order |