It cited under the Ahmedabad Bench of the Income Tax Appellate Tribunal (ITAT) that the deduction under section 80P cannot be claimed in Income Tax Return (ITR) filing beyond the due date stipulated u/s 139(1) of the Income Tax Act.

Dared Seva Sahkari Mandali Ltd. (Assessee) deposited cash of Rs. 5,31,61,730 and a time deposit of Rs. 21,81,997. It was discovered by the assessing officer that the taxpayer did not furnish the return. U/s 148 of the Income Tax Act 1961 the AO issued a notice. Post obtaining a notice the taxpayer has furnished the ITR, declaring the income nil.

The taxpayer was in the credit cooperative society activities, including accepting deposits from members, taking loans from cooperative banks, and selling agricultural inputs like fertilizers, pesticides, and seeds. The AO finished the assessment disallowing deduction u/s 80P of the Income Tax Act.

Before the commissioner of income tax (Appeals), the taxpayer appealed against the order of the assessing officer. The claim of 80P deduction of the taxpayer has been dismissed by CIT(A) and carried that as revised by the Finance Act of 2018, section 80AC and section 80A(5) of the Income Tax Act mandates the returns to get filed in the said deadline to claim the deductions u/s 80P. As the taxpayer has furnished the ITR beyond the said date u/s 139(1), the deduction was disallowed.

The taxpayer dissatisfied with the CIT(A) order filed an appeal to the ITAT, Ahmedabad where the counsel of the taxpayer claimed that the deduction u/s 80P must be permitted despite the late return filing. They laid on the judgment of the Kerala HC in Chirakkal Service Co-operative Bank Ltd. vs. CIT, which permitted an identical deduction for the late returns.

The counsel of the revenue laid on the ITAT decision, Rajkot Bench for the matter of Lunidhar Seva Sahkari Mandali Ltd. v. The Assessing Officer which disallowed deduction u/s 80P due to ITR filed exceeding the date restricted under section 134(1) of the Act.

The two-member bench, T.R. Senthil Kumar (Judicial Member) and Ramit Kochar (Accountant Member) noted that no citation in the body of the assessment order for the disallowance which can be an irregularity on the assessing officer’s portion. However, the calculation of the income and demand notice attached to the order verified the refusal of the deductions.

It was emphasized that the revision of section 80AC which obligates deduction u/s 80P can be claimed merely when the ITR was filed within the deadline u/s 139(1) from 1st April 2018. The tribunal directed identical rulings, like the Nileshwar Rangekallu Chethu Vyavasaya Thozhilali Sahakarana Sangham case, supporting the revenue’s perspective on the amended Section 80AC. Accordingly, the tribunal dismissed the taxpayers’ plea.

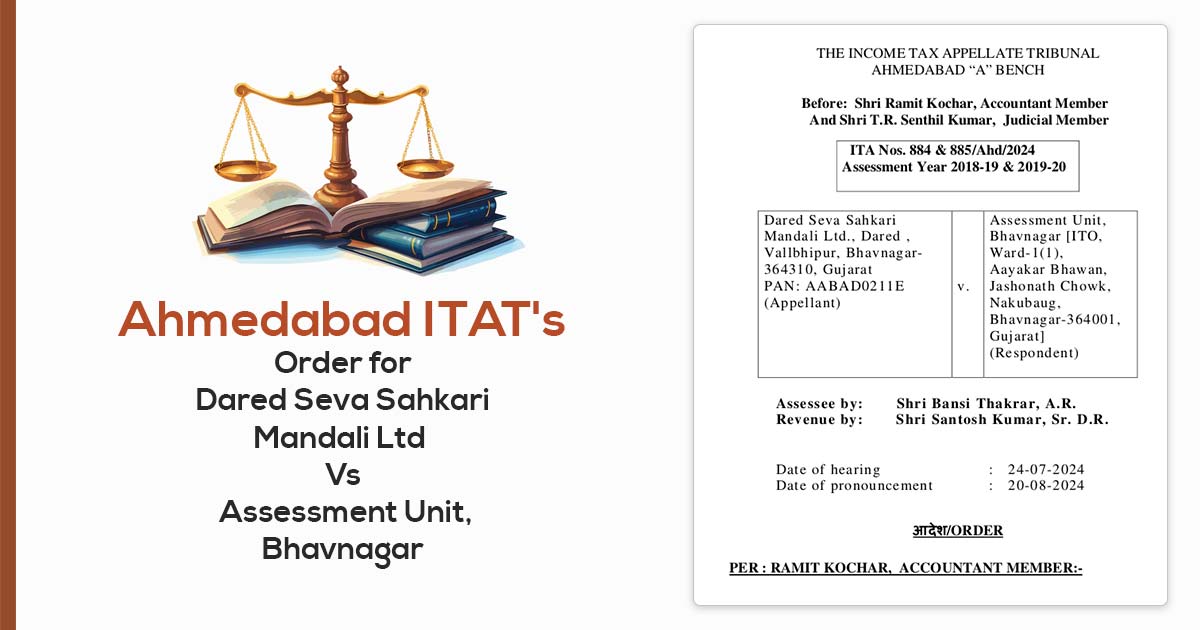

| Case Title | Dared Seva Sahkari Mandali Ltd Vs. Assessment Unit, Bhavnagar |

| Citation | ITA Nos. 884 & 885/Ahd/2024 |

| Date | 20.08.2024 |

| Counsel For Appellant | Shri Bansi Thakrar, A.R. |

| Counsel For Respondent | Shri Santosh Kumar, Sr. D.R. |

| Ahmedabad ITAT | Read Order |