The Ahmedabad Bench of Income Tax Appellate Tribunal (ITAT) has held that the AO failed to specify whether the penalty was for concealment or inaccurate particulars in the notice issued under Section 274 and Section 271(1)(c) of the Income Tax Act.

The bench of Suchitra Kamble (Judicial Member) and Makarand V. Mahadeokar (Accountant Member) has marked that the penalty notice must define whether it is for hiding income or providing wrong particulars. The penalty proceedings vitiate a vague notice.

The petitioner/taxpayer is a cooperative bank mentioned to be in liquidation. RBI has furnished the directions levying certain limitations. According to the restrictions the bank without prior approval in writing from the Reserve Bank of India (RBI) was not permitted to allow or renew loans and advances, make any investments, or incur any liability, including borrowing of funds, acceptance of fresh deposits, etc.

RBI has cancelled the license authorized by the bank to continue the banking business in India. The taxpayer has furnished its ITR for AY 2010-11, showing the income under the heading of income from business or profession. Post claiming set off of the carried forward business loss of AY 2003-04 to the extent of income available, the gross total income was worked out at Rs NIL.

The matter was chosen for scrutiny via furnishing the notice U/s 143(2) of the Income Tax Act. The notices were issued, and the taxpayer furnished the responses to the notices. At the time of the assessment proceedings, the AO noted that the taxpayer had not furnished the income tax return for the duration from A.Y. 2003-04 to A.Y. 2008-09. The AO was directed to provide the evidence of return filing, but the taxpayer cannot provide it except for the AY 2003-04.

The opportunity has been furnished to the taxpayer to show cause as to why the claim of setoff carried forward losses must not be cancelled. In response the taxpayer mentioned that the bank’s business is not closed, however, it is beneath liquidation, and its cooperative status is not lost. The bank is winding up and making interest on advances due, and thus unabsorbed losses and depreciation must not be rejected.

AO not being satisfied with the response of the taxpayer passed an order denying the claim for the setoff of the carried forward business loss of AY 2003-04 against the income. The penalty proceedings for providing the wrong facts and concealment of the income have been begun by the AO.

The taxpayer has filed a petition to the CIT(A) against the order passed which affirmed the disallowance of set off against the carried forward losses. The taxpayer before the tribunal has furnished the plea. The appeal has been dismissed by the tribunal as of the non-prosecution.

The AO, not regarding the assessee’s submission as acceptable, imposed the 100% penalty of tax sought to be evaded.

The taxpayer has filed a petition to the CIT(A) against the penalty order. In the appellate proceedings, the taxpayer mentioned that the deduction must be permitted via the CIT(A) in the quantum plea after furnishing all the interest information.

Read Also: Ahmedabad ITAT Removes Addition, No TDS Deduction U/S 194C for Land Levelling Costs

The taxpayer’s plea has been dismissed by the CIT(A) post confirming the penalty and concluding that the taxpayer has incorrectly claimed set off of unabsorbed brought forward losses of A.Y. 2003-04 when no returns were filed for the A.Y. 2004-05 to A.Y. 2008-09.

It was argued by the taxpayer that the interest income under acknowledgement is made via the liquidator on the FDs putting the recovery made from the borrowers. From DICGCI the bank has obtained the money as a settlement of the claim and under the norms of the settlement of the claim precisely as per Section 21(2) of the DICGC, Act 1961, the liquidator was mandated to repay to the corporation on realizing the amount in his hand.

An overriding title was there on its income in favour of DICGC, therefore to that extent it is not the taxpayer’s income. The taxpayer put a copy of the claim Settlement letter from DICGC to reinforce its claim.

It was argued by the department that the taxpayer has incurred a wrong claim of set-off towards carried forward losses when the same does not file its income return for the forthcoming years, and hence to the extent of the income not revealed, it is the matter of the concealment of the income. On the orders of lower authorities, he put reliance.

While permitng the petition the tribunal ruled that the penalty imposed u/s 271(1)(c) of the Income Tax Act is not justified. All the material facts have been shown by the taxpayer and no intent to conceal the income or provide the wrong facts was there.

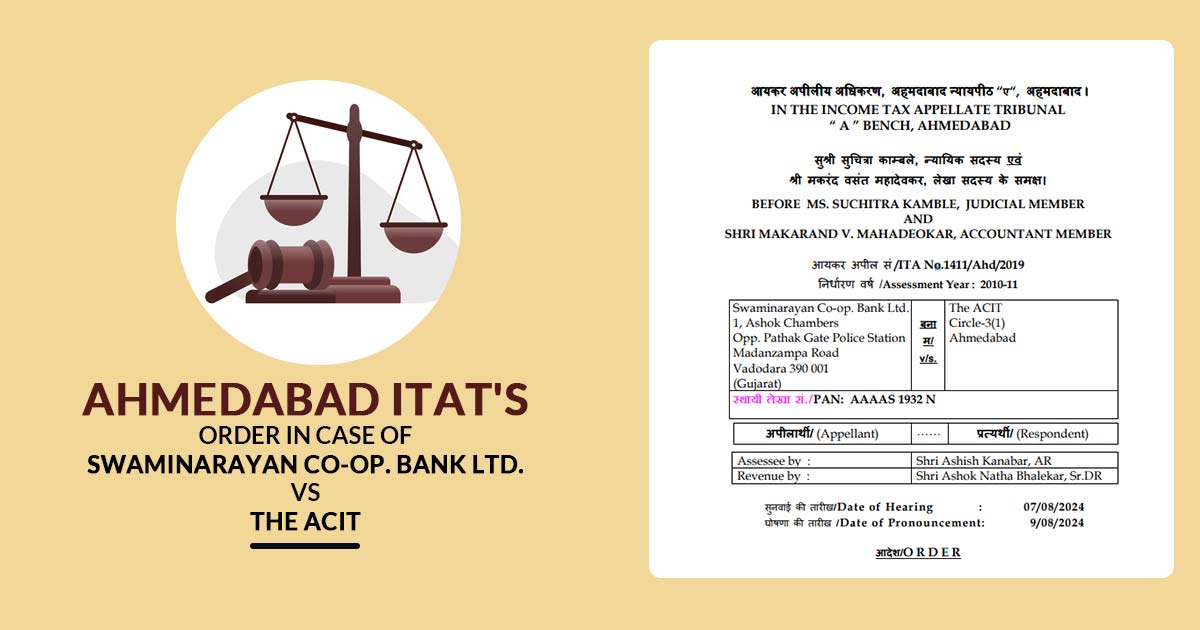

| Case Title | Swaminarayan Co-op. Bank Ltd. Vs The ACIT |

| Citation | ITA No.1411/Ahd/2019 |

| Date | 09.08.2024 |

| Assessee by | Shri Ashish Kanabar, AR |

| Revenue by | Shri Ashok Natha Bhalekar, Sr.DR |

| Ahmedabad ITAT | Read Order |