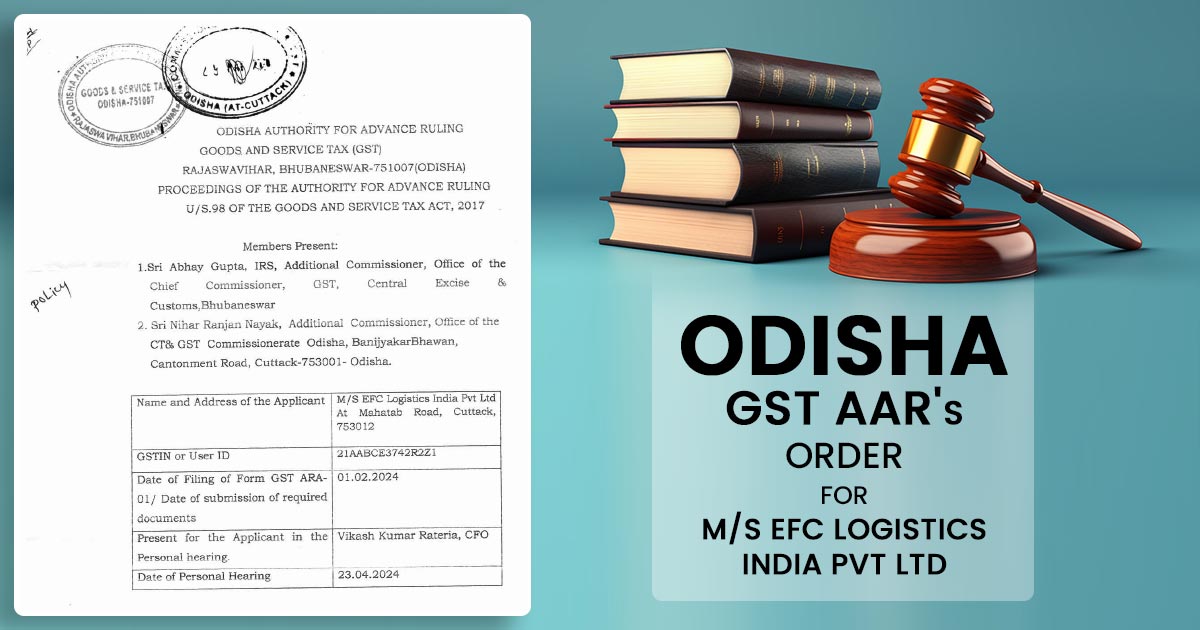

In the matter of “In re EFC Logistics India Pvt. Ltd. (GST AAR Odisha),” M/S EFC Logistics India Pvt Ltd (after this referred to as the ‘Applicant’), filed an application for an advance ruling u/s 97 of the CGST Act, 2017, and the related section of the OGST Act.

The petitioner is a Goods Transport Agency (GTA) registered under the GST provisions, furnishing transport services to M/s Rungta Mines Ltd., and filing a 12% GST under the Forward Charge Mechanism with an input tax credit (ITC).

Advance Ruling Queries

The petitioner had asked for the clarification on the two major parts-

- Whether the supplier, being the owner of the vehicle itself could impose the GST on the rental/hire services under the Forward Charge Mechanism, even though his service is waived.

- If the answer to the first question is Yes whether the applicant being a GTA could avail for the ITC on the grounds of the invoices of the supplier u/s 16 of the CGST Act, 2017.

Context

The petitioner intends to enter into an agreement with Govinda Transport Private Limited, the vehicle owner, to rent vehicles. The rental agreement comprises fuel, tolls, driver’s salary, repairs, and other maintenance costs. On 28.06.2017 the Applicant referenced Notification No. 12/2017-Central Tax (Rate), specifically Entry No. 22(b), which waives the services through giving on hire to a GTA, a means of transportation of goods, implying that the supplier (Govinda Transport) is not authorized to charge GST.

Individual Hearing and Recommendations

On 23.04.2024, a personal hearing was conducted in which the petitioner represented via Shri Vikash Kumar Rateria, repeated the application’s submission they made. The revenue authorities do not furnish any comments or appear for the hearing.

Review and Decision-Making

Question 1: Chargeability of GST on Rental/Hiring Services

The Odisha Authority for Advance Ruling (AAR) assessed whether the supplier can levy GST on rental/hire services under the Forward Charge Mechanism. However, they discovered that this question is not carried u/s 95(a) of the CGST Act, 2017. As per section, an advance ruling related to matters or questions specified in Section 97(2) or Section 100(1), concerned with the supply of goods or services undertaken or proposed to be undertaken by the Applicant. As the Applicant is not the supplier of the rental services, the question is not within the purview of the advance ruling, and thus, no ruling can be furnished on this end.

Question 2: Criteria for ITC (Input Tax Credit) Eligibility

U/s 16 of the CGST Act, 2017, AAR analyzed the ITC eligibility, which states that every enrolled person is qualified for ITC on goods or services used or intends to use for the course or furtherance of business. The petitioner being a GTA and enrolled under GST filing 12% GST under the Forward Charge Mechanism, is qualified for availing ITC. It depends on satisfying the conditions and limitations defined in Section 16 of the CGST Act, 2017.

AAR’s ruling could be summarized as

- GST Chargeability on Rental/Hiring Services: The question of whether the supplier could levy the GST under the Forward Charge Mechanism is not carried according to Section 95(a) of the CGST Act, 2017, as the same is relevant to the inward supply of services not undertaken via the petitioner.

- The claim of ITC: The petitioner as a registered individual under GST could avail the ITC on any supply of goods or services utilised in the course or furtherance of business, within compliance with Section 16 of the CGST Act, 2017.

Appeals

If aggrieved via the same ruling, the petitioner or the jurisdictional officer may appeal to the Odisha State Appellate Authority for advance ruling u/s 100 of the CGST/OGST Act, 2017 within 30 days from the date of receipt of the advance ruling.

Impact and Consequences

The same ruling mentions that while the authority may not adjudicate on the GST levy on the inward supply for the petitioner, the same would not affirm the GST ITC eligibility for GTAs on expenses made in the course of business, furnished all the requirements u/s 16 are satisfied.

| Name of Applicant | M/S EFC Logistics India Pvt Ltd |

| GSTIN or User ID | 21AABCE3742R2Z1 |

| Date | 23.04.2024 |

| Present for the Applicant | Vikash Kumar Rateria |

| Madras High Court | Read Order |