The Madras High Court remanded the order validating the GST obligation as of the failure to provide oral or document proof. The case was remanded for reconsideration on 10% pre-deposit.

The applicant/taxpayer Jai Maa Engineering Co. has claimed that they were not aware of the proceedings directing to the impugned order since all the communications were only uploaded to the GST portal and not conveyed via another mode. The applicant merely became aware of the proceedings in late February 2024, if their bank account was attached.

The counsel of the applicant furnished that the GST dispute emerged from a mismatch between the GSTR-3B returns and the auto-populated GSTR-2A. They argued that provided a chance they could show that there was zero difference between their returns and GSTR-2A.

As per the counsel, no date for a personal hearing was established. However, they stated willingness to pay 10% of the disputed GST demand as a condition for the reconsideration. For the taxpayer, Mr. A. Dhamodaran appeared.

The counsel of the respondent elaborated that an ASMT-10 notice was issued following the taxpayer’s scrutiny of returns. Also, the counsel of the Government T.N.C. Kaushik furnished that the show cause notice was issued, along with an offer for a personal hearing.

It was remarked by the Bench of Justice Senthilkumar Ramamoorthy that the order was confirmed since the assessee was unable to answer or furnish any proof and it revealed the merit of the taxpayer’s claim that they were not notified about the proceedings and therefore were not provided a fair chance to contest the GST demand. Therefore, the impugned GST order was set aside.

The case was remanded for reconsideration on the condition that the 10% deposit of the taxpayer of the disputed tax asked for within 15 days of obtaining a copy of the order. The taxpayer was permitted to provide the response to the show cause notices (SCN) within the identical 15-day period. Also, the bank attachment levied on the taxpayer was also raised.

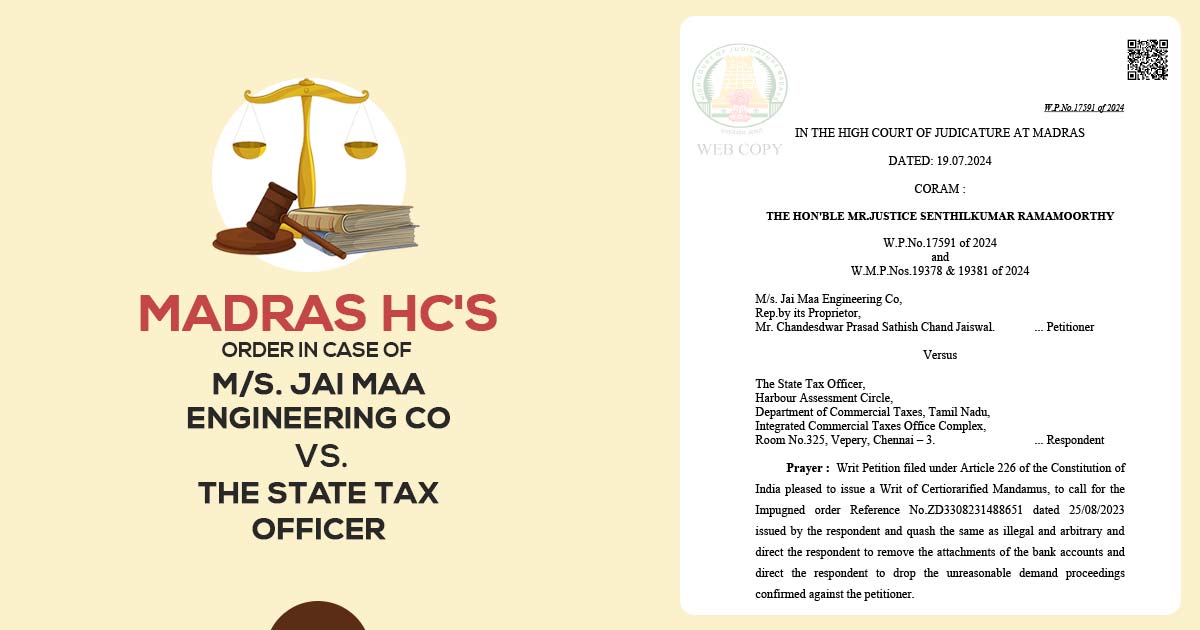

| Case Title | M/s. Jai Maa Engineering Co Vs. The State Tax Officer |

| Citation | W.P.No.17591 of 2024, and W.M.P.Nos.19378 & 19381 of 2024 |

| Date | 19.07.2024 |

| For Petitioner | Mr. A. Dhamodaran |

| For Respondents | Mr. T.N.C. Kaushik |

| Madras High Court | Read Order |