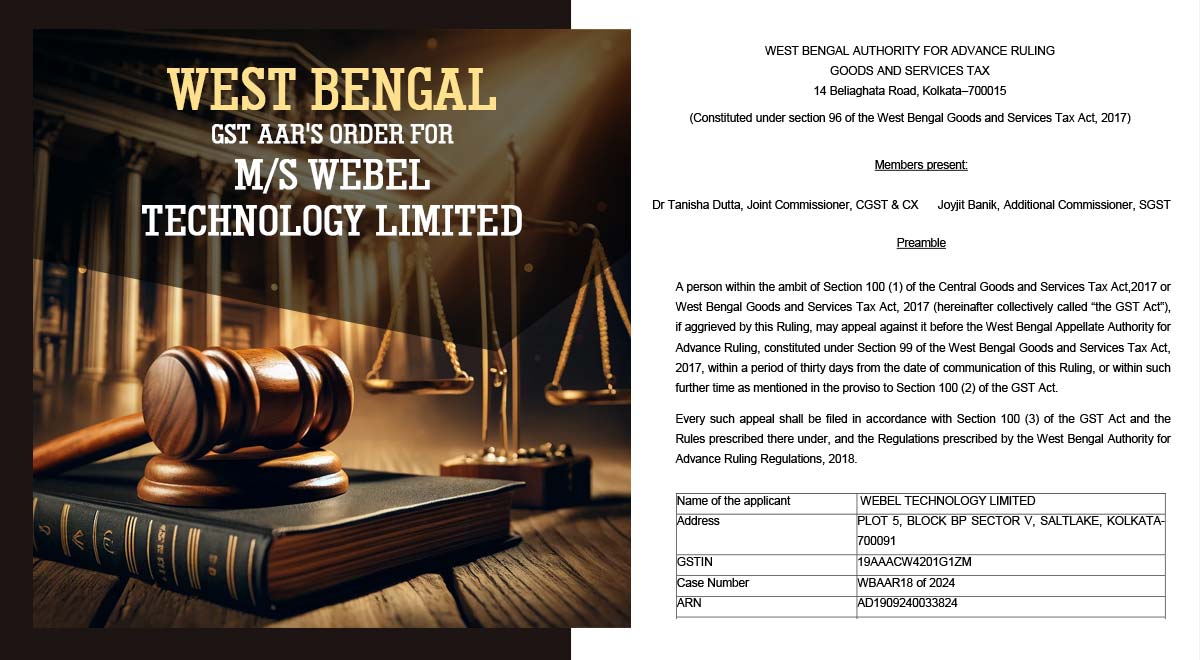

The West Bengal Authority for Advance Ruling Goods and Services Tax (AAR) in a case has ruled that the Goods and Services Tax (GST) exemption is not subjected to the supply of manpower services before Webel Technology Limited.

The petitioner, Webel Support Multipurpose Service Cooperate Society, is a cooperative society registered under the West Bengal Co-operative Societies Registration Act.

The petitioner furnishes multipurpose service, along with the supply of manpower support services to distinct government departments under M/s Webel Technology Limited (WTL, for short).

A work order has been obtained for the petitioner from the WTL for furnishing the manpower services before the Public Health Engineering Directorate of the Government of West Bengal for implementing their ‘JAL JEEVAN MISSION’ Project in the state of West Bengal.

It was questioned by the applicant whether Jal Jeevan Mission is appropriate in categorising the services furnished to the government entities as waived services. And whether the services are waived under notification no. 12/2017 Central Tax (Rate) dated 28.06.2017?

The petitioner wishes to get an advance ruling and is mandated to submit an application on the common portal in FORM GST ARA-01 concerning the subject matter as cited in sub-section (2) of section 97 of the GST Act. The questions on which the advance ruling is desired are found to be covered under clause (b) of sub-section (2) of section 97 of the GST Act.

It was cited by the applicant that the raised questions in the application have neither been determined by nor are due before any authority under any provision of the GST Act. The officer related to the revenue has sought no objection to the admission of the application.

It was informed by the applicant that he was notified on 15.07.2024 by WTL that the Public Health Engineering Directorate of the Government of West Bengal had issued a letter to WTL and claimed that under the Government Notification No.56/2017/25 dated 29th June 2017 and Notification No. 12/2017-Central Tax (Rate) dated 28.06.2017 (1136 F.T. dated 28.06.2017), GST rate for the services rendered concerning the above referred work is NIL.

By the said memo, the Public Health Engineering Directorate of the Government of West Bengal has directed the Chief Executive Officer, WTL, to return the amount paid for GST, being excess payment and therefore refundable.

The authorized advocate of the dealer for the personal hearing and subsequently via email has furnished that, as per the applicant, the instant supply will be levied to tax at 18%.

A work order has been received to the applicant from WTL for furnishing the manpower services before the Public Health Engineering Directorate of the Government of West Bengal for executing their ‘JAL JEEVAN MISSION’ Project in the state of West Bengal. The problem is to determine whether these supplies are entitled to the exemption vide entry number 3 of the Notification No. 12/2017 Central Tax (Rate) on 28.06.2017, as revised.

It was mentioned in the document that the work had been given via the PHED to Webel Technology Limited for directing manpower services to them for the JJM project. Therefore it is proven that WTL has obtained the work order from the Public Health Engineering Department, Government of West Bengal. Therefore WTL has engaged the petitioner to furnish the aforementioned manpower services.

The term pure services has not been specified under the GST Act. But a bare reading of the services description, as cited in the entry serial number 3 of the Notification No. 12/2017 Central Tax (Rate) dated 28.06.2017, as amended, specifies that the supply of services that does not involve any supply of goods can be considered pure services.

The applicant stated that under the work order issued to him by WTL, he provided manpower services for the ‘JAL JEEVAN MISSION’ Project, which included 513 Junior Engineers (Civil), 45 Junior Engineers (Mechanical), 25 Junior Engineers (Electrical), and 99 Data Entry Operators.

It first appears that the above-said supply does not comprise any transfer of materials in goods. Hence, it cited that the supply of services as furnished via the applicant is pure services.

The contract has been given to the applicant by WTL for which WTL is obligated to file the consideration to the applicant. Therefore, there could be no dispute that the petitioner is furnishing the services before WTL. It was carried by the bench that the second condition, i.e., the petitioner furnishes the services to the Central Government, the State Government, Union Territory, or local authority, does not get satisfied in the instant case.

Read Also: WB AAR: Comprehensive Water Supply Planning Services Are Exempt from GST

A two-member panel consisting of Dr Tanisha Dutta, Joint Commissioner, and Joyjit Banik, Additional Commissioner, stated that all three conditions mentioned in paragraph 2.5 must be fulfilled to qualify for the exemption under serial number 3 of Notification No. 12/2017-Central Tax (Rate), dated June 28, 2017, as amended.

The bench found that the petitioner provides services to Webel Technology Limited and not to the Public Health Engineering Department of the Government of West Bengal AAR. As a result, the supply of services in question does not qualify as an exempt supply under serial number 3 of Notification No. 12/2017-Central Tax (Rate) dated June 28, 2017, as amended.

| Case Title | M/s Webel Technology Limited |

| GSTIN | 19AAACW4201G1ZM |

| Case Number | WBAAR18 of 2024 |

| Date | 14.01.2025 |

| Applicant‘s | Mr. Subal Saha, Ms Pinki Shaw |

| West Bengal AAR | Read Order |