In the case of In Re. Dredging and Desiltation Company (P.) (Ltd.) [Order No. 25/WBAAR/2023-24 on December 20, 2023] the West Bengal AAR, governed that, no tax is chargeable toward the supply of service of removal of hump by dredging to the Government as the supply of aforementioned service is waived from imposing the GST vide Sl. No. 3A of Notification No. 09/2017-Integrated Tax (Rate) dated June 28, 2017 (“the Service Rate Exemption Notification”).

Points:

With the Irrigation and Flood Control Department, Government of Delhi (“the Government”) Dredging and Desiltation Company (P.) (Ltd.) (“the Applicant”) has entered into a contract for the removal of the hump (slit/earth/manure/sludge etc.) by dredging. The aforementioned contract includes a supply of service of dredging and excavation which is a pristine service work and the material cost transferred and consumed for execution and completion of works contract is less than 5% of the total work value.

An application for advance ruling has been filed by the applicant on whether the Irrigation and Flood Control Department would arrive within the purview of Union Territory and thus, the supply of aforementioned service to the Irrigation and Flood Control Department would be waived from levy of GST vide Sl. No. 3A of Service Rate Exemption Notification.

Problem:

Whether supply of service of removal of hump by dredging to the Government waived from GST imposition?

Had:

The AAR, West Bengal in the case of Order No. 25/WBAAR/2023-24 held as under:

- The central problem to be investigated in the current case is whether the activities of delisting and cleaning of drain would counted under the purview of “Public Health Sanitation Conservancy and Solid Waste Management” as per Serial No. 6 of the Twelfth Schedule placing reliance upon Article 243W of the Indian Constitution.

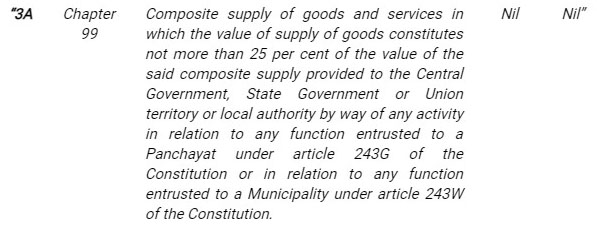

- Remarked that, as per Sl. No. 3A of the Service Rate Exemption Notification, the composite supply of goods and services where the value of supply of goods includes not exceeding 25% of the value of the composite supply made to the Central Government, State Government, Union Territory, or local authority by way of any activity concerning any function entrusted to Panchayat under Article 243G of the Indian Constitution or with any function entrusted to a municipality under Article 243W of the Indian Constitution is exempted.

- Guided that the supply incurred via the petitioner is a composite supply of goods and services in which the goods do not exceed 25 per cent of the value of the aforementioned composite supply.

- Also, it said that the supply of service via the petitioner to the Government counted under the aforesaid Entry of Service Rate Exemption Notification.

- It ruled that the supply of service for removal of the hump (slit/earth/manure/sludge etc.) by dredging shall be covered under Sl. No. 3A of the Service Rate Exemption Notification and is, thus, waived from the imposition of GST

The applicable extract of the Service Rate Tax Exemption Notification

Sl. No. 3A Notification of Service Rate Exemption

| Name of the Applicant | Dredging and Desiltation Company Private Limited |

| GSTIN | 19AABCD0790Q1Z5 |

| Date | 20.12.2023 |

| Case Number | WBAAR 25 of 2023 |

| Applicant | Mr. Sumit Nishania |

| WB GST AAR | Read Order |