What is an ITR Computation?

You can use an ITR Computation to explain your income tax liability and source of income. It’s a simplified document that’s already paid via the Authorized ITR Acknowledgment. Official Income Tax Return Forms-1,2,3,4 usually take 8-15 pages to complete, so bank officials don’t use them for checking income. They need ITR Computation, which facilitates everything from an income source to necessary elements into just a couple of pages.

Demand for the ITR Computation

Computation of ITR is required mainly by banks and credit firms, as well as Visa offices and other government agencies. Documents related to ITR computation are required in this case:

- Apply the VISA to any Country

- Bank Home Loan, Car Loan or Mortage Loan

- Apply for a Credit Card at a Bank

- Provide the ITR for Scholarship or Admission to the School

Short Brief About Income Tax Deductions

In order to encourage saving and investment among taxpayers, the income tax office has established a variety of deductions under Chapter VI A. In addition to the famous 80C deduction, there are other deductions that can reduce a taxpayer’s tax liability.

Different Types of Income Tax Deductions

- Section 80C

- Section 80D

- Section 80E

- Section 80G

- Section 80U

- Section 24B

- Section 80CCC

- Section 80CCD

- Section 80DD

- Section 80DDB

- Section 80CCG

- Section 80EE

- Section 80EEA

- Section 80GG

- Section 80TTA

Why Choose Genius Software for ITR Computation and Deductions Process?

In India, Genius is the most popular software used by tax professionals for filing tax returns since the Assessment Year 2001-02. Using the software, clients can file unlimited income tax returns, TDS returns, AIR/SFT returns, etc. There are 6 modules in the Genius, including GEN IT (Income Tax), GEN BAL (Balance Sheet), GEN FORM MANAGER, GEN CMA, GEN TDS (Tax Deducted at Source), and AIR/SFT.

Features of Genius Return Filing Software are as follows:-

- This software provides a facility for unlimited e-filing of Income Tax, TDS, etc.

- A quick method of uploading returns is provided by the ITD web service

- The software handles a variety of provisions related to set-off losses, clubbing of incomes, chapter VIA deductions, rebates, arrears, etc.

- Additionally, it calculates relevant ratios and provides automated returns.

- In addition to providing bulk verification options, it generates various management information reports about refund statuses, returns that have been filed and pending returns.

- Online application for a PAN, corrections and changes to the PAN, and the online submission of the PAN through form 49A.

Procedure of ITR Computation & Deductions By Genius Software

Listed below are two examples to help you understand the process of income tax computation and deductions:

Case 1: Prepare Computation Sheet

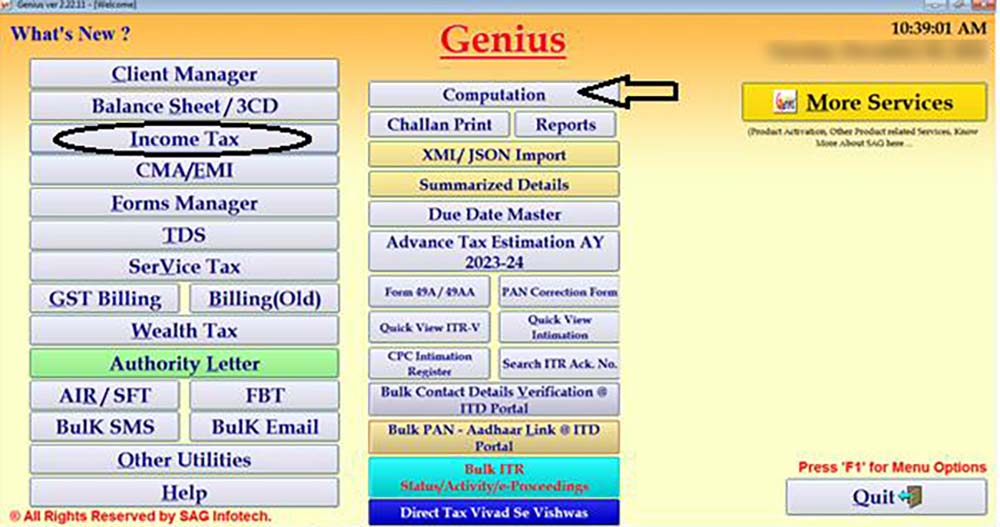

Step 1:– First Install the Genius Income Tax Return Filing Software on your laptop and pc.

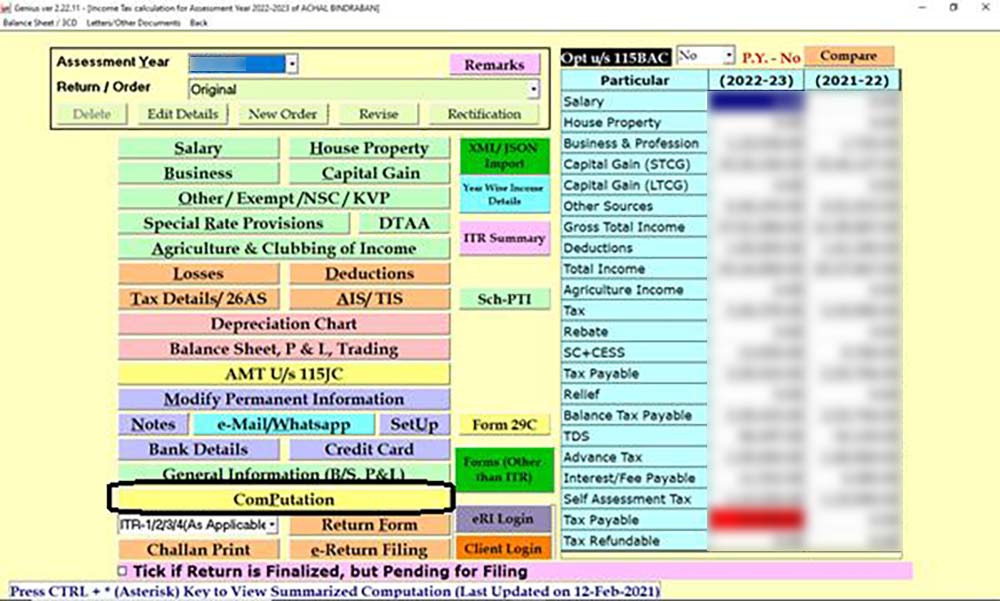

Step 2:- Now go to Income Tax -> Computation Option as shown in the screenshot below.

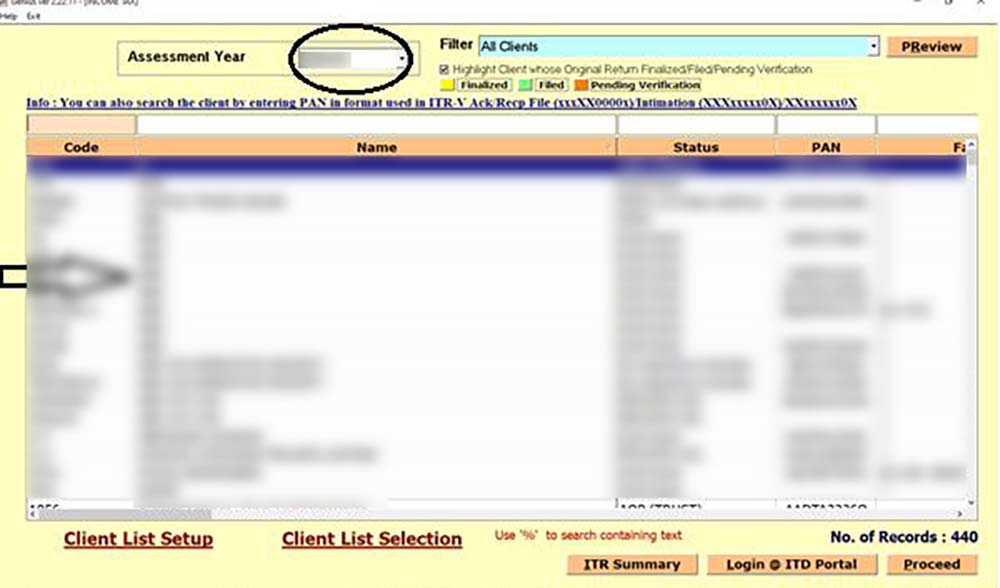

Step 3:- After that select the client and the assessment year for which you want to enter the deductions and other details.

Step 4:- Then fill in the details of Income, Losses, Deductions etc. as applicable to you.

Step 5:- Now click on the computation tab to view the computation prepared by you.

Step 6:- At last you can take the print preview of the computation by clicking on the Print Preview tab.

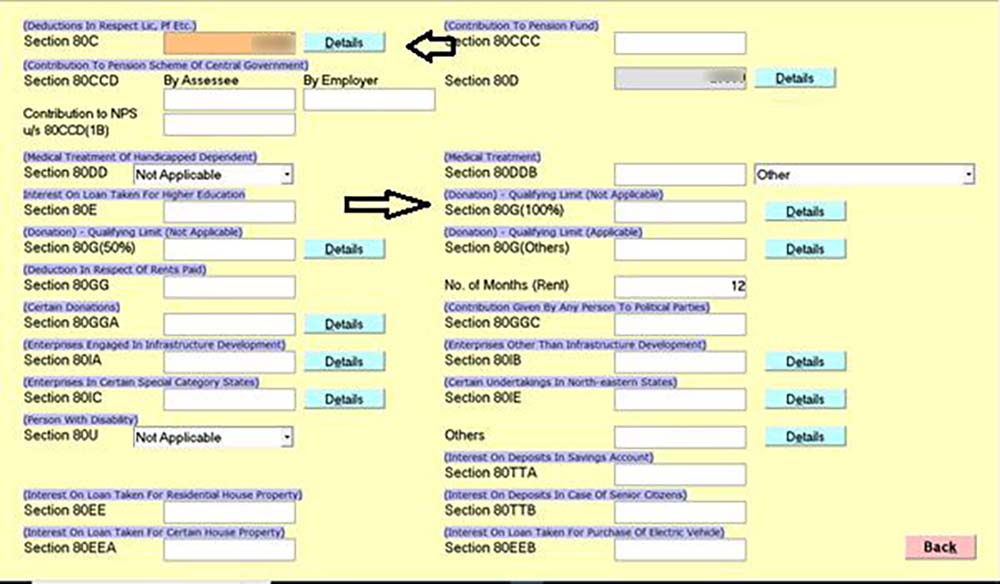

Case 2: Fill Deductions Details

Step 1:- First click on the Income Tax->Computation Option and then select the client and the assessment year for which you want to enter the deductions.

Step 2:- Go to the Deductions tab to fill the Chapter VI-A Deductions.

Step 3:- Fill in the Deductions as applicable to you.