The sale of residential units of the project is not a sale of immovable property but a sale of services and GST is subject to be levied. Once, the GDA rejects the Completion Certificate to the applicant, the Completion Certificate cannot be stated to be considered approved, Uttar Pradesh Authority for Advance Ruling (AAR) ruled.

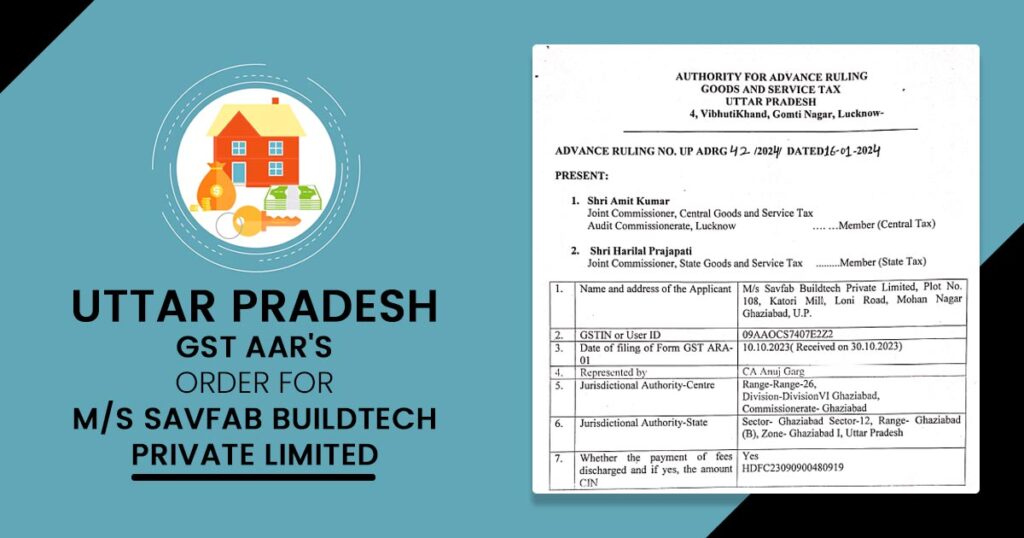

The applicant M/S Savfab Buildtech Private Limited, has applied for Advance Ruling u/s 97 of the CGST Act. 2017 read with Rule 104 of the CGST Rules, 201 7 and Section 97 of UPGST Act, 2017 read with Rule 104 of the UPGST Rules, 2017 in Form GST ARA-01 (the application form for Advance Ruling), discharging the fee of Rs. 5,000/-each under the CGST Act and the UPGST Act.

The petitioner is an Indian company incorporated under the Companies Act, 1956 (Now repealed by the Companies Act, 2013) and is developing a group housing project in the name and style of ‘Saviour Park’ located at Mohan Nagar, Ghaziabad and has received GST registration in the state of Uttar Pradesh for construction and sale of the group housing project named ‘Saviour Park’.

The query is the subjected GST rate under the provisions of the CGST Act and the obligation to file the GST, therefore is considerable u/s 97(2)(a) of the CGST Act 2017.

Under the declaration furnished via the applicant in Form ARA-01, the issue via the applicant is neither pending nor decided in any proceedings under any of the provisions of the Act, against the applicant.

Read Also: Current GST Rate and HSN Code on Construction Services

The petitioner is developing the project ‘Saviour Park’ having 1150 Units in aggregate. The project has been split into 4 phases. The First Three Phases have already been completed and delivered to customers.

Phase IV has a total of 282 units and is registered under RERA vide registration number UPRERAPRJ7191. The articulated phase was constructed and completed in two parts. Parts I of Phase IV having 169 units was completed earlier and delivered. Part Il of Phase IV having 113 was under construction and was completed in April 2023.

In April 2023 the construction of 113 units in Phase IV was completed and the applicant has received certificates / NOC via distinct authorities needed for the completion of the building structure i.e. Fire Safety NOC. Structure stability certificate, lift NOC, Electrical NOC.

The petitioner has applied to Ghaziabad Development Authority for issuance of a completion certificate of 113 units in block Al and A2enclosing copy of the Fire Safety NOC, Structure stability certificate, lift NOC, Electrical NOC, RWH-certificate etc.

The petitioner has furnished that the letter received via GDA rejecting the application for a completion certificate after the expiry of the stipulated 8 working days is regarded the said letter is itself in breach of the building bylaws of GDA.

Recommended: Madras HC: Officers Can’t Attach Property Under GST If Assessee Commences Appeal Proceedings

An Occupation certificate (OC) is a certificate that quotes that the project has been built by all construction norms, building bye-laws, etc. It is solely after a project receives an OC, can the builder apply for different utilities for the project? While a possession certificate is issued before the buyer via the developer as transfer of ownership evidence.

Whereas a possession certificate shows the transfer of possession while an occupancy certificate is a green signal via the local council that the property is good for residence. The latter furnishes you to occupy the property with official rights, a guarantee not proposed by the possession certificate.

The GST AAR including Amit Kumar and Harilal Prajapati discovered that the letter of possessions cannot be replaced for the occupation certificate. Therefore, holding a letter of possession or sale deed does not indicate that “first occupation” has taken place. The Completion Certificate was refused to the applicant via GDA.

After GDA rejected the Completion Certificate to the petitioner. Therefore, a Completion Certificate cannot be expressed to be considered approved. The ‘first occupation’ could not be stated to be taken either.

Therefore, the sale of residential units in Phase IV of the project by the petitioner does not be the sale of immovable property but a sale of services, and therefore Goods and Services Tax is subject to be levied.

AAR ruled that the residential units sale in Phase IV of the project by the applicant is not a sale of immovable property but a sale of services and therefore GST is levied to tax.

| Applicant Name | M/S Savfab Buildtech Private Limited |

| GSTIN of the applicant | 09AAOCS7407E2Z2 |

| Date | 16.01.2024 |

| Represented By | CA Anuj Garg |

| Uttar Pradesh GST AAR | Read Order |