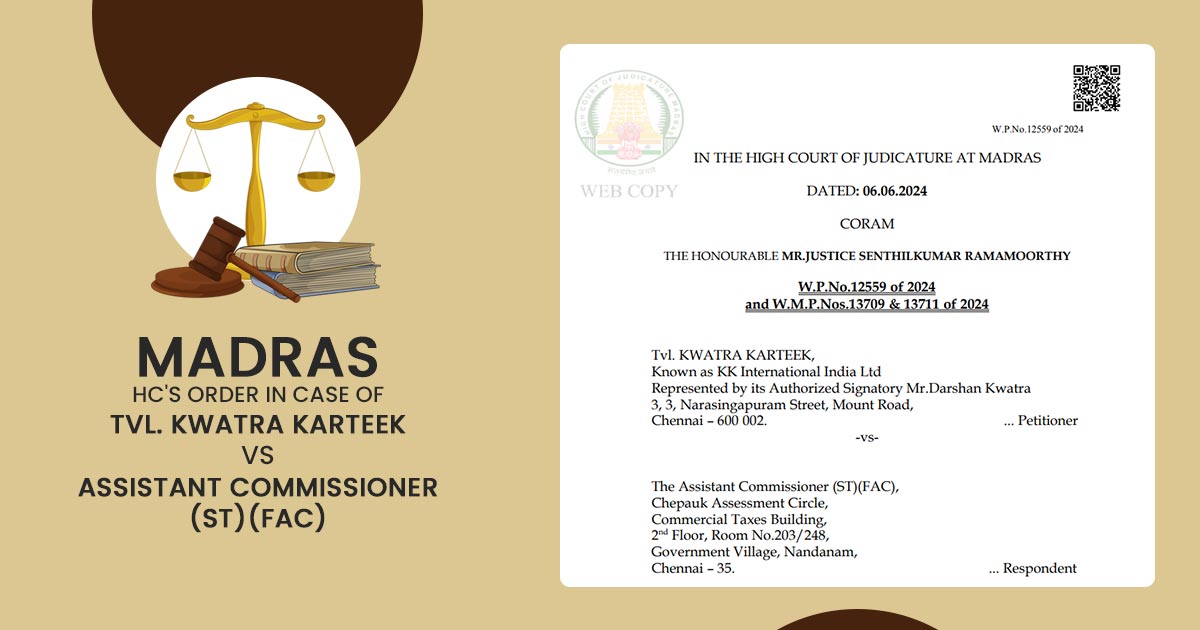

The Madras High Court in a ruling set aside an order for GST obligation because of the non-payment under the Reverse Charge Mechanism (RCM). The matter, Tvl. Kwatra Karteek Vs Assistant Commissioner (ST)(FAC), is on the violation of natural justice principles and the applicant’s accidental error during filing Form GSTR 3B. The importance of due process and fair hearing in tax assessments is shown in this judgment.

Detailed Analysis in the Case of Kwatra Karteek

On December 28, 2023, the case derived from an original order, which Tvl. Kwatra Karteek contested, quoting a violation of natural justice. The applicant asserted unfamiliarity with the proceedings directing to the order because of a lapse by their part-time accountant. The same analysis resulted in the applicant not receiving critical information for the tax demand.

The problem was that an alleged short GST payment was attributed to an accidental error in filing Form GSTR 3B. The counsel of the applicant claimed that given a chance, they can establish no short payment has emerged. This justification shows the procedural lapse, stressing that the impugned order was issued without any notice and chance for the applicant to show their matter.

Mr. V. Prasanth Kiran, representing the respondent remarked that the order complied with a SCN on 30th September 2023. Even after this, the court discovered that the tax demand concentrated on the non-payment under RCM (Reverse Charge Mechanism) arrived from the filing error of the applicant. The same error can be improved if the applicant was permitted to challenge the demand on its merits.

The court on analyzing the matter regarded the need to furnish the applicant with a fair opportunity to address the tax demand. The court nextly set aside the original order, on a prerequisite that the applicant remit 10% of the disputed tax within 3 weeks of obtaining the order of the court. The applicant was allowed to answer the SCN within the same duration.

The respondent should provide a reasonable chance for a personal hearing, on receipt of the 10% payment and the response of the applicant. After that a fresh assessment order should be issued within three months, the court asked.

Closure: The decision of the Madras High Court in Tvl. Kwatra Karteek Vs Assistant Commissioner (ST)(FAC) emphasizes the role of the judiciary in ensuring compliance with principles of natural justice in tax matters.

The court by setting aside the original order and mandating a 10% pre-deposit, balanced the requirement for compliance with fair hearing procedures. The same ruling serves as a reminder of the crucial significance of due process in the administration of tax statutes, ensuring assessees are provided a fair chance to contest and clarify tax demands.

| Case Title | Kwatra Karteek Vs Assistant Commissioner(ST)(FAC) |

| Citation | W. P.N o.12559 of 2024 W.M.P.Nos.13709 & 13711 of 2024 |

| Date | 06.06.2024 |

| For Petitioner | Mr.D.Vijayakumar |

| For Respondent | Mr.V.Prasanth Kiran, GA (T) |

| Madras High Court | Read Order |