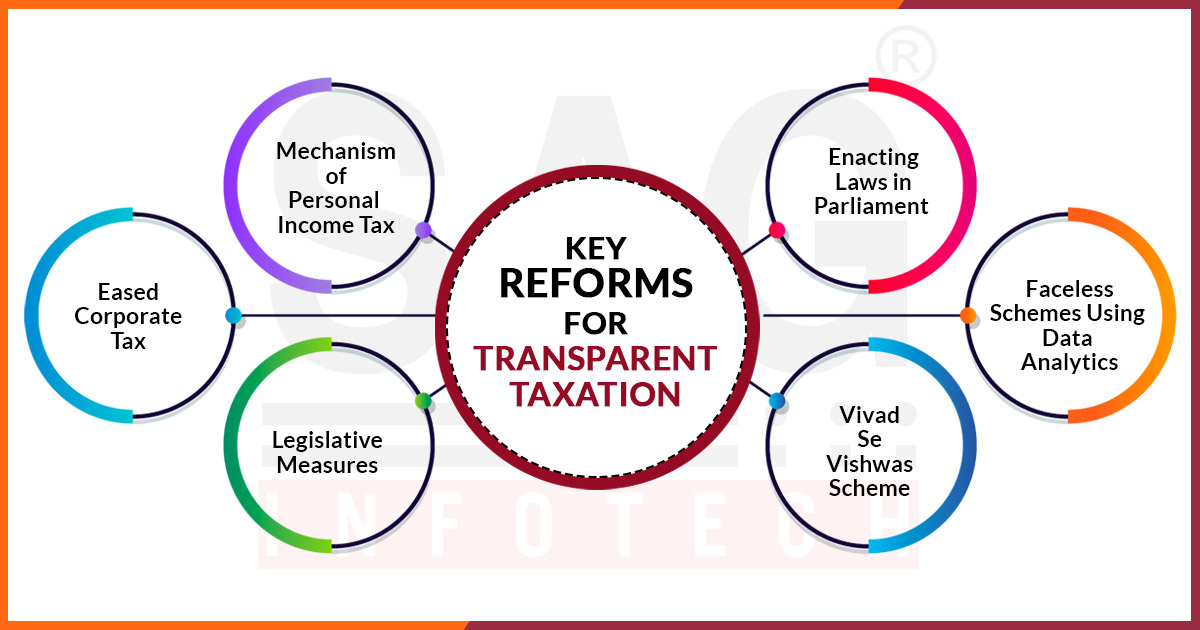

We must have heard about the era of the Industrial Revolution, the IT era and so on. But what about this era? This is an ‘Era of Transparent taxation’ or in other words ‘Era of Tax reforms’. The reason attributed to the new ‘era of Transparent Taxation’ or ‘era of tax reforms’ is the blend of advancement in Information and communication technology with the high vigilance of the Income Tax Department. Additionally, legislative measures curbing corruption, ushering in transparency in the tax system, the introduction of Vivad se Vishwas Scheme

Major Key Reforms That Make Easy Compliance for Taxpayers

- Now Income Tax Return Forms contain the pre-filled details of certain specific incomes thus reducing the time and efforts that are required to fill the ITR form.

- Electronic Verification of Income Tax Returns

- All the communications of the Income Tax Department are generated electronically with the unique Document Identification number that has brought more transparency in the tax mechanism

- Dividend Distribution Tax has been abolished with effect from April 1, 2020.

Eased the Mechanism of Personal Income Tax

The Finance Act 2020 has provided a choice-based personal tax system i.e. there are 2 tax rates mechanisms in which the personal Income taxpayer has to choose one tax mechanism.

Eased Corporate Tax

Interestingly, India has one of the lowest tax rates in the world consequently making it an attractive destination for foreign direct investment and foreign portfolio investment. The Taxation Laws (Amendment) Act, 2019 has further simplified the mechanism of the Corporate Tax by offering tax at the concessional rate. This initiative shall attract fresh investment, create jobs in the Indian economy and shall further stimulate it.

Legislative Measures Have Eased the Way Business is Done

Following are the various legislative measures that have eased the way business is done:

- Insolvency and Bankruptcy code 2016 has strengthened the Corporate Insolvency Resolution Process (CIRP)

- Under PM Garib Kalyan Package, The threshold of the default under the IBC 2016 has been increased from 1 lakh to 1 crore

- Various Appellate /specialised tribunals have been created for corporate dispute resolution and gave the momentum to expeditious disposal of cases. The various semi-judiciary bodies are NCLT, NFRA, IEPFA, IBBI and NCLAT

- Companies (Amendment) Act 2019 has strengthened the various enforcement Agencies & de-clogged National Company Law Tribunal along with special courts

- Many threshold glitches and growth without restriction has given a push to small companies and One Person Companies

Enacting Laws in Parliament along with other Steps taken for Curbing Corruption

Various laws have been enacted, agreements with other countries made and schemes launched in a pursuit to stop corruption:

- Benami Transactions (Prohibition) Amendment Act, 2016 has been enacted in the parliament to provide for specific provisions

- for the confiscation of ‘Benami property’ & prosecution of the ‘benamidars’.

- The Black Money (Undisclosed Foreign Income and Assets) & Imposition of Tax Act, (effective from July 1, 2015) to suppress the outflow of black money abroad.

- For capturing economic offenders, The Fugitive Economic Offenders Act, 2018 has been provided for the speedy confiscation of the proceeds of crime & properties that are owned by fugitive economic offenders in India or abroad.

- An agreement has been signed between the USA and India for the purpose of the ‘Foreign Account Tax Compliance Act’ (FATCA).

- Income Declaration Scheme, 2016 has been introduced to provide a chance to all those persons who had not declared income correctly in the earlier years

Ushering Faceless Schemes using Data Analytics and Artificial Intelligence

The Faceless Assessment Scheme

- Now there is no need for the taxpayers to visit the IT Office.

- There is no fixed territorial jurisdiction and cases are assigned by the system randomly.

Faceless Appeal Scheme 2019

- Conducting appeal related proceedings in the electronic mode

- National Faceless Appeal Centre (NFAC) established at Delhi & 4 other Regional Faceless Appeal Centers (RFACs) along with 293 Appeal Units established across the country.

‘Vivad Se Vishwas Scheme’ Effective from March 17, 2020

It is applicable to tax-related disputes. As per ‘Vivad Se Vishwas Scheme’, a tax-related dispute settlement mechanism has been devised in which tax disputes are settled in a speedier manner.

On whom ‘Vivad Se Vishwas Scheme’ Applicable?

Subject to excluding certain specific confrontations, taxpayers whose appeal had been pending as on January 2020 are eligible for the aforesaid scheme by paying only the disputed tax and getting the waiver from the payment of the interest and the penalty.

The ‘Vivad Se Vishwas Scheme’ has reduced tax litigation and immuned from penalty, interest and the prosecution of the taxpayers.

Achievements

From the year 2013-14 to 2020-2021, Number of persons filing returns has increased by 103% from 3.31 crores to 6.72 crores. The number of Taxpayers with income above Rs 1 crore has increased by 117% from 88.6 thousand persons to 1.93 lakhs persons.