The Telangana High Court declared that income tax garnishee notices against the taxpayer’s bank accounts were invalid, pointing out that the notices were sent despite pending appeals and a stay request.

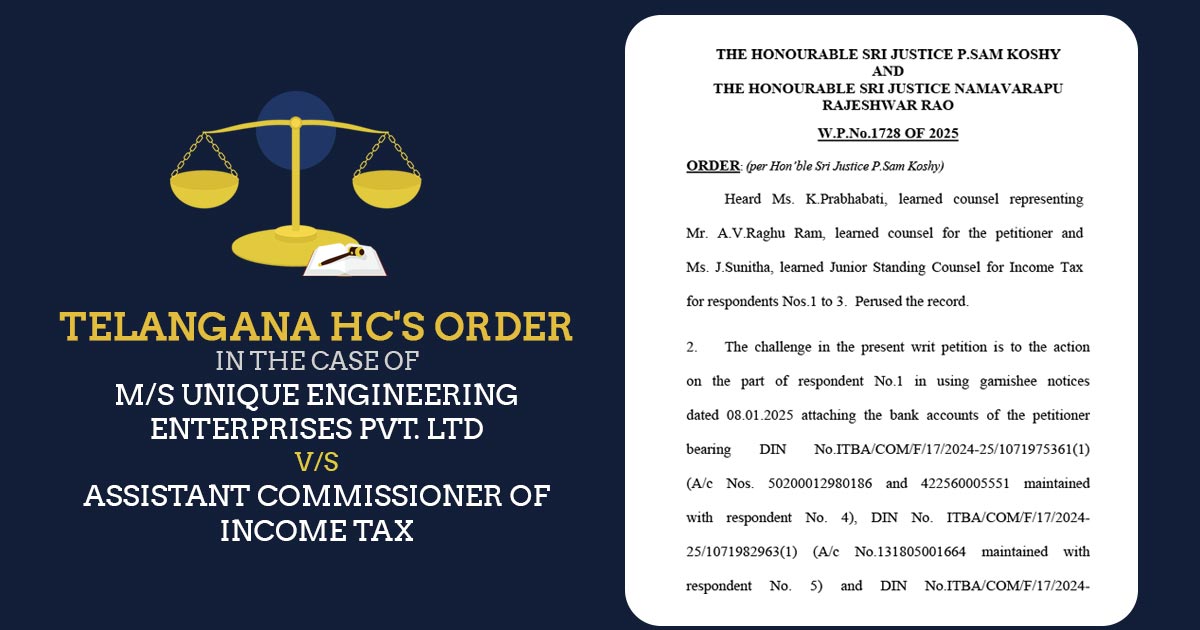

The applicant/taxpayer, Unique Engineering Enterprises Pvt.Ltd, contested the garnishee notices issued dated 08.01.2025 by respondent No. 1, attaching its bank accounts held with respondents No. 4, 5, and 6.

The assessment order dated 27.03.2024 for the assessment year 2022–2023 and the penalty order dated 17.09.2024 served as the basis for the issuance of these notices.

The applicant has furnished the appeals against both orders before respondent No. 3 on 18.04.2024, including a stay application. However, the appeals and stay requests were still pending when the garnishee notices were issued.

The counsel of the taxpayer claimed that the garnishee notices caused inconvenience to the business and must be set aside. It was mentioned that as the pleas had been furnished earlier, the authorities must not have taken coercive steps at that time.

Read Also: IT Notice U/S 148 Without Modified Process is Invalid: Telangana HC Quashes Reassessment Notice

The counsel directed to two recent orders of the High Court dated 03.01.2022 and decided on 17.01.2022, where interim protection was granted in likewise circumstances. The court in those matters has asked that the pleas and stay applications be decided first before issuing the garnishee notices.

The applicant had filed appeals and a stay motion questioning the assessment and penalty decisions, according to the division bench, which was made up of Justices P. Sam Koshy and Namavarapu Rajeshwar Rao. However, neither the appeals nor the stay request had been decided after over ten months.

It was noted by the court that the authorities must decide the stay application or the appeal before taking any recovery measures. Rather, they delayed the plea and moved with the coercive measures.

Recommended: Bombay HC: It’s Not Fair to Charge Taxes Based on Assumptions Made By a Lower Court Without Proper Investigation

Therefore, the bench set aside the garnishee notice on 08.01.2025 and asked the authorities to determine the appeal and stay application first, and then move under the law.

The writ petition was disposed of.

| Title | M/S Unique Engineering Enterprises Pvt.Ltd vs. Assistant Commissioner of Income Tax |

| Citation | W.P.No.1728 OF 2025 |

| Date | 23.01.2025 |

| Counsel for the Petitioner | Mr. A.V.Raghu Ram |

| Counsel for Respondents | Ms. J.Sunitha |

| Telangana High Court | Read Order |