Services furnished via Indian information technology (IT), marketing, and consulting companies to foreign clients might not always draw integrated goods and services tax (IGST) if a ruling by the Authority for Advance Rulings’ (AAR’s) Telangana Bench becomes a precedent.

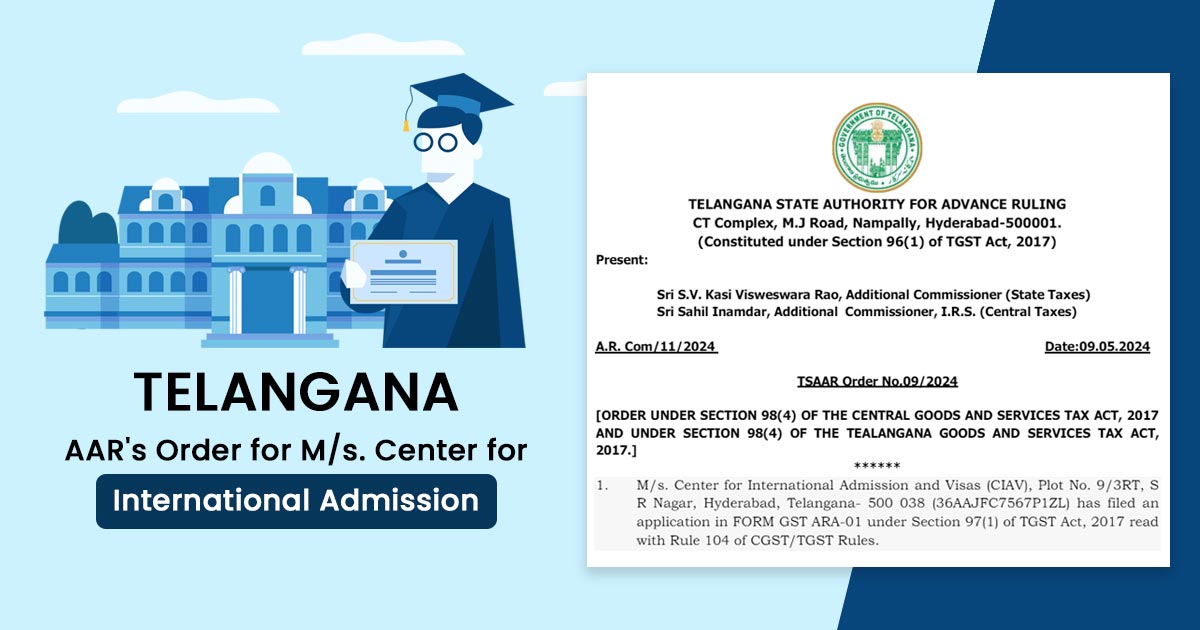

In the case of referral services furnished under the Hyderabad-based Center for International Admission and Visas (CIAV) to foreign universities and colleges for admitting Indian students, AAR furnishes its ruling. With universities, colleges, or students for guaranteed admission in particular places, the company does not secure any binding agreement.

AAR ruled that such services were not intermediaries but exports. It directed that such shall not carry the integrated GST which the intermediary services shall draw.

Trending:- Telangana GST AAR Denies Tax Exemption on Pure Services from Sellers By AIIMS

For other industries, the ruling may have ramifications that furnish the services to foreign clients, especially in the IT, consulting, marketing, and recruitment sectors.

A Key Point of Contention

In a specific case of referral services, AAR gave its ruling provided by the Center for International Admission and Visas (CIAV) to foreign universities and colleges

AAR ruled that such services were not intermediary through exports AAR kept the scope of an intermediary and does not comprise a company that furnishes the services on its own account.

Related: Bombay HC Supports GST Liability on Intermediary Services, Didn’t Confirm SGST, CGST or IGST

The company in a specific matter obtained the referral income or commission in foreign currencies from universities and colleges based on admissions.

No company that supplied services on its own account has been counted under an intermediary, AAR stated. For the current case, the company is under a principal-to-principal contractual relation with foreign universities and colleges and it is delivering its independent and main service of marketing and referral to them.

Apart from that the company does not influence the selection procedure of the prospective students to a contracted university, it carried.

Tax experts cited that the ruling set a precedent for the classification of the services under GST.

This decision furnishes a broader interpretation that affects different service sectors engaging with foreign clients.

The AAR cited services furnished before foreign clients on a principal-to-principal basis such as consulting, IT, marketing and recruitment must not always be considered intermediary services.

| Applicant Name | M/s. Center for International Admission |

| GSTIN of the applicant | 36AAJFC7567P1ZL |

| Date | 09.05.2024 |

| Applicant | Sri S.V. Kasi Visweswara Rao, Additional Commissioner (State Taxes), Sri Sahil Inamdar, Additional Commissioner, I.R.S. (Central Taxes) |

| Telangana AAR | Read Order |