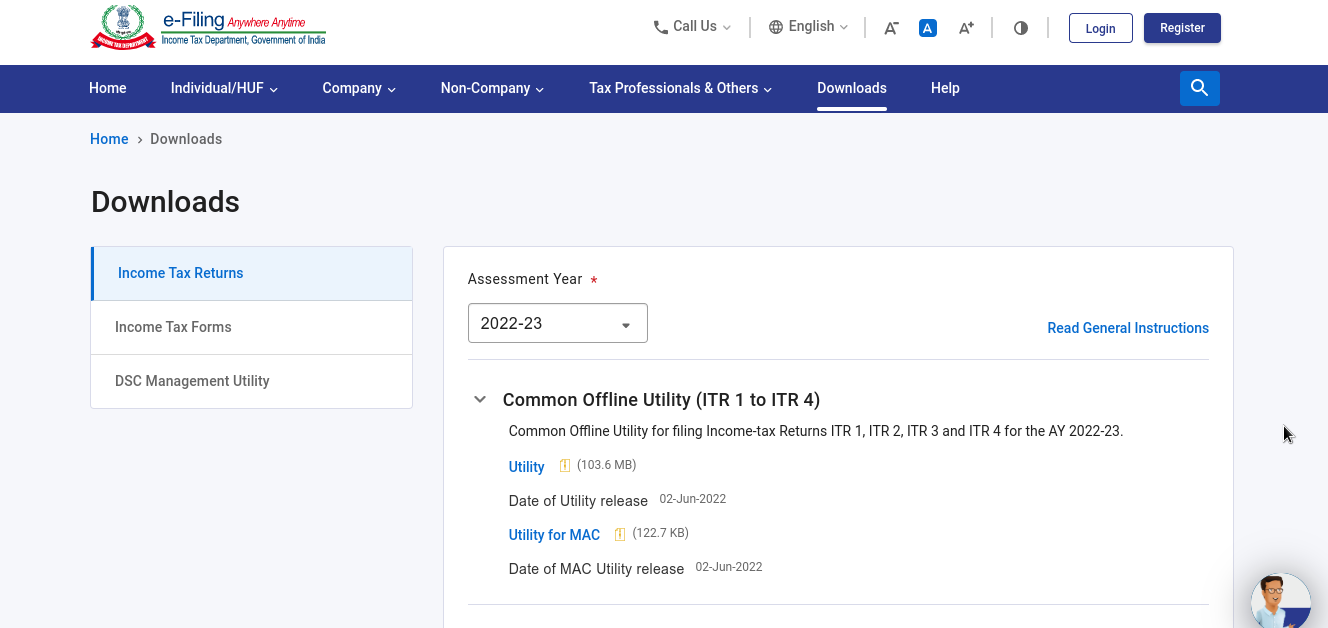

The online e-filing aids people and provides comfort in furnishing the TDS returns. The income tax department has managed the TDS as it shows in the online tax account of the taxpayer from whom the tax gets deducted. As the taxpayer, you have the right to take the credit for these TDS during furnishing the ITR

The guidelines have given that you will receive the credit on the grounds of the TDS returns. Hence you will not receive the credit if TDS is not mentioned in the yearly statement (AIS; earlier called Form 26AS). TDS may not show in your statement if the tax deductor is unable to pay the TDS or does not file a TDS return

The other issues are the credit is furnished to TDS for the year in which the income is provided to the tax. During the time of payment or credit of income, the TDS is deemed to be cut. Thus if you have got the advance but do not raise the invoice and you obey the accrual accounting system, no credit is to be given for TDS from the advance. The credit is offered to you in the corresponding year when you give the income to tax.

If you have asked for the invoice in the present year and TDS has cut down during the payment time in the following year. But the same Tax Deducted at Source (TDS) will not show in your statement for the present year and then the TDS credit will be denied if you claim credit for TDS afterward deducted to match it with the income.