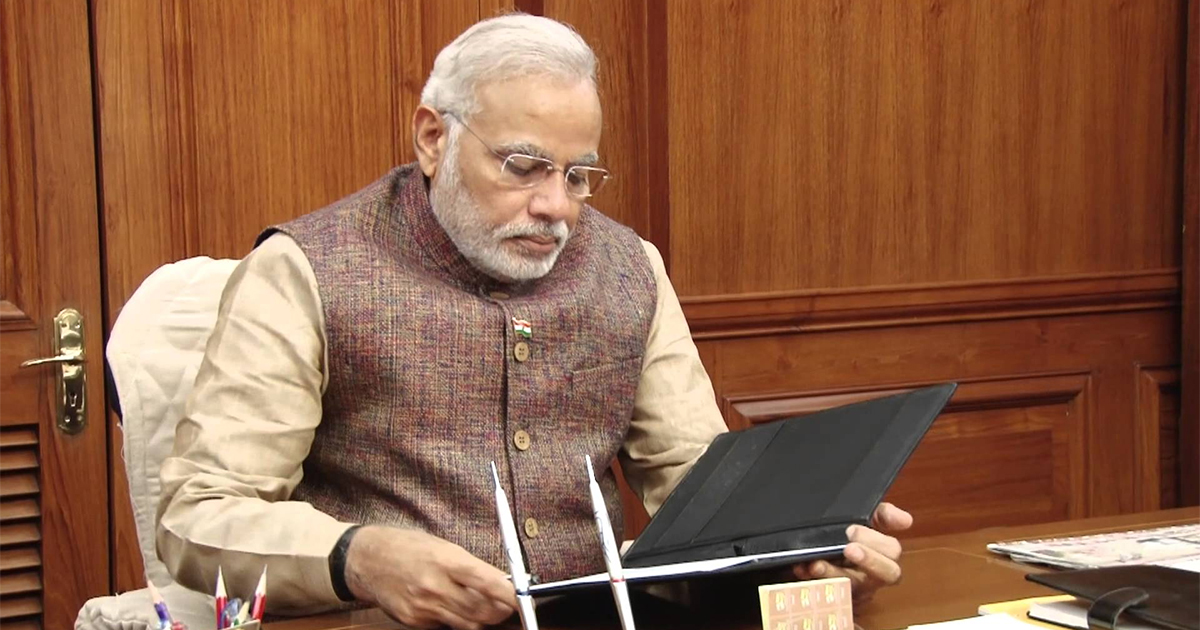

As a positive conveyer of the message, the tax department of indirect taxation has decided to send bulk letters approximating around 50 thousand to the Prime Minister of India Narendra Modi to create a positive panorama in the upcoming goods and service tax scheme. The letters are headed for the prime minister to seek their concern over some highly significant issues.

The All India Association of Central Excise Gazetted Executive Officers and Indian Revenue Service (Customs and Central Excise) took this decision to send a large chunk of letters to the prime minister. Anup Kumar Srivastava, President of IRS officers association told that, “We have decided that each employee working under Central Board of Excise and Customs (CBEC) will write a letter to the Prime Minister seeking his intervention for the successful GST, Though there are about 85,000 indirect tax employees working at various levels across the country, at least 50,000 letters will be sent to the Prime Minister within next two days.”

The GST council has finally concluded to grant the power to assess the economic activities on the territorial area of the sea under 12 nautical miles and also given the authority to assess the taxpayers below 1.5 crores of turnover after the implementation of GST. Mr. Anup Kumar also mentioned that “There are certain issues concerning economic interests of the nation and concerning such a large workforce like ours, who have been working for GST tirelessly for last 10 years and we want that these are resolved immediately to make roll-out of GST successful.”

Some of the major issues for which the tax department is concerned is that the GST network is being set up with the private companies and the security threat is at highest probability. The suggestion to set up the network with the CBEC has been thrown upon the council by the experts in cyber security. Now as the implementation dates are coming closer, the certainties are at peek and would require more and more indulgence into the matter for which the letter decision has been taken.