The income tax department has found that towards the AY 2022-23 they had obtained more than 2 cr ITR. The former date to furnish the yearly Income tax return for the salaried assessee and the non-auditable cases would be 31st July.

“Income Tax e-filing portal has received more than 2 crore Income Tax Returns (ITRs) for AY 2022-23. We urge you to file your ITR at the earliest, if not filed as yet,” the council tweeted.

With the former date to furnish the ITR for the present assessment year, the Finance ministry mentioned that they seek an effective number of submissions. The council mentioned that the income tax department website to furnish the ITR (incometaxindia.gov.in) would be in the review process to assure efficiency in the filing process.

What Happens If Assessee Miss Filing of ITR?

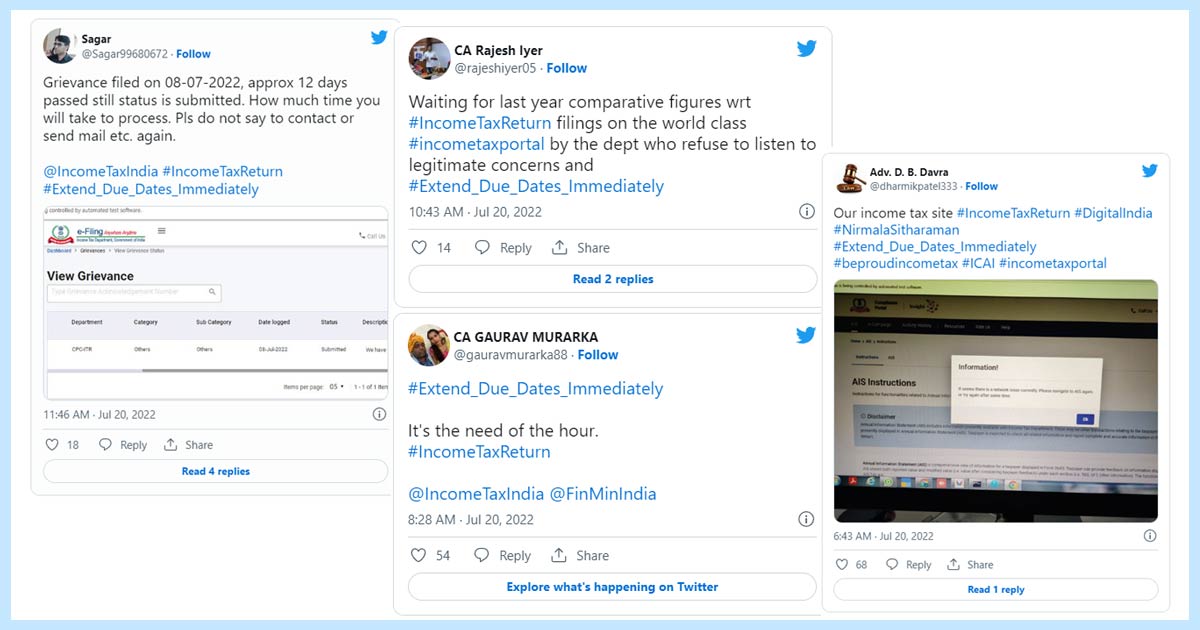

The department would be considered that the assessee would suffer from the problems in the e-filing portal. On the date 2nd July 2022, the income tax department tweeted that the software provider Infosys would be opting the proactive measures to fight the unwanted traffic. “Despite the ITR filing and technical issues, the tax practitioners are also packed with the GST return filing dates.”

The former dates for the GSTR 3B would be 20th, 22, and 24th July 2022. 20th July 2022 will be the last date to furnish GSTR-5 and GSTR 5A. From April to June, 31st July 2022 will be the last date for CMP-08.

The tax practitioners seek for extension of the last date since they are bounded with various complaints.