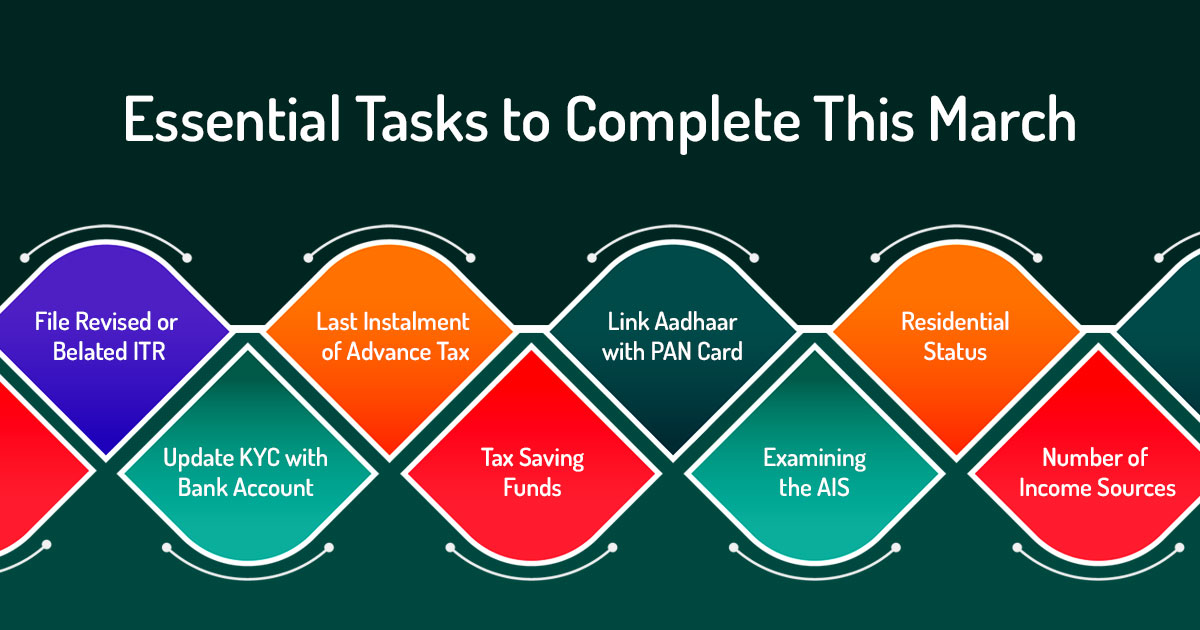

There are more essential due dates that are more than the end of this fiscal year that secure a direct link with your money and are going to be finished this month. The last date to furnish the belated or revised ITR, PAN-Aadhaar link, Bank account KYC, and others are some of them. Thus an earning person is suggested to monitor these last dates and finish these money chores before the last date.

Below is a list of 8 essential money chores that one is required to finish this month:

Revised or Belated ITR Filing

The due date to furnish the belated Income-tax return for AY 2024-25 is 31st December 2024 (Extended to 15th January 2025 for Resident Individuals). Thus those people who are earning ones and looses to furnish their ITR through the provided last date are recommended to furnish their ITR by the given last date towards furnishing the income tax return.

Identical to that the last date to furnish the belated or amended ITR towards FY 2023-24 is 31st December 2024. When an earning person has e-filed his late income tax return, he would still edit it on or before 31st December 2024. Hence if the assessee sees that any errors are there in one’s e-filed ITR then it would still edit that error online on or prior to the date 31st December 2024.

Linking Aadhaar-PAN Card

30th June 2023 was the last date to link one’s PAN with Aadhaar without any Penalty of Rs.1000/-. Those people whose PAN and Aadhaar are not linked are recommended to do that before the 31st May 2024 with a Penalty of Rs. 1000/- Otherwise their PAN card will be invalid which leads to different fiscal losses and penalties. Beneath section 272B having an invalid PAN card might be rendered towards a Rs 10,000 fine. Besides, one’s TDS on bank deposit interest would be doubled.

Last Installment of Advance Tax

Under section 208 of the Income Tax Act, every assessee whose estimated tax liability is Rs 10,000 or exceeds would furnish advance tax which is furnished in 4 instalments. The last date for the first installments stands on 15 June the second on the 15th September, the third on 15th December, and the fourth on 15th March in each fiscal year. Hence the assessee who furnished the advance tax installments in the former quarters is advised to remember the last date for furnishing the last installments of the advance tax is 15th March.

Investments in Tax Saving Funds

To finish the tax-saving objective only one month is left for an earning person. Thus one is required to make sure that is has deposited the tax-saving funds such as the Public Provident Fund (PPF), National Pension System or NPS, and others. But it is essential to remember that when an earning person is not able to save then some of the expenditures beneath the head like tuition fees of the child, principal repayment on the home loan, and others give the tax advantage to an income taxpayer.

Examining the AIS Under Income Tax

AIS is available on the income tax e-filing portal and furnishes a complete summary of several fiscal transactions done by the assessees, along with the information on taxes withheld or paid in the fiscal year, prescribed financial transactions, tax demand or refund, and the tax proceedings. A review of the AIS would assist the assessee by ensuring that all the financial transactions that come under the taxable income are duly understood and considered to compute the taxes.

Tax Laws in India Governing Residential Status for FY 2023-24

Various people of Indian origin travel to India and have been stuck in India. In these situations, it is essential to find out the residential status in India to ensure that the taxability is seen correctly.

A person’s residential status determines the taxability in India. The person who comes under the class of the normal tax residents would be taxed in India based on income earned throughout the world. The non-residents are to be taxed on the income earned via sources in India or income obtained in India.

Number of Income Sources & Application of Advance Tax

Taxable income is normally divided into the mentioned 5 heads of the income such as the income from salary; income from house property (rental income); income from capital gains; income from business or profession; income from other sources (for example, interest, dividend, or any other income which does not fall under above heads).