There are various queries that might be in the minds of various assessee for the subject of ITR filing particularly the new taxpayers as the season of ITR filing would be about to initiate. Here the question emerges is what the term TAN or Tax deduction and collection account number stands for and what would be the need for the person to secure the same during deducting tax deducted at source (TDS).

In the post, the discussion about the TAN Number in income tax, who will utilize it, and why the same is essential shall take place.

What is the TAN Number Under Income Tax?

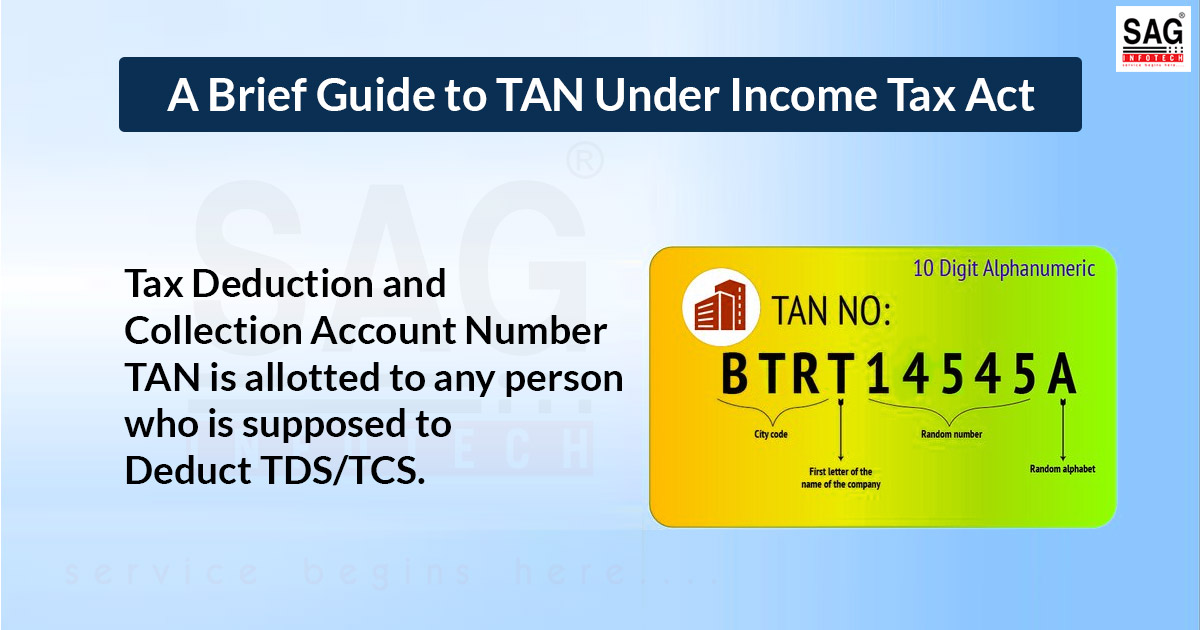

TAN, or Tax Deduction and Collection Account Number specified as a ten-digit alpha-numeric number that should be received by people who are in charge of deducting or collecting taxes. It is essential that all the TDS statements along with the Tax Deduction Account Number (TAN) allotted via the Income Tax Department (ITD), as per section 203A of the Income Tax Act of 1961.

Which Person is Responsible When Applying for a TAN Number?

TAN is important to be taken by every individual who is responsible for deducting tax at source or collecting tax at source. It is required to quote TAN in all TCS or TDS transactions, along with any e-TCS or TDS return, TDS/TCS payment challan, and TDS/TCS certificates.

Online and Offline Methods for Applying TAN

TAN number can be applied for by people through online or offline modes.

Offline Process for TAN

For an offline application, one should file Form 49B (Form of application for allotment of tax deduction and collection account number) in duplicate and submit it to any TIN Facilitation Centre (TIN-FC). Addresses of TIN-FCs are available at the NSDL-TIN website (https://www.protean-tinpan.com/).

Online Process for TAN

One should visit the NSDL-TIN website for online application.

On https://incometaxindia.gov.in/Pages/default.aspx or https://www.protean-tinpan.com/, the addresses of TIN FC would be available.

Rs.77 will be subjected to be applied as a fee for TAN application filing (the application fees may change from time to time).