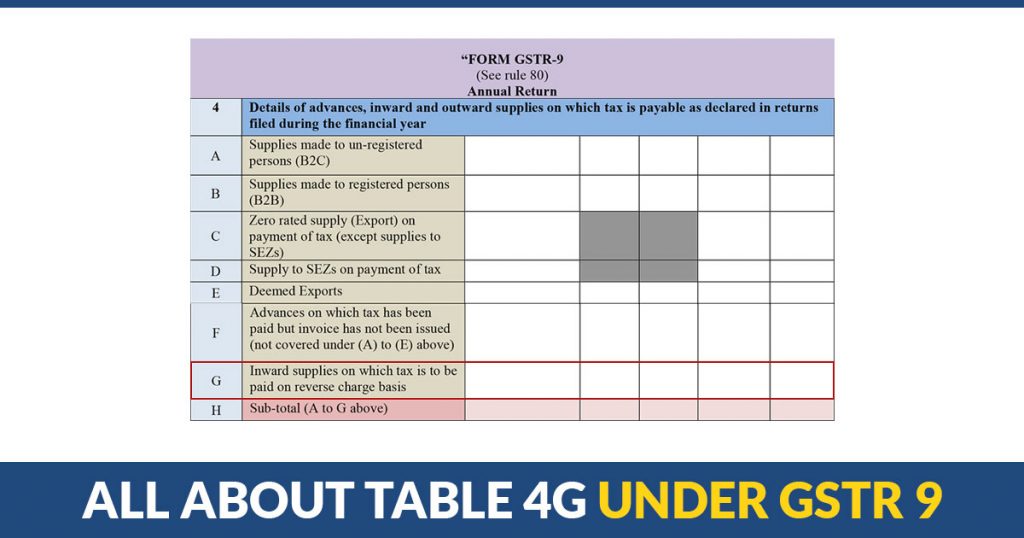

In some cases, a registered person comes under an obligation to pay tax on a reverse charge basis. Table 4G in GSTR 9 encompasses details of such inward supplies which makes a registered person liable to pay tax on a reverse charge basis.

Important Points of Table 4G:

- The amount furnished in Table 4G includes the total value of services imported and supplies received from registered and unregistered individuals on which tax is charged on a reverse charge basis.

- Both the intrastate & interstate nature of supplies

- The information in this table is sourced from Table 3.1(d) of GSTR 3B. However, it should always be reconciled with Table 4A(3) of GSTR 3B for the ITC claimed.

Some Cases when Tax is Paid on Reverse Charge Basis:

(a) Amount rectified in 2018-19 is to be reported

- The total amount to be furnished in Table 4G is the total amount of supplies under RCM for 2017-18. The amount rectified in 2018-19 (of 2017-18) in GSTR 3.1 (d) will also be summed up with the amount reported in this table. But the tax paid on this rectified amount shall not be reported in 4G but in Tables 10 & 14 of GSTR 9 respectively.

For Example

- An invoice of INR 4,00,000 for inward supplies which is liable to reverse charge, was mistakenly entered in Table 3.1(d) as Rs 2,50,000/- in October 2017. The same was rectified in May 2018 while filing GSTR 3B for May 2018 (2018-19).

Solution:

- The total amount of INR 2,50,000/- will be reported in Table 4G and the tax paid on rectified amount i.e. Rs 1,50,000 (4,00,000 – 2,50,000) will be reported in Tables 10 & 14 respectively.

(b) Tax Payment under incorrect Head (CGST + SGST = IGST )

For Example

- Interstate supply liable to Reverse Charge, has been furnished as intrastate supply and mentioned as CGST + SGST in Table 3.1.(d) in March 2018 but was rectified in May 2018.

Solution:

- Initially, table 4G reported this tax paid as CGST + SGST. The rectification was done in May 2018 which shall be revealed in Tables 10 & 11 of GSTR 9 by furnishing the tax in the IGST column to elevate the liability and the same amount divided by two in each CGST & SGST column of Table 11 to curtail the liability. Like if the IGST is INR 4000 then INR 2000 will be reported as CGST and another INR 2000 will be reported as SGST.

(c) Supplies which are not under RCM should not be reported in Table 4G of GSTR 9

Read Also: Easy Guide to RCM (Reverse Charge Mechanism) Under GST with All Aspects

For Example

- Inward supply of worth INR 1,00,000/- received from GTA in February 2018, on which GST was applied @ 12%. This inward supply was reported in Table 3.1(d) of GSTR 3B in July 2018. But actually, the invoice from GTA with GST @ 12% was not to come under RCM. So, the error was rectified in July 2018.

Solution:

- Since the amount of INR 1,00,000/- provided in GSTR 3B would have been auto-populated in Table 4G of GSTR 9, It needs to be rectified manually by reducing the amount of INR 100000/-in Table 4G of GSTR 9.

(d) ITC claimed in Table 4A(3) of GSTR 3B not revealed in Table 3.1(d) as inward supply under RCM

Recommended: How to File GSTR 9 Easily Via Gen GST Software Version 2.0?

For Example

- ITC claimed in Table 4A(3) in Jan 2018, missed to be reported as Inward supply under RCM in Table 3.1. (d) of GSTR 3B which has not been rectified yet.

Solution:

- In such cases when an error has not been rectified yet, the inward supplies liable to RCM need to be reported in Table (4G ) and tax has to be paid via DRC 03 in the annual return.

Verification of the Amount Furnished

- Reconcilement of tax paid on inward supplies under RCM and the ITC claimed on inward supplies as revealed in GSTR 3B should be done. The mismatch may happen because of the stagnant credit under 17(5).

- Reverse charge payments under Sec 9(4) are applicable only when the supply has taken place prior to 13th Oct 2017. Therefore, there should not be any revelation of reverse charge under section 9(4)