For a wide variety of purposes, Indians use the Permanent Account Number (PAN) card, which holds substantial importance in every sector. Apart from its major use for filling the tax forms, it is considered an identification document for different grounds. A sample number of people are applying for it because of its rapid prominence over the years. To simplify the process of applying for the card, the IT department has made an initiative where people can fill in the new PAN online.

Important Points Regarding PAN Card

The permanent account number PAN card is used as a mandatory document. It is generated through the income tax department. Its goal is to stop tax evasion. Indeed to stop all these evasions the PAN card has been linked to all financial transactions. The NSDL AND UTITSL have the responsibility to make the PAN card.

- According to the information given on the website of the PAN card, the PAN generated once will be valid throughout the country. The PAN card validity will be the same despite any changes done to the PAN card by the related officer.

- According to the tax department, there will only be one PAN card for one individual. as per the income tax law, section 1961, 272 B, It is an offence to make more than one PAN card and if found then Rs 10000 will be imposed as a penalty.

- The income tax filing is only to be furnished out when you come under section 139. It is not mandatory that if you had made the pan card then the filing is necessary.

- Whenever you buy bigger items such as a car or house then there is the requirement to provide the xerox of PAN card and you cannot work anymore without the PAN card.

- The income tax department has recently added the instant PAN card function on their e-filing portal. Inside that with the help of an Aadhar card number you can apply for a PAN card instantly. On the same, you are provided with the e-PAN number which you can download.

- The PAN card will be used for filing the ITR, opening an account in the bank, buying a car or selling it, applying for a credit and debit card, buying jewellery, making the investment, foreign exchanges, property, loans, cash deposits, telephone connection, insurance payment, and to avail the ID proof like things

Steps For Filling New PAN (Permanent Account Number) Online

- Log on to the website https://tin.tin.nsdl.com/pan.

- The home page portal discloses various categories that include applying for a new PAN card, enquiry and tracking status, correction in PAN, reprinting, etc.

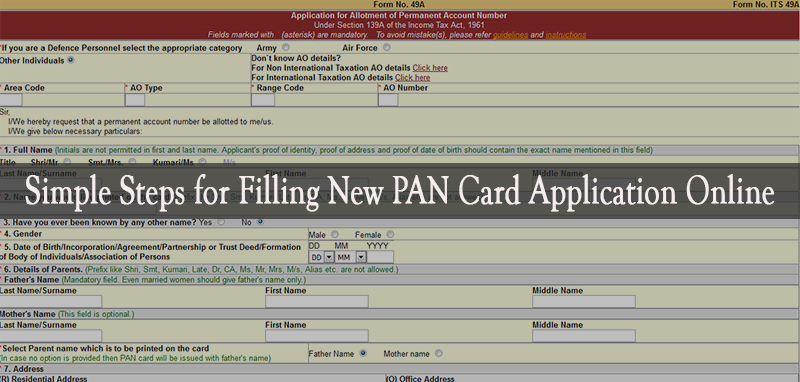

- If applying for the new PAN, visit https://tin.tin.nsdl.com/pan/newpan.html. PAN application consists of form 49A/49AA. Submit the form after filling in all the mandatory particulars. After the form is submitted online successfully, an acknowledgement will be generated.

- The acknowledgement duly signed, affixed with a photograph (in case of ‘Individuals’) along with Demand Draft, if any, and proof of identity, proof of address, and proof of date of birth (applicable for Individuals & Karta of HUF) as specified in the application form are to be sent to NSDL at ‘Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411016’.

List of Mandatory Documents:

Identity proofs

- Aadhar Card

- Voter Id Proof

- Driving License

- Passport

- Arms License

- Photo identity card issued by the Central Government or State Government or Public Sector Undertaking

- Pensioner card having a photograph of the applicant

- Central Government Health Service Scheme Card or Ex-Servicemen Contributory Health Scheme photo card

- Certificate of identity in original signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councillor or a Gazetted officer

- Bank certificate in original on letterhead from the branch (along with name and stamp of the issuing officer) containing the attested photograph and bank account number of the applicant

Address Proofs

- Aadhaar Card issued by the Unique Identification Authority of India

- Elector’s photo identity card

- Driving licence

- Passport

- Passport of the spouse

- Post office passbook having the address of the applicant

- Latest property tax assessment order

- Domicile certificate issued by the government

- Allotment letter of accommodation issued by Central or State Government of not more than three years old

- Property registration

- Certificate of address in original signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councillor or a Gazetted officer

- Employer certificate in original

The documents below can be submitted as well if they are less than three months old:

- Electricity bill

- Landline telephone or broadband connection bill

- Water bill

- Consumer gas connection card or a book or piped gas bill

- Bank account statement

- Depository account statement

- Credit card statement

Date of Birth Proofs

- Birth Certificate

- Pension payment order

- Marriage certificate issued by Registrar of Marriages

- Matriculation certificate

- Passport

- Driving licence

- Domicile certificate issued by the government

- An affidavit is sworn before a magistrate stating the date of birth

- Photographs

- Two recent passport-sized photographs.

Make sure that your name is in the correct format as you have written on form 49A.

Apart from all this, there is an amount of Rs. 110 (Application fee 93.00 + 18.00% Goods & Services Tax), which has to be paid if the communication lies inside Indian boundaries. If not, you’ll have to pay Rs. 1020 (Application fee 93.00 + Dispatch Charges 864.00) + 18.00% Goods & Services Tax).

The charges can be paid online or via demand draft and credit/debit card in case the address lies in India. Online paid charges will get you a payment receipt, which you need to attach to your documents showing proof of payment.

For the latter case, the only medium via which you can pay is through Credit Card / Debit card or Demand Draft payable at Mumbai.

Within 15 days of online application, the acknowledgement letter along with the above-stated proofs must be sent to NSDL. After that, you can check your application status from time to time. Also, you can track it by sending SMS NSDLPAN <space> Acknowledgement No. & send it to 57575.

Recommended: What is the Future Scope for Chartered Accountants?