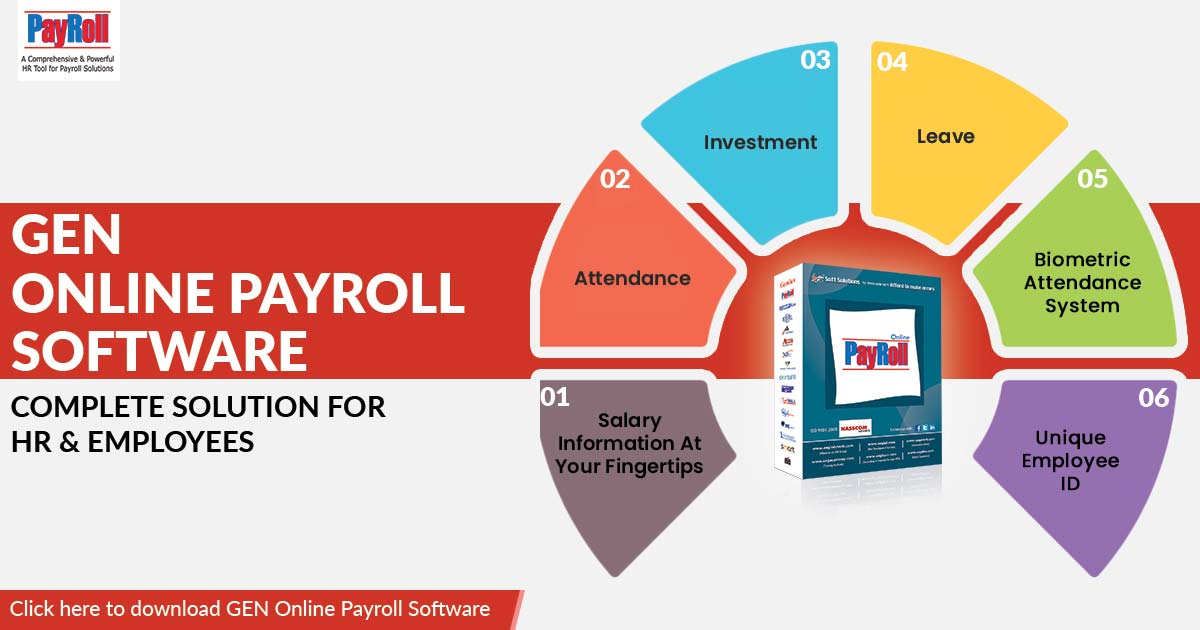

Every businessman, either small or large, has to handle different roles to run their business. Human Resource Management and the HR Payroll Software both play an important role to run any business successfully. Secure your employee data via Gen Payroll Software each time in the right way leads to success.

Every business enterprise is required to maintain the personnel file or details of each employee. The personnel file of each employee includes the history, salary, employment application, important dates like joining date and resigning date, appraisal, job reviews, and government forms. All of the aforementioned details of personnel will be kept in one place in an organised manner and must be available easily and quickly.

Frequently Used Terms in Online/Offline Payroll Software

Unique ID & Password for Employee Login

The company will provide a unique ID and password to each employee at the time of joining the organisation. This ID will be used to Login the payroll system. Gen offline payroll HR management software can handle this feature at a certain place of operations.

Employees Attendance

Attendance is one of the features of Gen Payroll Software. Through this, all employees will be able to check their daily, monthly attendance, and attendance summary along with check-in and check-out timings of the office.

Manage Employees Leave

The leave section will be used to apply for paid leave as well as leave without pay. Through this, an employee is able to check the closing of leave. And all this can be done with mobility, i.e. online payroll software facility.

CTC Calculator

CTC is an abbreviation of ‘Cost to Company’, which includes the total salary package (pay) the company will provide to the employee in a year. It includes Basic Salary, HRA, Medical, Conveyance, and several other facilities.

Employee (User: AJAY | Password: 1234 | Company Code: 01)

HR – (User: AJAY | Password : 123456 | Company Code : 01)

Workers Salary

Through Gen HR Payroll Software, employees will be able to view the details of their salary month-wise, along with proper deductions. Employees can also download payslips and take print-outs as well.

Resignation Letter

When an employee wants to resign from the organisation, he/she has to fill out the resignation form available in the software, mentioning the reasons for resigning from the job and giving at least one-month prior notice to the organisation.

Various Classifications of Employees Based on Payroll Software

There are a few different sets of pairs that help in answering important questions of the employees. Understanding three sets of pairs can save the unexpected costs of the organization and unnecessary problems.

Is that Your Organization Work with Employees or Independent Contractors

In terms of payroll, there is a difference between employees and Independent Contractors. IRS is not only concerned about the employment status of those who are working with the organisation, but is also concerned about the kind of work done by them and how the work is being done by the employees or those working on a contractual basis.

Employees are entitled to claim benefits and compensation, whereas Independent Contractors are not entitled to any kind of compensation or benefits.

If you are working with Independent Contractors or Freelancers, they cannot claim anything after the end of the contract or if the organisation terminates the contract, whereas if the organisation fires an employee he/she can claim benefits or compensation.

Read Also: How to Download Free Trial Gen Payroll Software Full Version

Is that Employee Exempted or Non- Exempted

In terms of Payroll, employees who come under the title of Exempt are exempted from overtime, and hourly pay and are not covered under the Fair Labour Standards Act (FLSA). Besides, exempted employees (are those who either receive a salary or a high hourly wage) are not eligible for overtime pay, and they work for more than 40-hours in a week.

On the other hand, non-exempt employees are paid for overtime, i.e they are paid for every extra hour they work and are entitled to other aspects of employee benefits. They are also covered under the Fair Labour Standards Act (FLSA).

The following are the circumstances employees are exempted from overtime payments:

- Employees who are getting a certain annual income (prescribed by the FLSA)

- Employees who are getting a basic monthly or annual salary

- Employees who have a special designation prescribed by the U.S. Department of Labour specifically. The special designation includes such as executives, professionals, sales professionals, highly skilled computer-related employees, babysitters and some agricultural workers.

If you have any queries regarding exempt and non-exempt clear it with your lawyer or accountant.

Is that Your Employee Get a Salary or Hourly Wages

Normally, when you ask how will you calculate employee pay, you will straightforwardly get the reply that either through ‘salary’ or an hourly wage:

- Hourly wage workers are paid for every single hour they work

- Salaried employees are paid a certain amount of money annually or monthly

Read Also: Easy Guide to Create Companies via Gen Payroll Software

Before paying to someone, it is important to know whether that employee’s position comes under exempt or non-exempt. Exempted employees are generally salaried, whereas non-exempt employees typically get payments on an hourly basis and are entitled to overtime pay.

There are some exceptions for hourly highly compensated employees such as doctors, lawyers, and several other highly skilled professionals. If you have any doubt about exempt or nonexempt, clear it either with a lawyer or accountant.