Supreme Court held on the taxation of interest-free/concessional loans to bank employees. This blog furnishes an in-depth analysis of the judgment, analyzing the legal framework, challenges, and implications of the decision.

Around the interpretation of Section 17(2)(viii) of the Income Tax Act and Rule 3(7)(i) of the Income Tax Rules, the case is focused on. The applicants along with the staff unions and officers associations of distinct banks, contested the vires of such provisions claiming against the taxation of interest-free/concessional loans provided by banks to their employees.

Section 17(2)(viii) describes ‘perquisites’ to contain ‘any additional fringe benefit or amenity’, as defined. Rule 3(7)(i) determines that interest-free/concessional loan benefits delivered by banks to employees are levied to tax as perquisites if the interest levied by the bank is lower compared to the Prime Lending Rate (PLR) of the State Bank of India.

The applicant asked concerns regarding the excessive delegation of the legislative function to the Central Board of Direct Taxes (CBDT) and claimed that Rule 3(7)(i) was arbitrary and breached Article 14 of the Constitution. The Supreme Court denied such arguments, asserting the provision’s validity.

The court stressed that the delegation of legislative authority should be within the parent legislation and should not amount to abdication of critical legislative functions. It carried that Section 17(2)(viii) delivered sufficient direction to the CBDT for formulating rules, and Rule 3(7)(i) was uniform with the legislative policy and norms stipulated in the Act.

The court concerning the benchmarking of interest rates to the PLR of SBI considered the same rational and non-arbitrary. It learned that the interest rates of SBI influence those of other banks and that those who use a single benchmark ensure consistency and clarity in taxation. The Court concluded that Rule 3(7)(i) was established on a fair determining principle and did not breach Article 14.

The decision of the Supreme Court to keep the taxation of interest-free/concessional loans to bank employees reaffirms the legality of Rule 3(7)(i) under the Income Tax Rules. On the taxation of fringe benefits, the judgment delivers clarity and highlights the importance of consistency and justice in tax legislation.

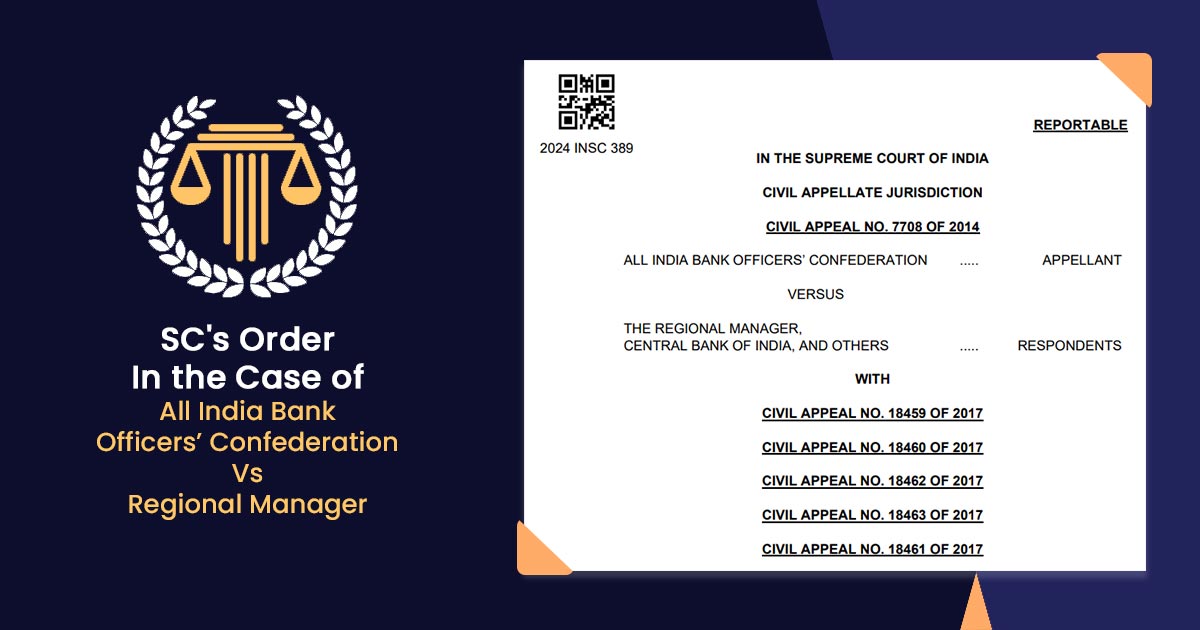

| Case Title | All India Bank Officers’ Confederation Vs Regional Manager |

| Citation | Civil Appeal No. 7708 of 2014 |

| Date | 07.05.2024 |

| Supreme Court | Read Order |