Considering the conflicting views of the Delhi High Court and the Madhya Pradesh High Court, the Apex Court is set to regard the problem of whether the authorities can seize cash u/s 67 of the Central Goods and Services Tax Act, 2017.

The development arrived as a bench of Justices PS Narasimha and Sandeep Mehta furnished the notice on a petition furnished via tax authorities Attacking the direction of the Delhi HC for refund of seized cash to the respondents.

The applicant mentioned the facts of the matter, and the applicant-authorities performed an investigation at the residential premises of the respondents u/s 67 of the CGST Act. Meanwhile, they discovered the cash of Rs 1,15,00,000 which cannot be elaborated effectively via the respondents, and seized it. The respondents asked that it be discharged to them but there was no benefit.

The respondents approached the HC arguing that the applicant-authorites are not empowered to seize cash u/s 67 of the CGST Act based on the fact that it was not elaborated effectively.

Answering that it was conceded that the problem stood covered via previous decisions of the Court in Deepak Khandelwal Proprietor M/s Shri Shyam Metal v. Commissioner of CGST, Delhi West & Anr. and Rajeev Chhatwal v. Commissioner of Goods and Services Tax (East). Therefore the petition was permitted and the applicant-authorities asked to remit back the seized amount.

The High Court decision has been attacked by the applicant authorities and approached the Apex court. It asserted that divergent views exist on the problem of seizure of cash u/s 67 of the CGST Act. Delhi High Court mentioned that the authorities have not been empowered to seize cash, it was opined by the Madhya Pradesh High Court to seize the cash.

The Apex court considering the aforesaid has issued the notice in the present case.

For context, Section 67 of the CGST Act reads thus:

“(2) Where the proper officer, not below the rank of Joint Commissioner, either pursuant to an inspection carried out under sub-section (1) or otherwise, has reasons to believe that any goods liable to confiscation or any documents or books or things, which in his opinion shall be useful for or relevant to any proceedings under this Act, are secreted in any place, he may authorise in writing any other officer of central tax to search and seize or may himself search and seize such goods, documents or books or things:

Read Also: Delhi HC: “Cash” is Not Considered a Type of “Goods”, Can’t Be Seized Under GST

Provided that where it is not practicable to seize any such goods, the proper officer, or any officer authorised by him, may serve on the owner or the custodian of the goods an order that he shall not remove, part with, or otherwise deal with the goods except with the previous permission of such officer:

Provided further that the documents or books or things so seized shall be retained by such officer only for so long as may be necessary for their examination and for any inquiry or proceedings under this Act.”

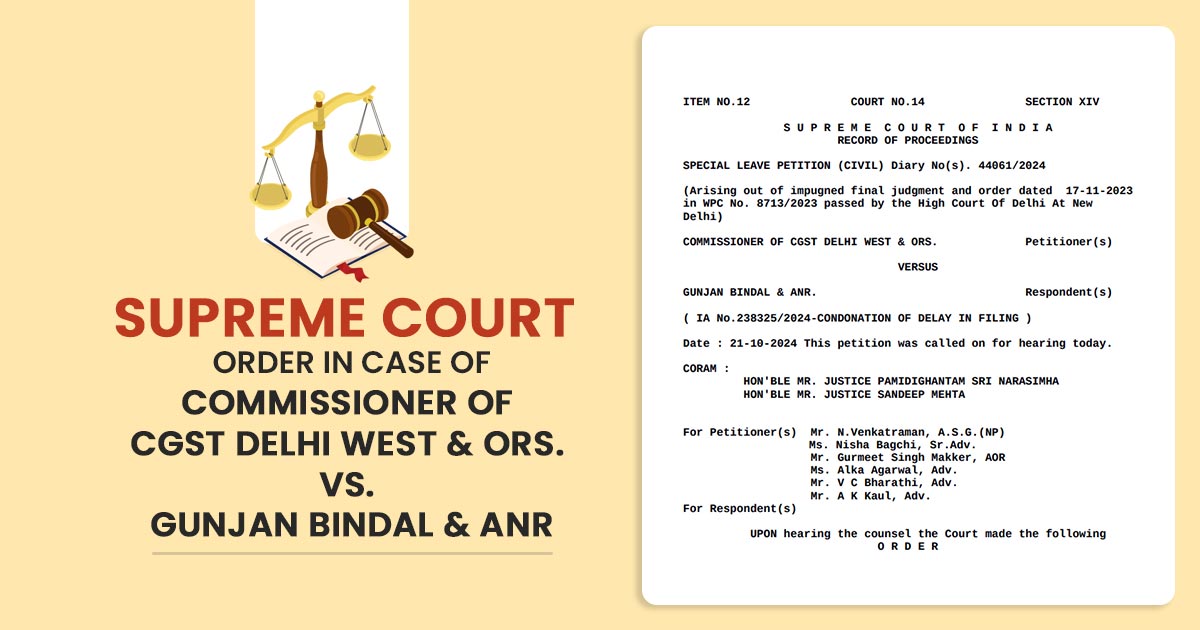

| Case Title | Commissioner of CGST Delhi West & Ors. vs. Gunjan Bindal & ANR |

| Date | 21.10.2024 |

| Counsel For Appellant | Mr. N.Venkatraman, A.S.G.(NP) Ms. Nisha Bagchi, Sr.Adv. Mr. Gurmeet Singh Makker, AOR Ms. Alka Agarwal, Adv. Mr. V C Bharathi, Adv. Mr. A K Kaul, Adv |

| Supreme Court | Read Order |