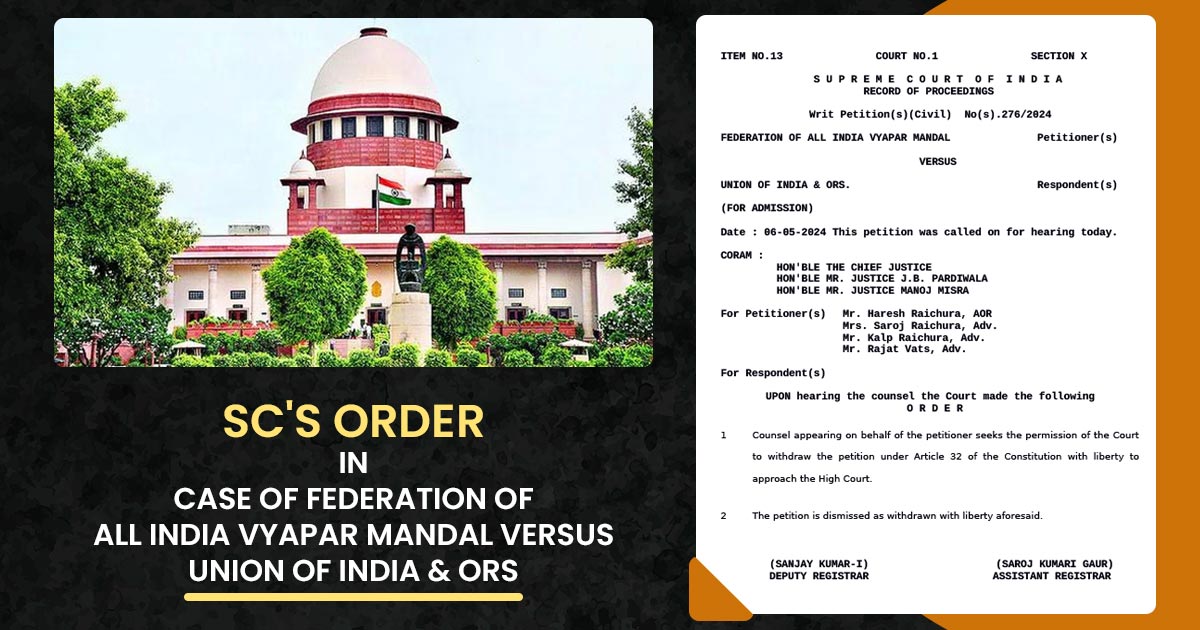

The Supreme Court has denied looking into the petition that the Micro and Small Enterprises (MSEs) submitted contesting a 45-day payment rule stated in Section 43B(h) of the Income Tax Act.

SC replying to the petition recommended the MSEs ask for recourse via the HC when they want to pursue any relief pertinent to the same case.

SC authorized the withdrawal of the petition and also granted the MSEs to pursue their statute matter in the High Court if they wished to do so.

A petition pushed the same decision that has been put forth via the Federation of All India Vyapar Mandal, serving as the voice for MSEs nationwide.

Section 43B(h) of the Income Tax Act puts down statutes controlling the credit terms that MSEs can propose, explicitly preventing them from extending credit to buyers for durations of more than 45 days. It specifies that any amounts left for the MSEs should be settled within this duration.

Related: MSME 45 Days Payment Rule from 1st April 2024, Confirmed by FM

Non-compliance with the same provision consequences in penalties and disallowance of deductions u/s 43B(h) of the Income Tax Act. From the buyer’s taxable income, there may be a chance of losing the benefit of deducting the payments made before MSEs if they do not comply with the said duration.

| Case Title | Federation of all India Vyapar Mandal versus Union of India & ORS. |

| Date | 06.05.2024 |

| Counsel For Petitioner | Mr. Haresh Raichura, AOR Mrs. Saroj Raichura, Adv. Mr. Kalp Raichura, Adv. Mr. Rajat Vats, Adv. |

| Supreme Court | Read Order |