The Supreme Court is ready to investigate the problem of the applicability of the provisions of tax deduction at source (TDS) on the allowances furnished before judicial officers under the Second National Judicial Pay Commission (SNJPC). The same issue has been analyzed via the Court in the All India Judges Association case in which it is overseeing the implementation of the suggestions of the Second National Judicial Pay Commission (SNJPC).

At the time of the hearing amicus curiae K Parameshwar described to the bench that many states are charging TDS on the allowances provided to judicial officers. He mentioned that the issue needed a determination.

Additional Solicitor General (ASG) Mr N Venkataraman asked to analyze the question of TDS applicability with the Revenue Department of the Ministry of Finance.

Read Also: Full Guide to New TDS Section 194R with Important FAQs

As per that, the bench comprising CJI DY Chandrachud and Justices JB Pardiwala and Manoj Misra posted the case on August 5 for further deliberation. Also, the Court asked that the issue of applicability of the National Pension Scheme to district court judges be heard dated July 22 at 2 PM.

The Supreme Court on January 10 in its decision in the All India Judges Association asked the States to execute the recommendations of the Second National Judicial Pay Commission for the pay and allowances for judicial officers.

A due date of February 29, 2024, has been set under the judgment for the States to pay the arrears to judicial officers within the recommendations of the SNJPC. The Court asked the High Courts to form a committee named ‘Committee for Service Conditions of the District Judiciary’ to oversee the implementation.

Recommended: How Income Tax Rules Are Affecting TDS, You Pay on Services

“All States and Union Territories shall now act expeditiously in accordance with the above directions. Disbursements on account of arrears of salary, pension and allowances due and payable to judicial officers, retired judicial officers and family pensioners shall be computed and paid on or before 29 February 2024.,”

The Court last week, took peculiarity to different States defaulting on the directions and directed the personal appearance of the Chief and Finance Secretaries of those States on August 23.

As per the allowances, the decision obscures 13 types of major and minor allowances for judicial officers. These include (1) House Building Advance (HBA); 2. Children Education Allowance (CEA); 3. Conveyance/Transport Allowance (TP); 4. Higher Qualification Allowance; 5. Hill Area/Tough Location Allowance; 6. Home Orderly/Domestic Help Allowance; 7. House Rent Allowance and Residential Quarters; 8. Medical Allowance; 9. Risk Allowance; 10. Special Pay for Administrative Work; 11.Transfer Grant; 12. Newspaper and Magazine allowance and 13. robe Allowance.

Each allowance detail can be discovered here.

Background

The Supreme Court in June 2022, asked for the implementation of the improved pay scale as suggested via the Second National Judicial Pay Commission on January 1, 2016. The bench of Chief Justice of India NV Ramana, Justices Krishna Murari and Hima Kohli asked the Centre and the States to pay the arrears to the officers in 3 instalments – 25% in 3 months, another 25% in the subsequent three months and balance by June 30, 2023. Revised directions on disbursal of arrears were passed via the Court in May 2023.

In 2017 the Second National Judicial Pay Commission was formed by the Supreme Court to review the pay scale and other conditions of Judicial Officers belonging to the district judiciary all over the country. Former Supreme Court Judge Justice PV Reddy as commission Chairman and former Kerala High Court Judge and Senior Supreme Court lawyer R.Basant as member has been appointed by the bench that consists of Justices J Chelameswar and Abdul Nazeer.

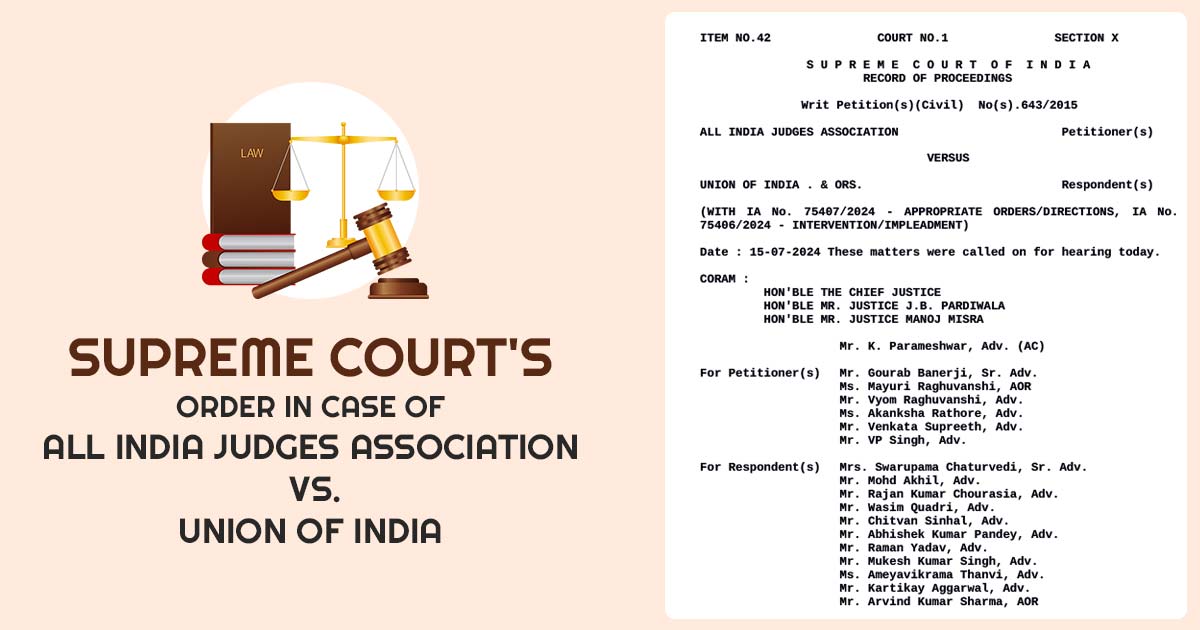

| Case Title | All India Judges Association Petitioner(s) Versus Union of India. & Ors. |

| Case No.: | Writ Petition(s)(Civil) No(s).643/2015 |

| Date | 15.07.2024 |

| For Petitioner | Mr Gourab Banerji, Ms Mayuri Raghuvanshi, Mr Vyom Raghuvanshi, Ms Akanksha Rathore, Mr Venkata Supreeth, Mr VP Singh |

| For Respondent | Mrs Swarupama Chaturvedi, Mr Mohd Akhil, Mr Rajan Kumar Chourasia, Mr Wasim Quadri, Mr Chitvan Sinhal, Mr Abhishek Kumar Pandey, Mr Raman Yadav, Mr Mukesh Kumar Singh, Ms Ameyavikrama Thanvi, Mr Kartikay Aggarwal, Mr Arvind Kumar Sharma |

| Supreme Court | Read Order |