The Proper Definition of Salary Slip

Employee salary slip is a document given by the employer to the employee upon receiving of income every month and has complete details including gross salary to net salary with deductions. All information can be seen in a proper salary format which is prescribed by the government.

It shall be a proud moment for an employee to receive the first salary post to work with hardships in an organization. There are various employees who are not able to understand the concept of salary slips. Employer provides the salary slips to the employee which is a payslip. The same comes under the systematic framework which consists of the financial statements of the employee’s salary.

The same salary slip consists of information such as HRA, LTA, bonus paid, and deduction. Post to the finish of the month the employers should furnish the salary slip to the employers. One does not need to ask the accountant section of their company for the salary slip. The e-slip shall be sent to you in your email every month.

- Who Obtains the Salary Slip?

- Importance of a Salary Slip

- Simple Format of a Salary Slip Format

- Salary Slip Format

- Most Advantages of Salary Slip

- All Parts of Salary Slip with Details

- Difference Between Hand-Taken Gross Salary VS CTC

- Salary Slip Deduction Part

- Steps to Generate Salary Slip Via Gen Payroll Software

- Important FAQs on Salary Slip

Who Obtains the Salary Slip?

A company follows compliance to provide salary slips to its employees. Full-time workers are subjected to getting a salary slip from the companies. E-payslip shall not be given to independent, self-employed, and part-time workers. When an employee chooses a particular job role and works for a month then he can get his salary slip.

But when he resigns then he will not be eligible for the salary slip for that month. A salary slip is composed of complete information about the pay scale and earnings towards the specific time duration. There are some employees who obtain the salary slip for a month, every 15 days, and weekly.

Submit Query for Best Salary Slip Software

Importance of a Salary Slip

It is important to find out the importance of e-payslip. During the time of loan sanctioning and advances, you might get confused. Salary slips pose various features such as basic salary, medical allowance, travel allowance, house rate allowance, taxes, deductions, bonuses, etc. A payslip permits the employees to opt for the benefits of free facilities and subsidiaries.

You shall be held with an approach of how much tax you are furnishing and how much refund you shall get during the finish of the year. The major reason to find out about the payslip is setting the fiscal goal. Claiming for a payslip is a legitimate right despite of you can get the payslip online. When you see the salary slip format every month then you shall find out if you are filing the tax or not.

Example of a Simple Salary Slip Format

Payslip is been divided into 2 divisions as income/ reimbursements/ perks and deductions in which every division is divided into 2 classes that differ from company to company.

Every month your firm provides you with a payslip after your account is filled with your salary. The importance of the payslip is mentioned as:

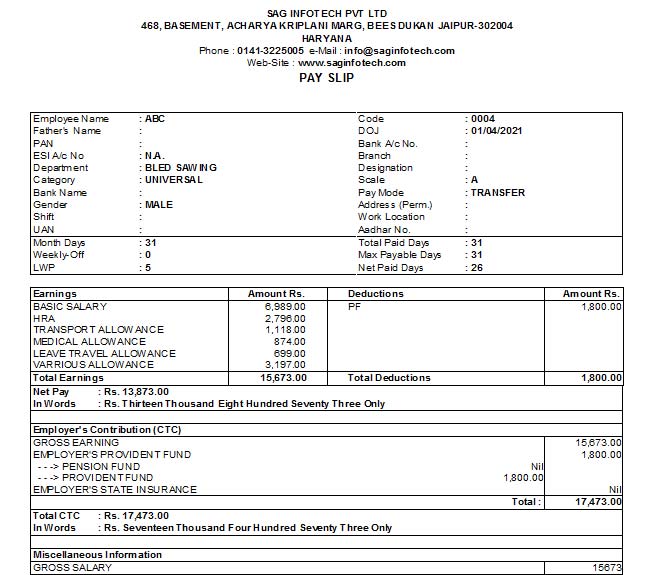

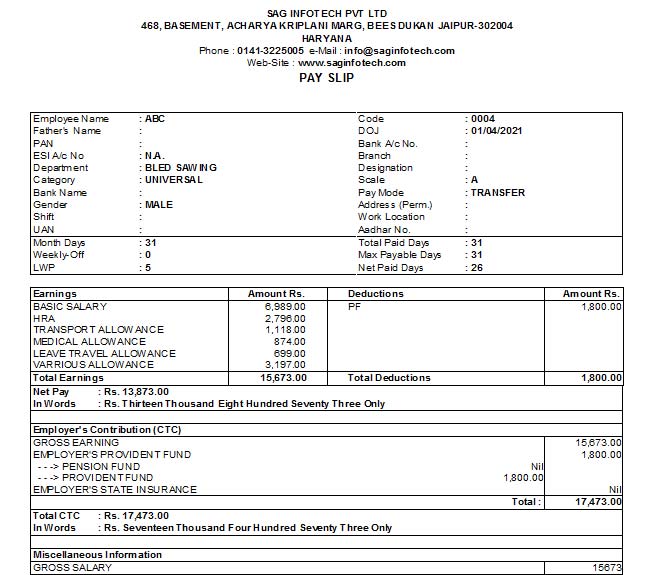

The format of the salary slip consists of the mentioned objectives:

- Company name, logo and address, month and year

- Employee Name, ID, Designation & Department

- Employee PAN, Aadhaar Number, Bank Account Number

- EPF Account Number, UAN (Universal Account Number)

- Working Days, Number of Leaves, Leave Without Pay if any

- List of Earnings and Deductions

- Gross Pay and Net Pay in numbers as well as words

Salary Slip Format by SAG Infotech

Most Advantages of Salary Slip

Below is the list of all benefits that an employee can get from the salary slip. We mentioned the benefits with a short summary.

ITR Base Towards

Salary slip format poses a clarity towards the tax which you are furnishing and the return which you obtain. These fiscal statements are mentioned earnings and deductions. The tax that deducts from your basic salary shall be shown in your salary slip. This shall assist you that how much money you furnish as a tax every year.

Furnishes Access to Every Class

The salary slip format permits you to avail yourself of the advantage of basic facilities such as medical insurance, subsidized food grains, etc.

Loan Obtain on CTC

You can ask for the loan after getting a payslip every month. At the effective interest rate, a lender shall provide you with a loan. If your CTC is higher then you can avail of over 20 lac loan with respect to the e-payslip if your CTC is perfect.

e-Payslip for Employment Proof

During the time of switching or obtaining the loan, every firm asks you to furnish proof of employment. e payslip is the only document that assists you in entitling you to a full-time employer.

Income Settlement Proof

When it is the case in which you want to give divorce your spouse then you need to show proof of your income and that shall be proven through furnishing the salary slip.

Tax Declaration on Income

An employee is required to furnish the declaration towards the estimated tax savings investments to the company’s accountant. Upon the grounds of it, the tax liability deducts and computes every month. Various firms urge their employees to furnish proof of tax savings investments.

All Parts of Salary Slip with Details

Earnings and deductions are the two important parts of salary slips. The earning poses basic salary, bonus, and additional allowance which an employee obtains through his company. The deduction is the objective which cuts from the employees’ salary some major elements of the earning and deduction.

Employee Basic Salary

It is the important part of a payslip that varies from 40 to 60 per cent of your total salary. It is a constant element of your payslip. In which a bonus and deduction differ as per the employee’s performance.

House Rent Allowance on Tax Deduction

House rent allowance comes in between 40 to 50 per cent of your basic salary. It is the kind of allowance to furnish the employee house rent. If someone is residing on rent then he shall enjoy the allowance provided by the company. The original amount of HRA relies on the location in which one resides. The companies shall not offer more than 50% HRA of the basic pay to the employees. One can avail of a portion of House Rent Allowance as a tax deduction beneath section 10D under an HRA claim.

Employee Dearness Allowance

Each employee gets the employee dearness allowance and it is available only to government employees.

Transport and Allowance Facility

The majority of the firms do not furnish free transport facilities to their employees. Thus they cut out some costs regarding travelling from salary. Travel costs need to be furnished by you if you use the transport facility of the company. In the salary slip, you shall see the cost of transport.

Employee Performance, Allowance and Bonus

This allowance differs as per the performance of the employees. You shall get the bonus as a hike for having effective performance. It is the kind of rise which enhances and boosts your work.

Additional Allowances to Employee

It consists of different allowances such as travel allowance, medical allowance, meal allowance, interim allowance, etc. it relies on the terms and conditions of the firm. Basically, the majority of companies give this allowance to their worthy employees. All these salary slip formats shall show all kinds of allowance.

Medical Allowance to Employee

Various recognized firms provide health insurance to employees. They furnish premiums towards their employee’s health insurance policies to medical companies. Rs 1250 per month is the medical allowance and you shall get the claim with respect to the medical expenses when you furnish the bill.

Difference Between Hand-Taken Gross Salary VS CTC

Prior to joining the firm, you must know about the financial terms of that firm such as CTC, Basic Salary, in-Hand Salary, etc. A cost to a company is described as a total income cost that a firm contributes directly or indirectly to the employees. During the hiring process, the employer talks about the hiring process as a total salary package. Various freshers have the wrong concept that CTC and in-hand salary are identical. A CTC consists of the elements such as basic pay, allowances, reimbursements, etc. On the other side in hand, salary comprises basic pay which is mentioned in the salary slip.

You must note that CTC and the take-home salary shall not be identical. CTC comprises several elements which one shall not obtain in his take-home salary.

CTC = Gross salary + PF + Gratuity

Gross Salary: It consists of the amount that has basic pay and allowance prior to the deduction.

PF: Every month the kind of investment that an employee do is called a Provident fund. The total amount of the PF shall get to the employee during the finish of his retirement period.

Gratuity: It is the kind of payable amount which the employee obtains for his or her services performed towards the company.

Thus the employer needs to furnish the CTC on the employee while hiring and supporting them in the company.

In-Hand salary: take-home salary is known as in-hand salary, it is the income which the employee obtains each month post-tax and additional deductions. Under the terms of the company, the employer deducts the amounts in the TDS form, PF, professional taxes, etc. Post deducting all kinds of tax the employee receives the amount every month which is said to be the in-hand salary which transfers through the employer of the company.

- Net Salary = Gross salary – Income tax- Provident funds- Professional tax

- We can also say that A net salary = Direct benefits- Deduction

Know the concept of the difference between the CTC and the net salary through the mentioned below example:

Mr Joe’s salary example:

Mr Joe’s salary lies between 2,50,001- 5,00,000 comes beneath the 10% tax slab.

10% of His income attains at Rs. 3,60,074.

Post to the income tax deduction and other professional deductions, he can obtain Rs. 3,24,006.6

All the earnings and deduction components will see in your e-payslip.

Salary Slip Deduction Part

Salary slip is made through the earning and deduction part. Some freshers undergo hardships in learning the concept of deduction. Below is the type of deductions mentioned with a good explanation.

Professional Tax by State Government

The state government deducts the professional tax it furnishes with the statement to the state government via employee towards the purpose of the welfare of the country. The tax is an essential one and every employee needs to furnish it. As per the finance budget 2019-2020, the employees held with the CTC below 5 Lac, are not required to furnish the professional tax.

Tax-deductible at source (TDS)

The company is enabled to deduct some of the amounts from its employee’s salaries upon the grounds of income tax. Deducting the TDS is the responsibility of the firm prior to releasing the monthly salary. Via investing in mutual funds or in other schemes the employees can save their TDS.

Employee Provident Fund Contribution

A Provident fund is a mandatory retirement savings plan. Beneath section 80C a company transfers nearly 12% of the basic salary to the EPF account beneath the policy of the provident fund. At the finish of retirement, one would receive the final assured amount from the scheme. From the tax the EPF contribution gets privileged. Both the employer and employee get advantages from the support of a provident fund which is a sort of investment.

Loans and Advances

In any case, if you opt for the loan with respect to the salary then every month a fixed EMI shall get deducted from the account. A payslip is an effective asset during the time of providing the loan. As it provides the assurance to the lender that within the prescribed time limit, you can repay the amount that is taken as a loan and poses financial stability.

Standard Deduction

Under the financial budget, 2018-2019, from the income of the employee Rs. 40,000 shall get deducted as a medical and travel allowance reimbursement. a standard deduction of Rs. 40,000 has been made by the finance minister Arun Jaitley in the finance budget 2018-2019. This standard deduction is replaced by the travel allowances of Rs. 1920 and medical allowances of Rs. 15,000 every year.

This standard deduction gets deducted from the gross salary and claims as an exemption. There is no need to show any proof by the employees of the company to avail of this deduction. As an outcome, because of the same, the appropriate standard deduction is the income exemption of Rs. 5,800 (40,000- (15000+19,200).

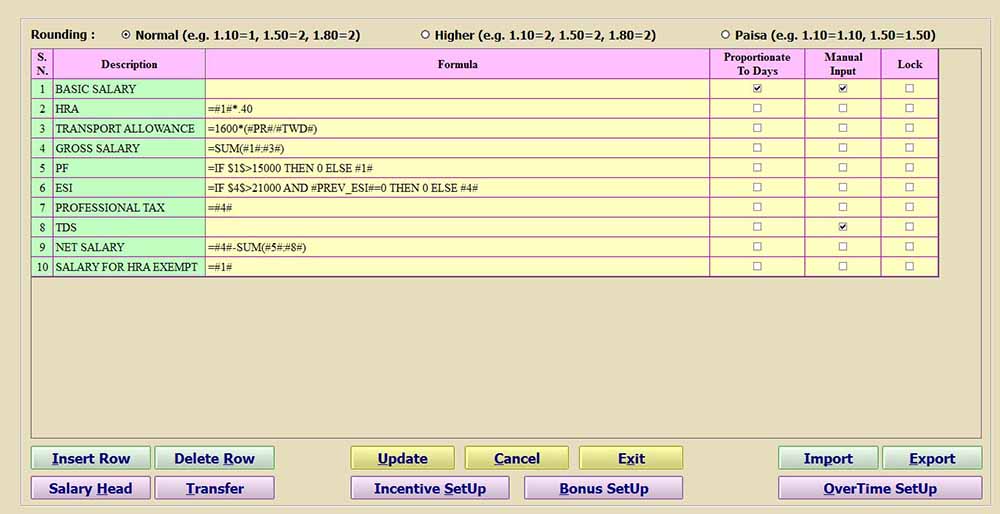

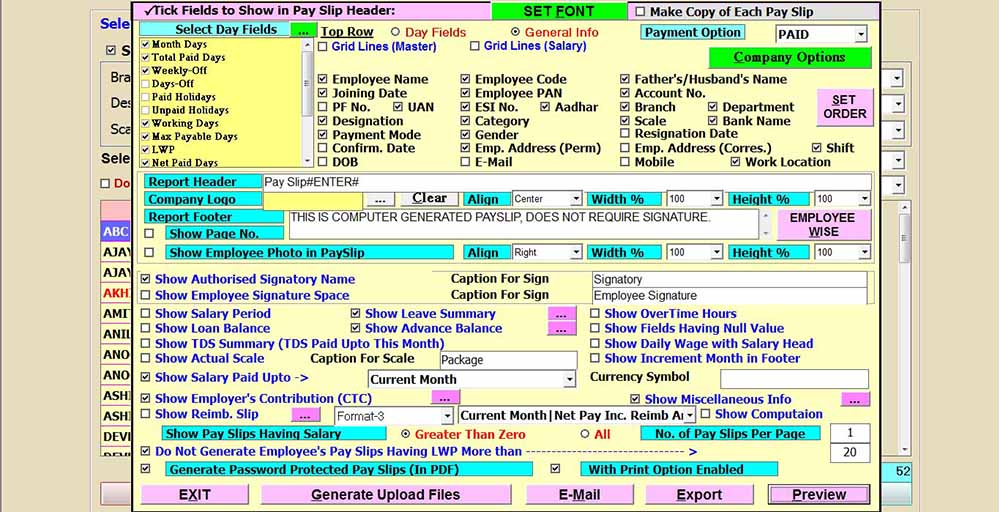

Steps to Generate Salary Slip Via Gen Payroll Software

Step 1: Run the Payroll software then select the master tab and then “Salary Setup”.

Step 2:

- It’s a Dynamic, flexible salary setup. Users can edit, modify, change and delete the formula

- sheet as per the company’s requirements.

- Users can add multiple salary heads in this software.

- Users can take help from the Support team of “Sag Infotech” to put the formula for

- calculating the salary in the software.

Step 3:

- Go to “Salary tab” -> “attendance sheet”

- Users can manage the attendance of the employees.

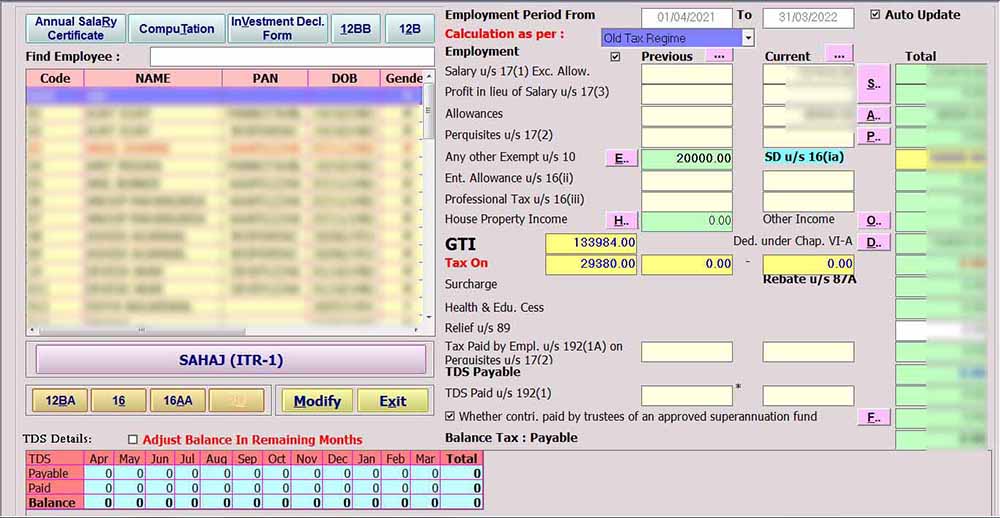

Step 4:

- Go to the “TDS tab” for the calculation of the salary including tax calculation

- Various relevant forms and deduction fields are given.

Step 5:

- Go to the “Report” tab -> “salary report” -> “Payslip generation”

- Users can edit, and modify the information as per requirements.

Step 6:

- Users can email the Payslip by clicking the “E-mail” button

- Users can export Pay to Slip by clicking the “Export” button

- Users can view the Payslip by clicking the “Preview” button

Conclusion: From the above discussion, so many things get clear about the salary slips. About the format of the salary slip, every employee has an effective understanding. This supports them in computing the taxes and what amount they are obtaining as in-hand income. The Gen Payroll HRMS time management software is also one of the best solutions for employee management in all organizations small or big with multiple advanced tools and features.

Important FAQs on Salary Slip

Q.1 What is the best way to get my salary slip online?

Every month, employees receive salary slips from their companies.There may be a separate payroll portal for this or the company may send it via email. The salary slips for each month can be downloaded.

Q.2 Is it necessary to keep my salary slips and securely store them?

Yes, it is important and even recommended to save and safeguard your salary slips. These documents hold significance in various situations such as obtaining bank loans, filing income tax returns, switching jobs, and more. Therefore, it will be beneficial for you to have your salary slips downloaded and stored in a secure place. Typically, for tasks like bank loans or employment verification, the salary slips from the past three months will be required. However, for taxation purposes, it is essential to retain salary slips for a minimum of 22 months from the end of the corresponding tax year.

Q.3 How can I create a basic salary slip?

You have two options to create a salary slip for your employees: using an Excel sheet or utilising specialised payslips or payroll software. In either case, you need to input employee data such as earnings, deductions, EPF contributions, bank details, etc., manually on the Excel spreadsheet or through the software. This will allow you to calculate the net salary and generate the salary slip.

Q.4 Is it possible to generate my own salary slip?

No, employees cannot generate their own salary slips as they are typically generated by the employer. Companies or organisations can create salary slips manually using Excel spreadsheets or through online methods. The manual method involves inputting employee data and relevant values for earnings and deduction components. Once the data is added, the salary slip can be printed.

Alternatively, online salary slips can be generated instantly using salary slip software. These online slips follow a standardised format that is easy to use and understand. They include details such as employee ID, employee name, designation, earnings, allowances, tax deductions, EPF deductions, and bank details. By adding the required values to the provided template, the salary slip can be generated instantly.

Q.5 Are handwritten salary slips accepted everywhere?

Yes. Salary slips can be issued in either electronic or handwritten format on paper. Handwritten salary slips hold the same value as electronically issued ones and can be used as proof of employment when obtaining bank loans or for other purposes.

Q.6 What is the process for downloading my payslip?

The HR or Finance department may provide you with a salary slip either through email or upload on the company’s payroll software. If it is sent via email, open the attachment, it may require a password (if they secured it), and download it. However, if they provide salary slips on payroll software, you need to follow the below steps to download it.

- Access your company’s salary portal by logging in with your provided credentials.

- Navigate to the profile section of the portal and locate the option ‘Salary Slips.’ Typically, you can find this option under the ‘My Statements’ tab.

- Select the ‘Payslip’ option within the ‘Salary Slips’ section.

- From there, you will be able to view the salary slip specific to the chosen year and month.

- To retain a copy, download the salary slip by clicking on the designated download button provided on the online salary portal.

- Downloaded salary slips may be password-protected for privacy purpose. Open and enter the password to access the pay slip, which will open in view mode.

- Now, you can print a physical copy of the salary slip, which will work as a supporting document for income verification purposes.

Q.7 Can I make corrections on my salary slip?

The responsibility of editing the salary slip lies solely with the employer. If you receive a salary slip with errors, you avoid making any edits on your own without informing HR or management, as it would be considered a fraud of distorting values. It is critical when filing returns. To rectify any mistakes in the salary slip, you should raise a request with the HR or finance department, requesting a correction that is legally valid. The employer will then make the necessary corrections on the software or excel sheet used to generate the salary slip and send the corrected copy to you.

Q.8 In what ways does a salary slip reduce my income tax?

A monthly salary slip includes various other important information such as Dearness Allowance (DA), House Rent Allowance (HRA), Medical Allowance, etc., that assist employees in saving income tax annually. Tax authorities permit organisations to structure their employees’ salaries in a way that enables tax savings through the inclusion of various allowances in their income. These allowances and tax deductions are mentioned in the salary slips, thus aiding in the reduction of Income Tax.

Q.9 What banks require for salary slips?

Most banks typically request the submission of your latest two or three months’ salary slips. These salary slips serve as evidence of your earnings, which is crucial for the approval of your loan. Additionally, when obtaining a mortgage or any other form of borrowing, banks may also require you to provide your salary slips.