The government certainly reduced Goods and Services Tax (GST) rates on 178 items in the last week, but businesses are searching for some confusing ways to not transmit the profits to the customers. Here is the explanation of what is happening at restaurants to manipulate the consumers after GST rates were diminished. It has revealed that some restaurants, summing up the big brand names also, have surged the prices after the rates were diminished thus not providing the rate cut profits to the consumers. The brands such as Starbucks and McDonald’s have received queries from tax departments to explain about their menu prices just after and before the latest amendment in the prices.

So, apart from having a deep conversation with the management and failing in it on the overcharged prices on eaten food, is there any further proceedings to complain against them for profiteering in the name of GST? Before explaining the procedure, just have a look at the fresh rates applicable to the restaurants:

Recommended: How to Check Genuine GST Bill Online Given by Traders

Fresh Rates Implemented On Food Products

On November 15, GST Council revised the tax rates for 178 products and the rates were reduced to 18% from existing 28% in regard to a solution to the higher tax rates on certain products. For all independent restaurants (AC or Non-AC), the tax rates were reduced to 5% from 18% outside of providing input tax credit. Also, a direct 5% tax rates were levied on services like deliveries and takeaways.

Steps for Registering Your Complaints

There are many ways for a customer to lodge their grievances against any GST-related deceptions. To lodge a grievance you can reach to the Department of Consumer Affairs or the Central Board of Excise and Customs (CBEC).

In case you get acquainted with such a problem of price confliction on the menu, here is a detailing of what you can do:

Visit CBEC GST Portal:

- Go to the link https://cbec-gst.gov.in/

- Scroll down and stop at ‘CBEC Mitra Helpdesk’

- Choose the option named ‘Raise Web Ticket’

- You will be redirected to a new window

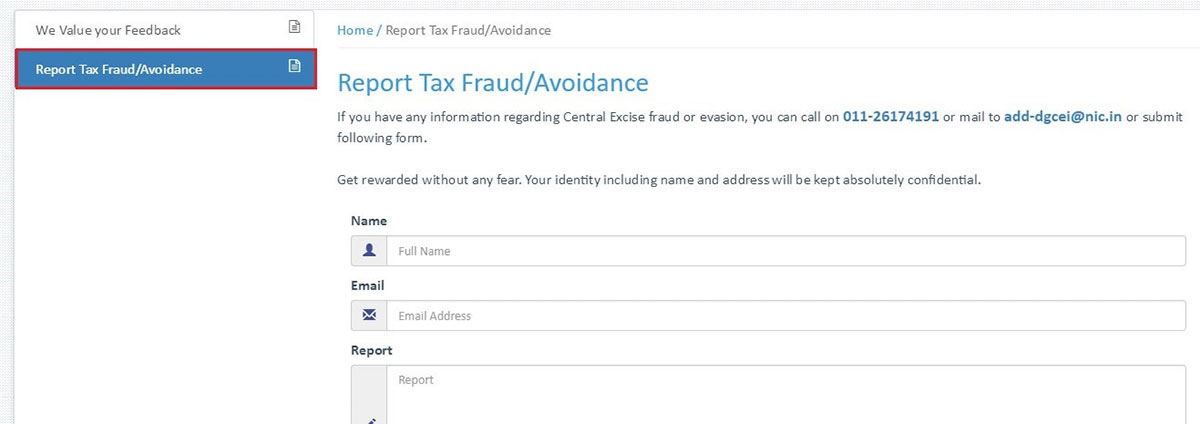

- On the left-side of the new window, choose ‘Tax Fraud/Avoidance’

- A new page will be open with some fields

- Enter the details under the heads like name, report, and email address

- In the ‘report box’, fill the information of the restaurant like name, address, type of complaint

After furnishing the details, a representative from grievance forum will make a communication with the restaurants to confirm the details and email you about the further details.

Email: Another Step to Lodge Your Complaint

CBSE: The other way is to email your complaint at cbecmitra.helpdesk@icegate.gov.in. Just mention all the details of name, phone number, restaurant name, address, and type of a complaint. Although it is not required to keep pre and post GST bills handy, as pre-GST bill details are enough. As per the CBEC helpline number, the representative on behalf of CBEC will first communicate the restaurant to confirm the details and then email you with the further details.

Complaint To Department Of Consumer Affairs:

To mail regarding the complaint to Department of Consumer Affairs, you need the post-GST bill handy as the procedure escalated. It is necessary to mention your contact details, name, city, restaurant name, address, contact details, and email address. Firstly, the consumer forum will communicate with the restaurants to confirm the details and email you about the further details. The mail can also be sent to the restaurant mentioning the consumer helpline email ID. if in both the cases, the consumer does not find any relevant solution from the restaurant within 7 days or if you do not agree with the answer, then the next step is to proceed to consumer court to lodge a complaint. If you are planning to go to Consumer Department, the toll-free number is 1800114000 where you will get direction to approach them.

CBEC Toll-Free Number:

To contact the fraud related department, call on toll-free number 18001200232 and lodge a complaint to get required solutions.

Twitter: Social Media Platform

To raise the issue on Twitter, you can tweet to officials of GST at askGST_Goi, and the Finance Ministry at @FinMinIndia.

As after GST implementation, businesses are trying to look for the ways to cheat the system. It was noted down that the persons without GSTN are charging the GST from the consumer and even though some are caught imposing the GST over and above the MRP, which is extremely unlawful. It was informed that after restaurants, the GST council will go for a check for fast-moving consumer goods (FMCG) companies who are not reverting the profits of rate reduction to the customers. The government also warned the companies that for illegal events, they can be acted by Anti-profiteering Authority. The cabinet ministry established the Anti-profiteering Authority last week to make sure that the profits should be passed to the end users. The government is trying hard to remove unashamed entities, it also requires your contribution to get the problems solved.