A company is referred to as a Section 8 Company when registered as a Non-Profit Organization (NPO) i.e. when it has the motive of promoting arts, commerce, education, charity, protection of the environment, sports, science, research, social welfare, religion and intends to use its profits (if any) or other income for promoting these objectives.

The income of NPO can not be used for paying out dividends to the company’s members and has to be for the promotion of charitable objectives. Such companies obtain an incorporation certificate from the central government and are liable to adhere to the rules specified by the government.

Fill Form for MCA/ROC V3 Software

According to the rules, failure to comply with the responsibilities stated by the Central Government may lead to the company’s winding up on the government’s orders. Besides, strict legal action will be taken against all the members of the company if the objectives laid down by the company prove to be bogus.

- Eligibility to Apply

- Incorporation of Section 8

- Simplified Process of Incorporation

- Company Already Have the License Number

- Documents Requirement

- Important Advantages

- Exemptions and Reliefs

- Number of Directors

- Number of Board Meetings

- Annual, Quarterly and Monthly Compliance

Read Also: Download Trial & Start ROC/MCA Return Filing by Gen CompLaw Software

Its manner of carrying out the operation is similar to any other limited company and even the rights & duties of a limited company and NPO are alike.

However, the titles of “Section 8” and “Limited” can not be interchanged.

Eligibility to Apply for a Section 8 Company

An individual or an association of individuals are eligible to be registered as a Section 8 Company if it holds the below-mentioned intentions or objectives. The objectives have to be confirmed to the satisfaction of the Central Government.

- When the company intends to promote science, commerce, education, art, sports, research, religion, charity, social welfare, protection of the environment or other objectives;

- When the company holds an intention to invest all the profits (if any) or any other income generated after incorporation in the promotion of such objects only;

- When the company does not intend to pay any dividend to its members.

Incorporation of a Section 8 Company

Companies Act, 2013 deals with the procedure Application for the grant of a License to an existing company under Section 8, an application in Form No. INC.12 has to be submitted along with the below-mentioned linked forms to the Registrar of Companies. INC- 12 Form aims to convert itself into a Section 8 company. Consequent approval, a license under section 8 will be issued by the registrar along with a fresh certificate of incorporation.

Form no. INC – 31– Articles of Association (AOA), in Form No. INC – 13 and the Company’s Memorandum of Association (MOA) (as specified in Act) along with the affixation of subscribers’ photographs and other mandatory and optional attachments.

New & Simplified Process of Incorporation of Section 8 Companies

Companies (Incorporation) Sixth Amendment Rules, 2019 dated 7th June 2019 to ease the Incorporation process has knocked off the need for filing Form no. INC 12, which was initially needed.

This amendment has made the Process of Incorporation of Section 8 Companies as easy & simple as that of other companies.

Section 8 Companies can be incorporated by reserving names in part A of Spice+ followed by part B of the Spice+ form or by directly filing Spice+. License No. shall be given to the Section 8 company during the incorporation.

- Fill part-A of the SPICE+ form on the MCA V3 portal and reserve the name of the proposed company.

- The next step is to access the SRN dashboard by clicking on the mini dashboard to fill in the information, Part-B of the SPICE+ form, if Part A and Part-B are filed separately. In case Part-A and Part-B are filed together: Fill up Part-A and submit on the portal, and then click on proceed for incorporation, and the user will be redirected to Part-B of the SPICE+ form, then fill all the required information along with attachments.

- The next step in the incorporation procedure is to fill Linked forms INC-31 e-AOA (e-Articles of Association), INC-13 e-MOA (e-Memorandum of Association), AGILE PRO S, URC-1(Application by a company for registration under section 366).

- Once all the forms are duly filled, the INC-9 Declaration for subscribers and directors will be auto-generated by the MCA system. Download the forms and affix the Digital Signatures (DSC) of the directors and the professional, and upload all the forms together in a single batch on the MCA V3 portal.

When the Company Already Have the License Number

Stakeholders having License Numbers already before the filing of the SPICe form may file the form at their ease. However, one thing should be noted form processing takes time to let the workflow changes be effective.

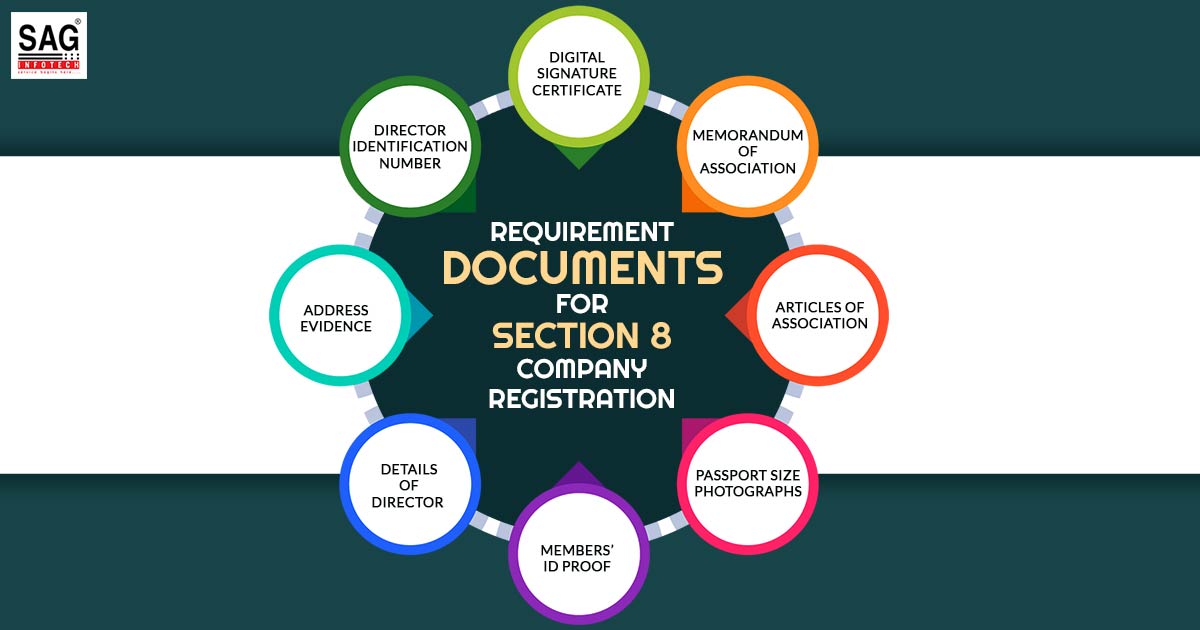

Documents Requirement for the Registration of Section 8 Company

- Digital Signature Certificate

- Memorandum of Association

- Articles of Association

- Passport Size Photographs

- Members’ ID proof such as Aadhar Card, Passport, Voter ID

- Details of Director (When the Members Are Other Companies/LLPs)

- Address Evidence

- Director Identification Number

- NOC and Rent Documents

- DIR-2

Most Important Advantages of the Incorporation of Sa ection 8 Company

- Through building the Section-8 company, the intention or goal of the company would perform any activity and obtain integrity and commitment because the same is being approved made through the Union government.

- Towards operations because of its strict rules, the same poses a trustworthy image in front of internal and external users of the details concerning the communities.

- The reliability of Section 8 companies has much more concerns the communities and the additional kinds of charitable firms.

- Grants and subsidies via the government and the additional institutions were acknowledged to the section-8 company according to the communities of trust.

Section 8 Company Total Exemptions and Reliefs

Companies Act 2013:

- The directorship under section 8 companies shall not come under the computation of the ceiling towards the highest number of the directorships which has been mentioned beneath Section 165 of the Act.

- Through furnishing the notice of not less than 14 exact days rather than 21 exact days a general meeting has been conducted.

- Section 8 firm would conduct at least one meeting every 6 calendar months rather than holding 4 meetings for a year.

- Recording of Minutes of General Meetings and Board Meetings along with additional resolutions shall not be subjected to apply upon the section 8 company. However, the minutes of meetings might be recorded within 30 days of the outcome of the meeting towards the cases in which the firm articles furnish the confirmation through the method of circulation of minutes.

- A company is a member of Section 8 company.

- Section 149(1) of the Act will not apply towards Section 8 Company, it shall not need to hire an Independent director. From the reasons above the Audit committee under section 8 company will not be needed to have independent directors similar to its board members.

- Section 8 firms shall not be needed to hire a qualified CS professional as their company secretary.

- From the applicability of secretarial standards, the same gets privileged.

- Section 8 firms shall not be needed to appoint a Nomination and Remuneration Committee or a Stakeholders Relationship Committee.

Number of Directors in a Section 8 Company

Section 149(1) of the Companies Act 2013 – prescribed a minimum of 3 & 2 directors for public limited & private limited companies respectively and a maximum of 15 directors.

But there is no minimum or maximum prescription for Section 8 Company.

The second proviso to section 149(1) – prescribes a woman director in a specified class of companies.

Section 149(3) of the Companies Act 2013 – prescribes resident directors in every company.

Section 165 of the Companies Act, 2013 – says Directorship in Section 8 Companies will not be summed up when the total number of directorships will be calculated i.e. it will not be counted while adhering to the maximum limit of twenty Directorship as prescribed in the Act.

Section 149(1) of the Companies Act, 2013 – vide exemption notification dated June 05, 2016, stated that Section 8 Companies are not under obligation to appoint an independent director and are free from all the consequential provisions concerned with Independent directors.

Under Section 149(3) – Section 8 company must have a minimum of one Resident Director i.e. a director who has resided in India at least for a total period of 182 days (one hundred and eighty-two days) or more within the previous calendar year.

Total Number of Board Meetings and its Quorum

As per the exemption notification read with sections 173(1) and 174(1), Section 8 companies must have at least one meeting within 6 calendar months and the quorum for its board meetings is 8 directors or 1/4th of its total strength, whichever is less, respectively. However, the quorum should have a minimum of at least two members.

Annual, Quarterly and Monthly Compliance for Section 8 Company

Here is a list of Monthly, quarterly and annual compliance for section 8 Company under MCA (Ministry of Corporate Affairs)

Annual Compliance Under Section 8 Company

- Appointment of an auditor: Under section 139 of the Companies Act 2013, it is essential for the firms to hire an auditor within 30 days from the start date. The book of accounts and manual returns of the company will get audited through the statutory auditor who will be hired for a duration of 5 years.

- Maintenance of Statutory Registers: It is obligated for the company to maintain a statutory register consisting of members, loans received, charges made, its directors, and others. as listed under section 8 of the Companies Act 2013.

- Calling board meet: Section 8 companies will have at least one meeting every 6 calendar months.

- Statutory Audit: Every entity that would enrol under the Companies Act would need to audit their books of accounts every year from a CA (refer to point 1).

- GM notice: A section 8 company could hold a general meeting i.e. whether yearly or extraordinary with min 14 days notice.

- Calling AGM: The annual general body meeting would be held once a year within 6 months of the finish of the fiscal year. But, in the case of the first annual general meeting, the company could hold an AGM in less than 9 months from the finish of the first fiscal year. You must learn that the time duration between 2 annual general meetings need not surpass 15 months.

- Board Reports: The Board of Directors of the company will furnish their board’s report in a specific way, it comprises all the financial statements and additional annexure. The board report will need to be furnished in Form AOC-4.

- Making of Financials Statement of the Company: The organization would obtain the balance sheet, profit, loss A/C, cash flow statement as well as additional financial statements audited via statutory auditor i.e. is to be furnished with ROC.

- Tax returns: Income tax returns will need to be furnished during the finish of every assessment year prior to the date of 31st Oct.

- Tax audit: Tax audit report in Form 10B would get filed through a charitable or religious trust or institution that would be enrolled u/s 12A or who has submitted an application for registration by filing Form 10A. Form 10B is an audit report which is provided by a CA upon nomination by the taxpayer.

- Filing Financial Statements: The financial statement would be furnished in the suitable form ( E-FORM AOC-4), within 30 days from the date of the annual general meeting (Discussed in point 7 above).

- Annual Return Filing: The annual return filing consists of all the details such as management details, and shareholders’ information would be filed in Form MGT-7 with the Registrar of Companies (ROC), within 60 days of the annual general meeting.

- DIN KYC: Every person who would be provided with a DIN dated 31st March of the fiscal year should submit his KYC on or prior to September 30 of the next fiscal year.

- GST Annual Return: Beneath GST, the enrolled assessee needed to file GSTR-9 i.e. the annual return. 31st December of the year will be the last date following the related fiscal year.

| Form No | Compliance | Due date | Last date |

|---|---|---|---|

| AOC-4 | Director report | Within 30 days of AGM | 29th October |

| MGT-7 | Annual returns | Within 60 days of AGM | 28th November |

| Form ITR-6 | Income tax returns | 31st October | 31st October |

| GSTR-9 | GST Annual Return | 31st December | 31st December |

| Form- 10B | Tax Audit | 31st September | 31st September |

Monthly or Quarterly Due Date

- GSTR-1 (return to be filed towards reporting details of all outward supplies of goods and services incurred)

- Monthly, by the 11th of every month- The business poses a yearly aggregate turnover exceeding Rs 5 cr or would not opt in the QRMP scheme.

- Quarterly, by the 13th of the month following every quarter of the QRMP scheme, the business has opted.

- GSTR- 3B (for filing summarised information regarding all outward supplies incurred, input tax credit claimed, tax liability ascertained, and taxes filed).

- Monthly, 20th of every month- For the assessee, an aggregate turnover in the former fiscal year exceeds Rs 5 cr or is eligible while still opting out of the QRMP scheme.

- Quarterly, 24th of the month following the quarter- To the assessee with aggregate turnover equivalent to or less than Rs 5 crore, eligible and remain opted into the QRMP scheme.

| Quarter ending | Month of deduction | The last date towards the payment of tax deducted | Last date towards filing the TDS return |

|---|---|---|---|

| 30th June | April May June | 7th May 7th June 7th July | 31st July |

| 30th September | July August September | 7th August 7th September 7th October | 31st October |

| 31st December | October November December | 7th November 7th December 7th January | 31st January |

| 31st March | January February March | 7th February 7th March 30th April | 31st May |

Additional Compliance

Besides the list of compliance specified above, a Section 8 company might need to function additional compliance chores depending on the situation.

- In the case when the company chooses donations or funding via donors, the incomes would be qualified for the tax exemptions. To claim the same exemptions the company needed to follow the conditions mentioned under Section 11 and enrol beneath Sections 80G and 12A.

- Director’s approval form (Form DIR 2) to occupy the office within 30 days from the appointment of the director.

- Returns form (Form MR-1) within 60 days from the appointment of a managing director, manager, or another key managerial posting.

- When the company has 20 or exceeding employees, employees would be mandated to be members of the Employees’ Provident Fund Organization (EPFO) i.e. company is required to take registration under EPF Act, 1952.

(Mandatory = Employees who draw less than Rs. 15000/- per month.

Optional = Employees if draws more than Rs. 15000 per month with permission of Assistant PF Commissioner).

- Provident fund returns should be furnished through all the entities securing PF registration every month. On the 25th of every month, PF returns would be due. Moreover, a final PF return would be due dated 25th April for the year finished on 31st March.

- For the case when the company secures 10 or more employees and the monthly wage shall not be more than Rs 21,000, the company would be obligated to opt for enrollment under the Employee’s State Insurance (ESI) Act, 1948.

- ESI returns should be required to be filed by the employer on monthly grounds, and the last date would indeed be fixed: The 15th of the subsequent month would be the last date for ESI return filing.

FAQs of Section 8 Company Under MCA

Q.1 – Is there any limitation upon a Section 8 Company from doing the investments, furnishing the loans, guarantees, etc to other Companies?

Yes, Section 8 firm would furnish the loans or guarantees or furnish security associated with the loan or procure through the method of subscription, purchase, etc. the securities of the company but the same must comply within section 180, 185, Section 186, and other sections, whatsoever relevant, of the Companies Act, 2013.

Q.2 – If the accounting standards are subjected to apply on the section 8 company?

Yes, there is no exemption furnished towards section 8 companies.

Q.3 – “Charitable Purpose” meaning with provisionals and sections pertaining 2(15) of the Income Tax Act, 1962?

As per Section 2(15) of the Income Tax Act, 1961, “charitable purpose” includes relief of the poor, education, medical relief, preservation of the environment along with the watersheds, forests and wildlife along with the upgraded of the additional object of the general public utility.

Q.4 – Does Section-8 Company subject towards any exemptions/ reliefs from payment/applicability of excise duty, service tax, customs duty, deduction of tax at source, collection of tax at source, and others?

No particular privilege shall be available towards Section 8 company towards the above-prescribed acts.