What are GSTR-2B and GSTR-3B?

GSTR-2B is a system-generated statement that furnishes information about all inward supplies or purchases, including information on eligible and ineligible Input Tax Credits (ITC) for a tax period. It acts as a verification tool, auto-populated based on the GSTR-1, GSTR-5, and GSTR-6 filed via suppliers.

GSTR-3B is a self-declared monthly return that explains the business’s outward supplies, ITC claims, and total tax obligation for that month. GSTR-2B provides the reference for the available ITC, but GSTR-3B is significant for reporting the monthly tax obligations.

Before filing the GSTR-3B, Businesses are required to reconcile these two statements frequently to ensure the precision of their ITC claims. Legal issues, financial losses, and penalties are been averted from the regular reconciliation by flagging any discrepancies between the claimed and available ITC.

For maintaining compliance with GST norms and ensuring financial accuracy, the same method is important.

What is the Method for Reconciling GSTR-2B with GSTR-3B?

To execute a GSTR-2B reconciliation, follow these steps:

- GSTR-2B Data Download: Start by logging in to the GST portal and downloading the auto-generated GSTR-2B statement for a tax period.

- GSTR-3B Statement Draft Download: Thereafter download the auto-drafted GSTR-3B return from the GST portal for the same tax period.

- Determine and Fix Differences: Compare the two to discover any ITC mismatches.

Using an automated GST reconciliation software will assist in finding the discrepancies here with 100% precision as against undertaking this practice manually.

GST ITC Differences B/W GSTR-2B and GSTR-3B Forms

The reasons for ITC discrepancies in GSTR-2B vs GSTR 3B can comprise the following cases (but not be limited to):

- The supplier has erroneously provided the numbers as a result of clerical errors or errors with the GST rate.

- The supplier has reported the translation wrongly as a business-to-consumer (B2C) transaction instead of a business-to-business (B2B) transaction.

- The supplier has wrongly provided an inter-state transaction as an intra-state or vice versa.

- ITC can relate to the import of goods, therefore not appearing in the GSTR-2B.

- The ITC can relate to the inward supplies from an SEZ which does not resemble the GSTR-2B.

Effects of GSTR-2B vs. GSTR-3B

After completing the reconciliation, the subsequent step comprises of rectifying the mismatches. The same may comprise contacting the suppliers for the rectification in their GSTR-1 or adjusting your GSTR-3B to show the precise ITC claims.

Use an excellent GST solution that includes an inbuilt vendor communication tool, which shall ease the procedure to rectify the discrepancies in your vendor’s returns.

Incomplete Reconciliation Between GSTR-2B and GSTR-3B

Penalties, notices, and legal ramifications from the tax department will take place if GSTR-2B is not reconciled with GSTR-3B. For effective learning, the implications of the mismatches between the GSTR-2B and GSTR-3B as well as the specifics of Rule 88D under the CGST Act, then you could refer to this detailed guide.

Steps to Reconcile GSTR-2B and GSTR-3B Using Gen GST Software

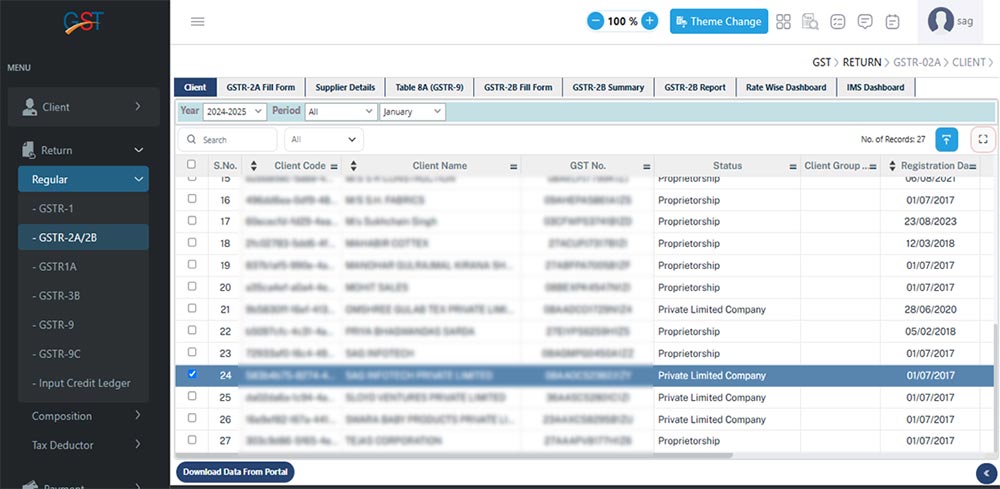

Step 1: You need to go to first Regular–>GSTR-2A/2B then select the required client for which you want to do reconciliation between GSTR 2B vs GSTR 3B

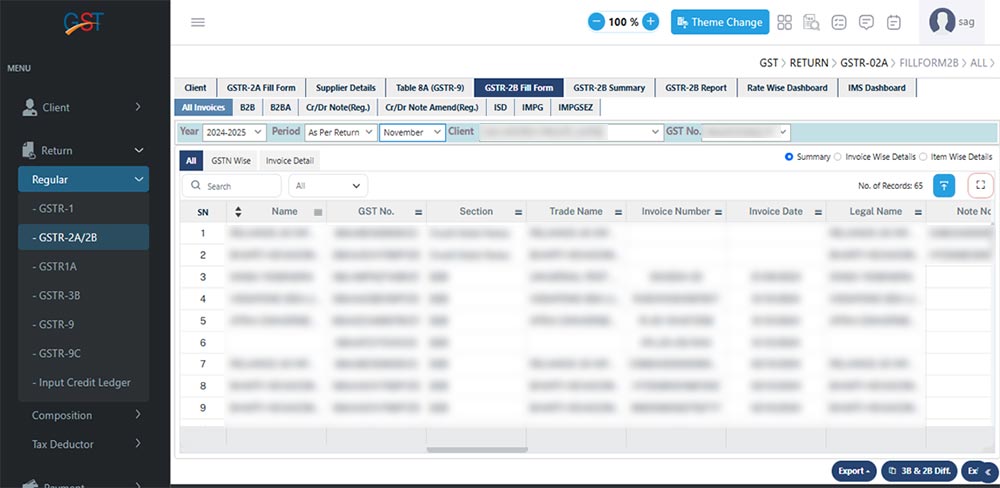

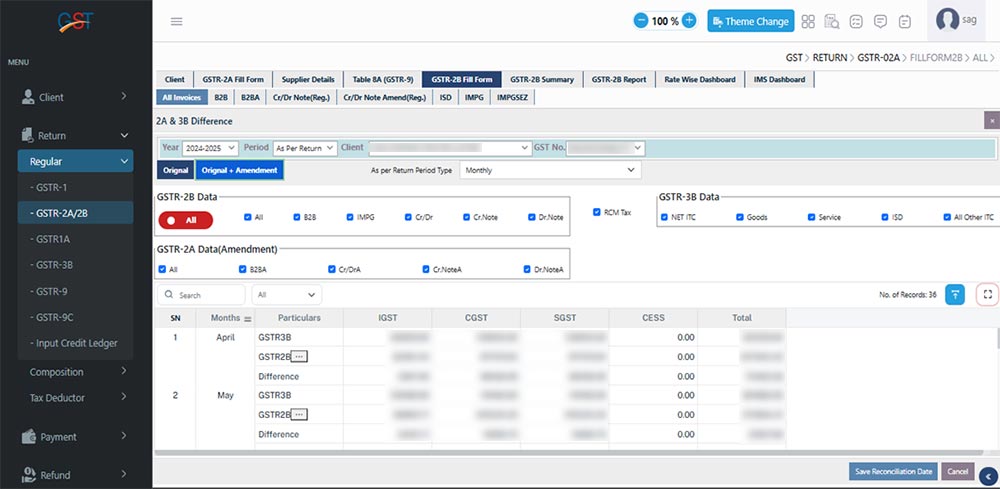

Step 2: After that click on the GSTR 2B Fill form and then click on the 3B & 2B diff button

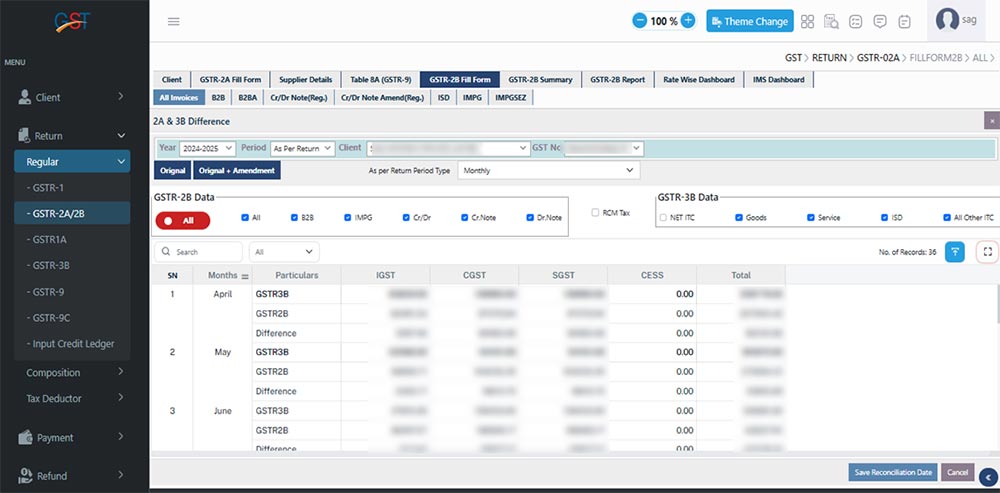

Step 3: It will display the Section difference between GSTR 3B & 2B with options Original and Orignal +Amendment

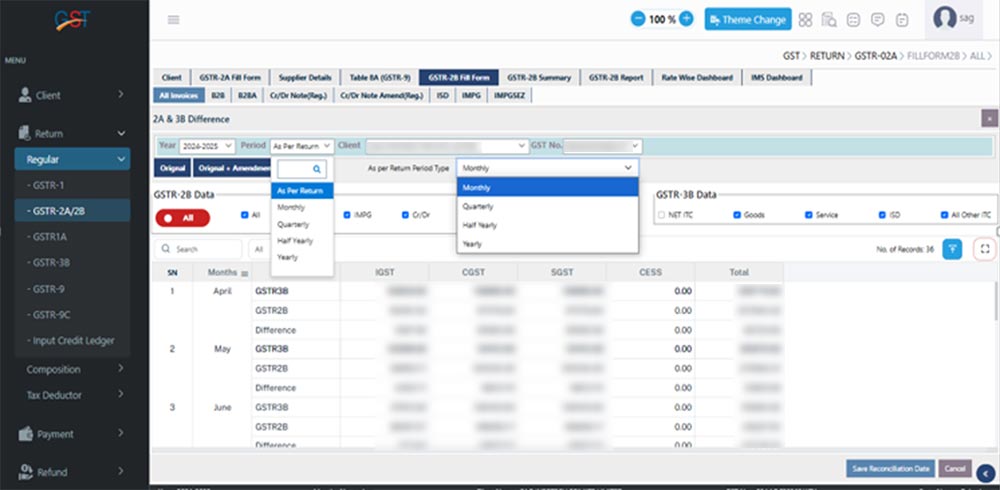

Step 4: It can be viewed as As per return-wise as well as period-wise, it can be viewed as Monthly /Quarterly /Half Yearly/ Yearly

Step 5: Under original It will display w.r.t orignal data only and under Original+Amendment it will display reconciliation with amendment effect.

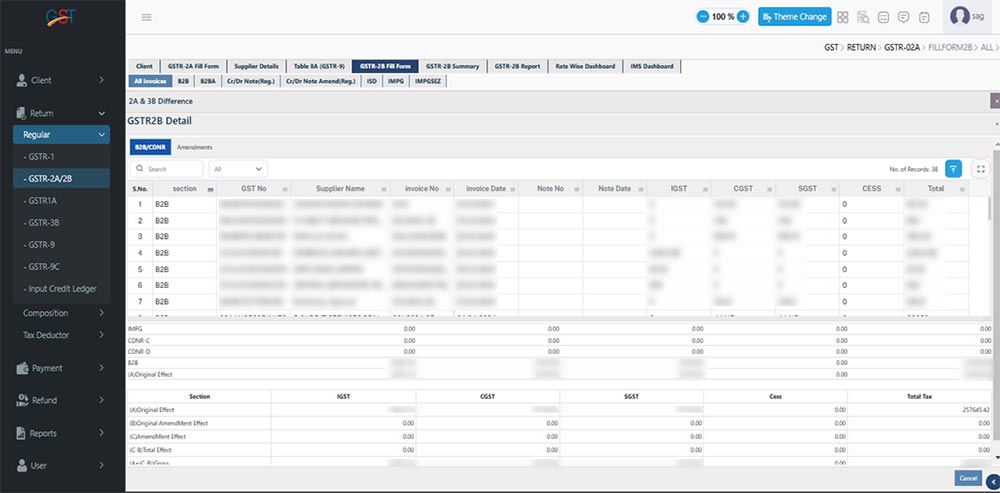

Step 6: When you click on three dots under the Original+ Amendment tab, it will show the original section as well as the Amendment section which is related to the original section.

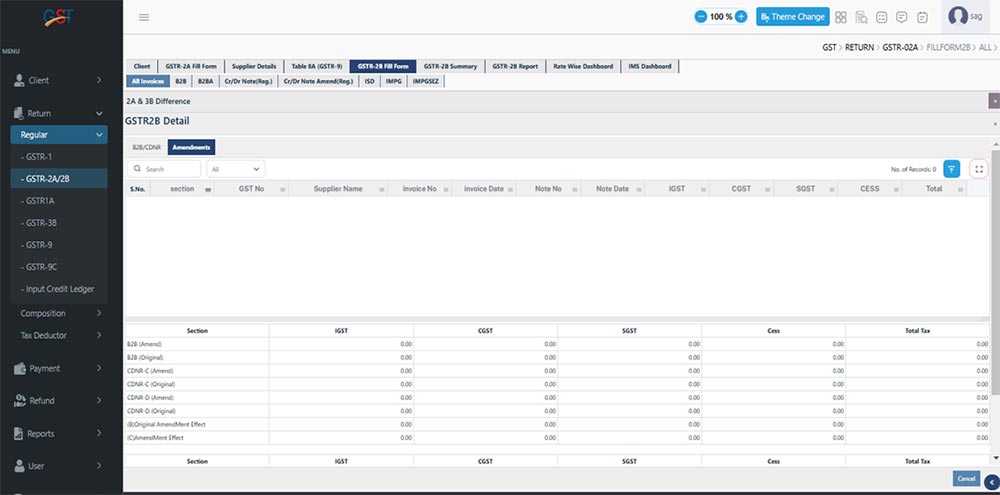

Step 7: Under amendment To, it will display the amendment effect data related to the original one.

Important FAQs to Reconcile GSTR-2B and GSTR-3B

Q.1 At what time do I reconcile GSTR-2B and GSTR-3B?

You need to perform reconciliation every month, instantly after the GSTR-2B auto-draft is available and before filing your GSTR-3B. This ensures you catch all discrepancies and can make adjustments in time.

Q.2 Can I revise the system-generated GSTR-3B?

Technically, you can modify the system-generated GSTR-3B functioning the same may trigger a warning if the variance in ITC is more than 10%. It directed to the complications with the tax department.

Q.3 What is Reverse Charge Mechanism (RCM) and how does it impact GSTR-2B vs GSTR-3B?

RCM is when the tax obligation transforms from supplier to receiver. It could make discrepancies in GSTR 2B vs GSTR 3B as RCM-related purchases may not be auto-populated in system-generated summaries, leading to potential mismatches.

Q.4 Can I use GST software for simplified reconciliations between GSTR-2B and GSTR-3B?

Yes, you can choose the best GST software for reconciliations between GSTR forms. Not only can it save time, but it can also help prevent ITC loss and penalties.