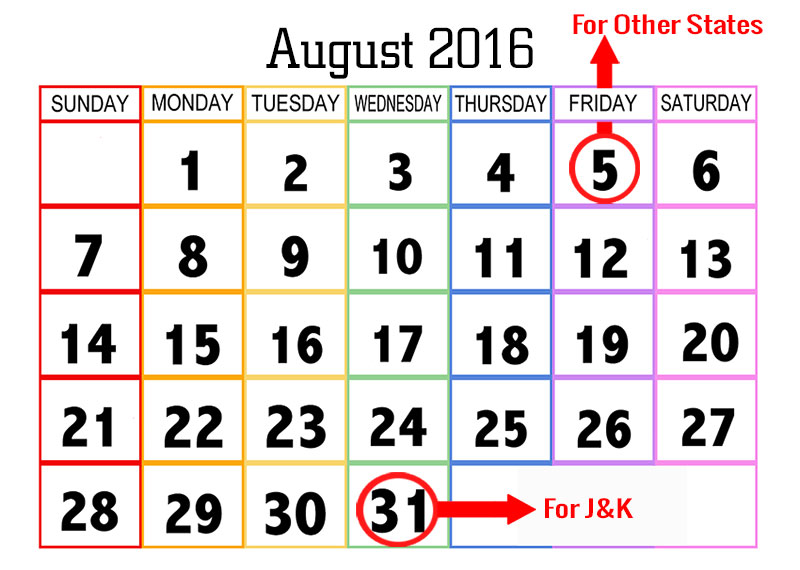

As per the Income tax Return guidelines, the deadline for filing IT return for FY 2015-16 was July 31 but due to PSU bank strike, the last date for filing income-tax returns got extended to August 5 by the Government.

In view of the day-long strike at public sector banks on behalf of merging the partner banks in the primary one , the deadline has been extended to August 5.

However, the deadline for Jammu and Kashmir will be extended to August 31 due to the ongoing stress in the state. Revenue Secretary Hasmukh Adhia tweets, “In view of today’s bank strike and disturbance in J&K, the due date of IT return filing is being extended,”

For assessees across India liable to file I-T returns by July 31, the deadline is extended up to August 5, For assessees in J&K, this date has been extended to August 31,” the secretary added.

Later, the Finance Ministry in a statement said, “As per provisions of Section 139(1) of Income-tax Act 1961, Central Board of Direct Taxes extends the due date for filing returns of Income for Assessment Year 2016-2017 from July 31, 2016 to August 5, 2016, in case of taxpayers throughout India who are liable to file their Income-tax by July 31, 2016.”

According to the Government sources, the extension of the return filing has been done in order to avoid any inconvenience to the taxpayers while making payment for their taxes pertaining to returns against fiscal year 2016- 2017. July 29 was the strike and July 31 was the bank holiday.

Recommended: Free Download Income Tax Return E-Filing Software AY 2016-17