What is the Method to Manual Check Bulk PAN/TAN Service?

The validation of the Bulk PAN or TAN service is available to external firms. The external firms consist of the Union and State Govt Departments or undertakings, RBI-approved Banks, recognized autonomous bodies and Financial Institutions. Upon its enrollment as an external agency on the income tax e-Filing 2.0 portal, it can take on some specific important services on the permission (Bulk PAN / TAN verification services). This service enables external firms (post-login) to:

- Uploading bulk PAN / TAN query templates to verify PAN / TAN on the 2.0 ITR e-Filing portal

- See previous token information upon the new ITR e-Filing 2.0 portal

Requirements to Take This Service

This service is available to the external firms who must:

- On the e-Filing portal become a registered user (with a valid user ID and password)

- Download the newest template for Bulk PAN / TAN query from the e-Filing portal (through this service)

Easy Guide of Bulk PAN and TAN Verification

Step 1: Log in to the e-Filing portal through your user ID and password.

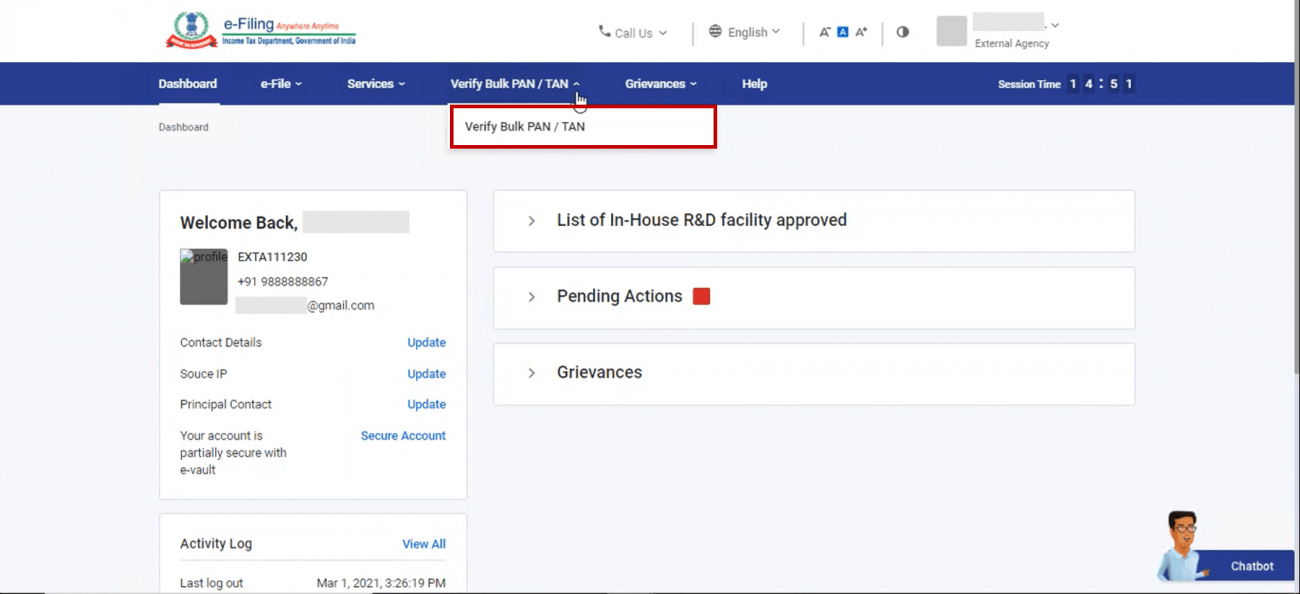

Step 2: Tap Verify Bulk PAN / TAN > Verify Bulk PAN / TAN

You could either upload a bulk PAN / TAN query or see the status of tokens already generated. In case you need to:

Upload Query of Bulk PAN / TAN with Easy Steps

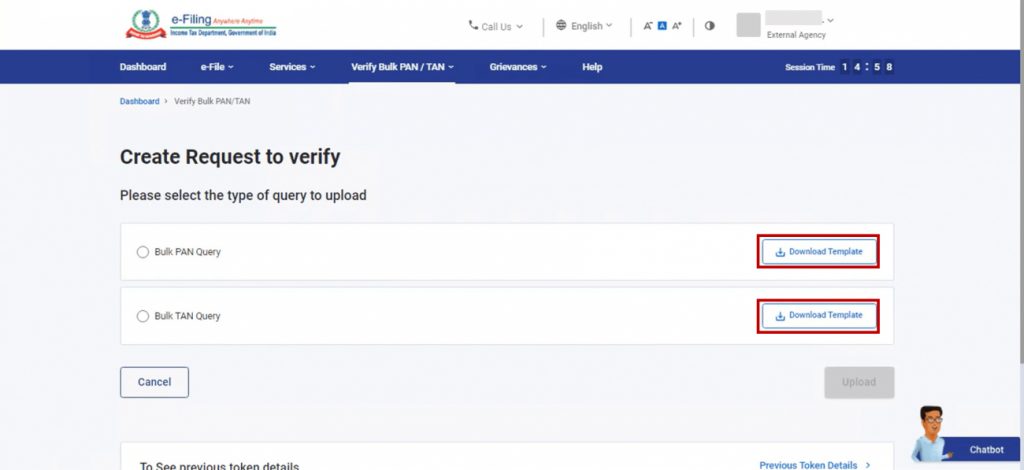

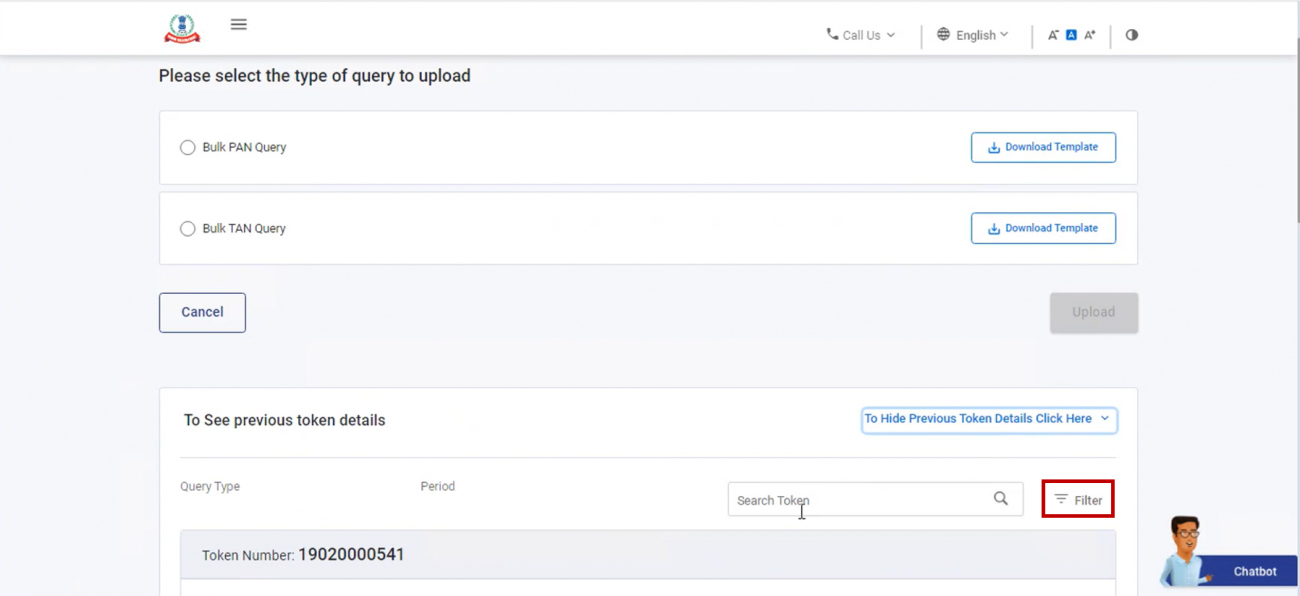

Step 1: Tap Download Template linked with the query (PAN / TAN) you opted

- Note: Separate JSON templates will be furnished to check the Bulk PAN and Bulk TAN queries.

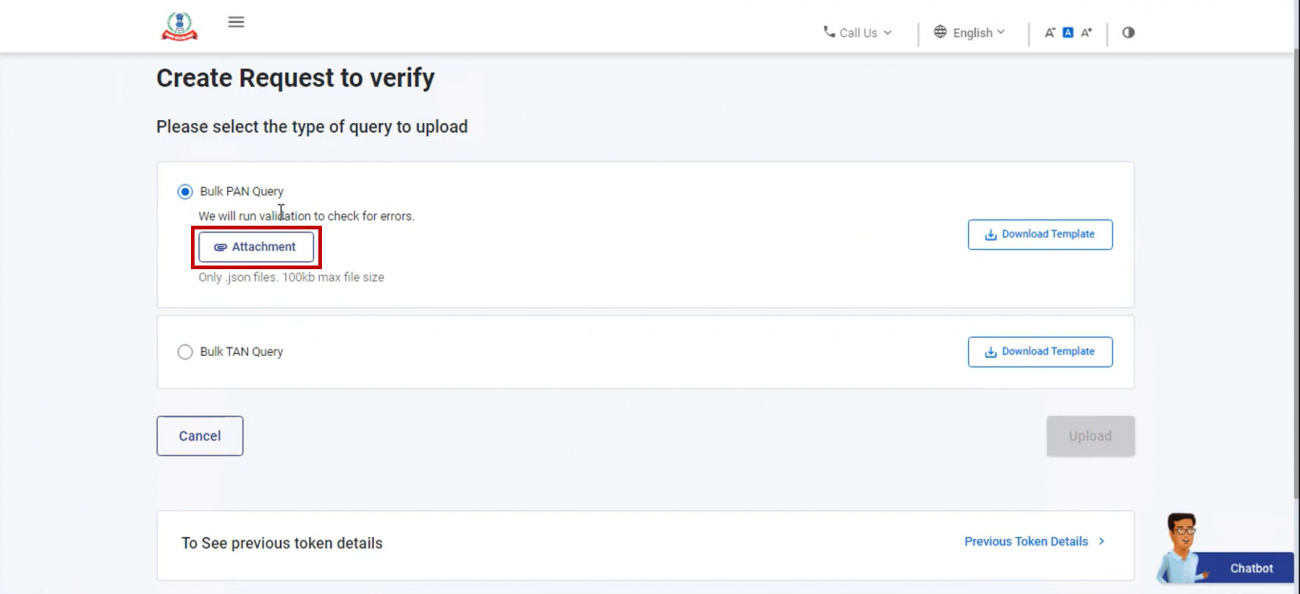

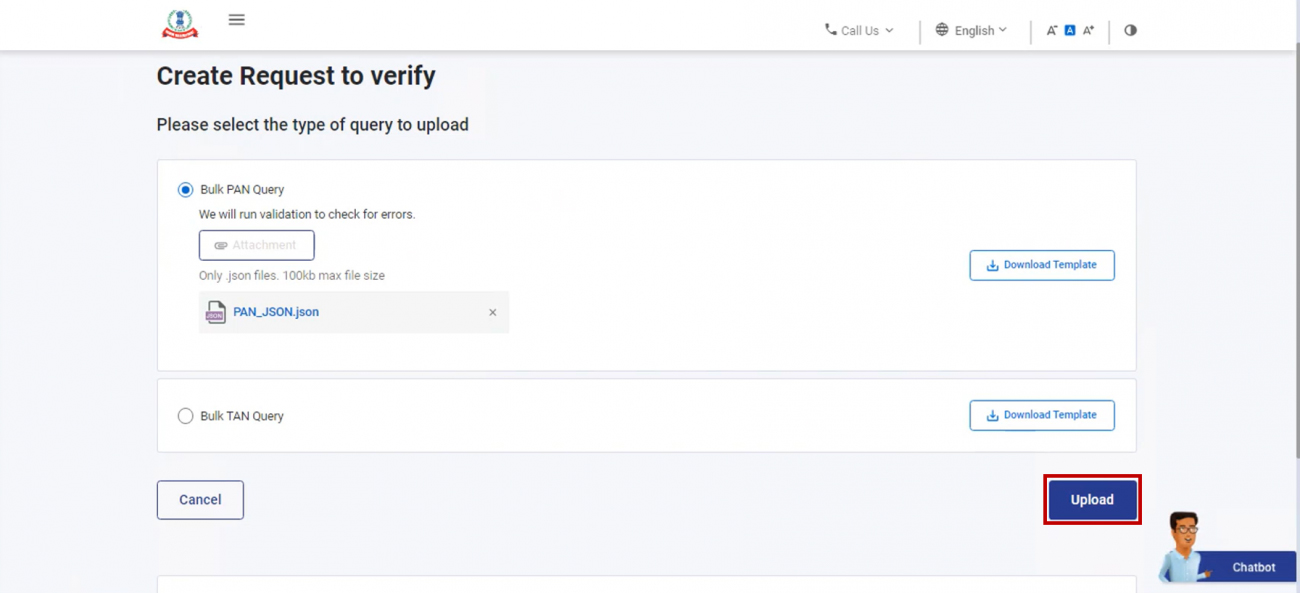

Step 2: After furnishing the template and generating a JSON file to get it uploaded, choose the kind of query you want to upload: ‘Bulk PAN Query or Bulk TAN Query’, tap the Attachment, and choose the related file from your computer.

Step 3: After attaching your file, tap Upload.

Note: In an individual “JSON file, only 100 PAN / TAN records can be uploaded.”

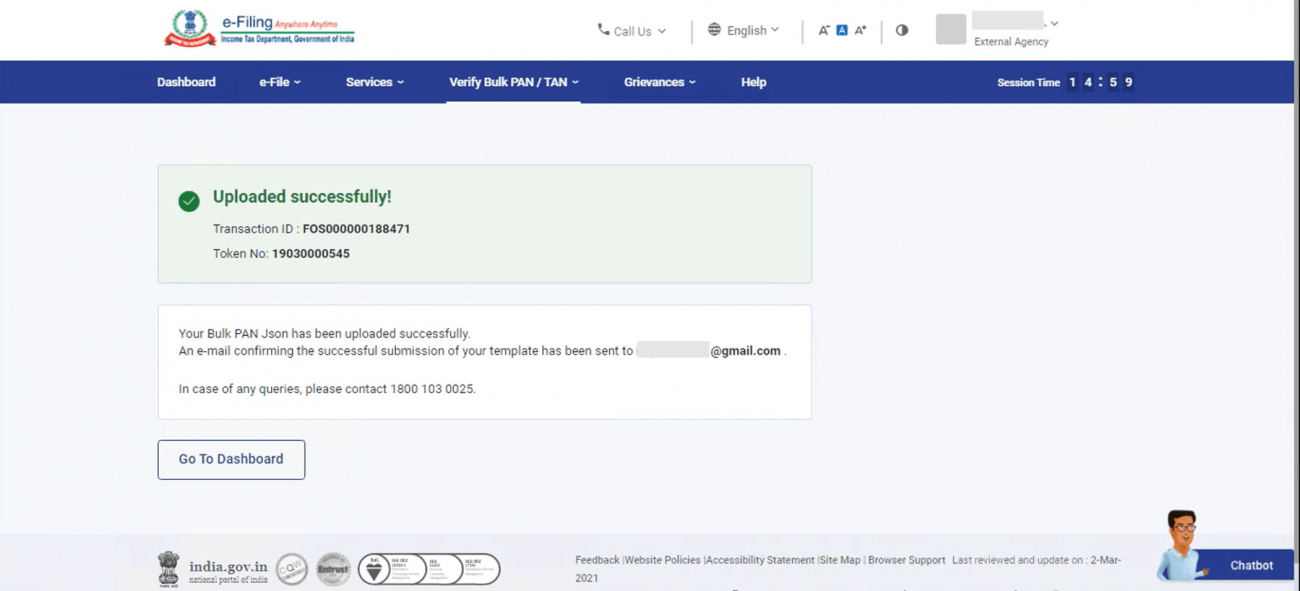

- When uploading is successful, a token number is generated. A success message prompts on the screen including the Transaction ID and a Token Number. You must remember the given Transaction ID and Token Number for future reference. You shall indeed obtain a confirmation short message on your registered email address on the 2.0 tax e-Filing portal. So you can also Bulk PAN verification via Gen TDS filing software without any errors

See Earlier Token Information

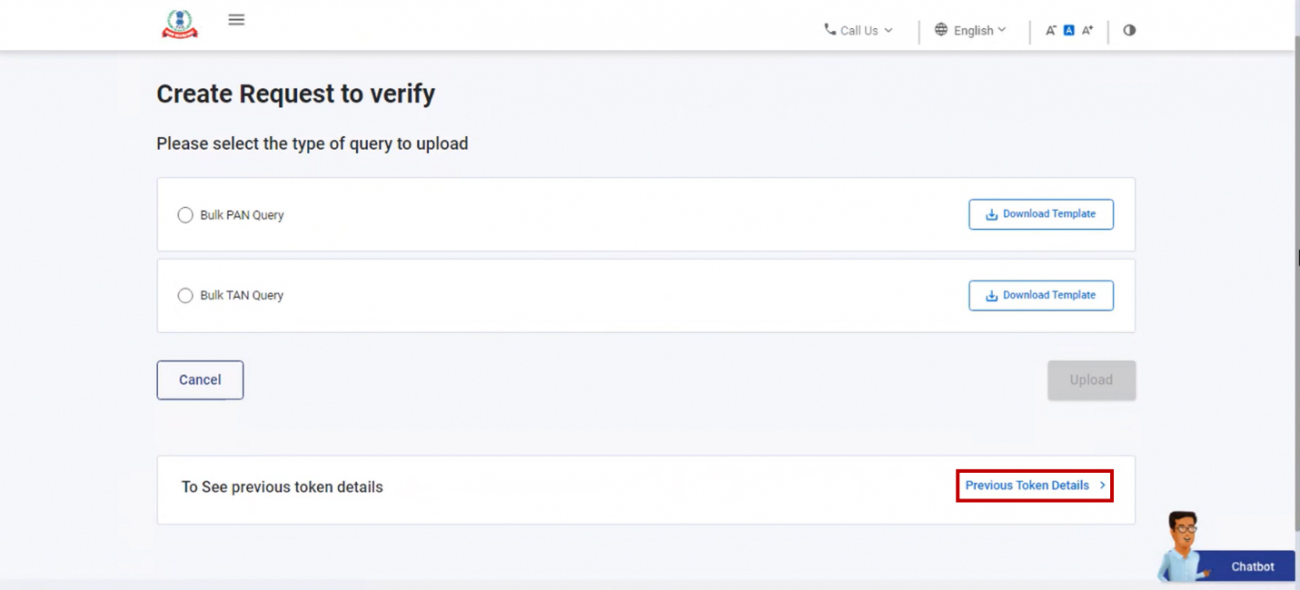

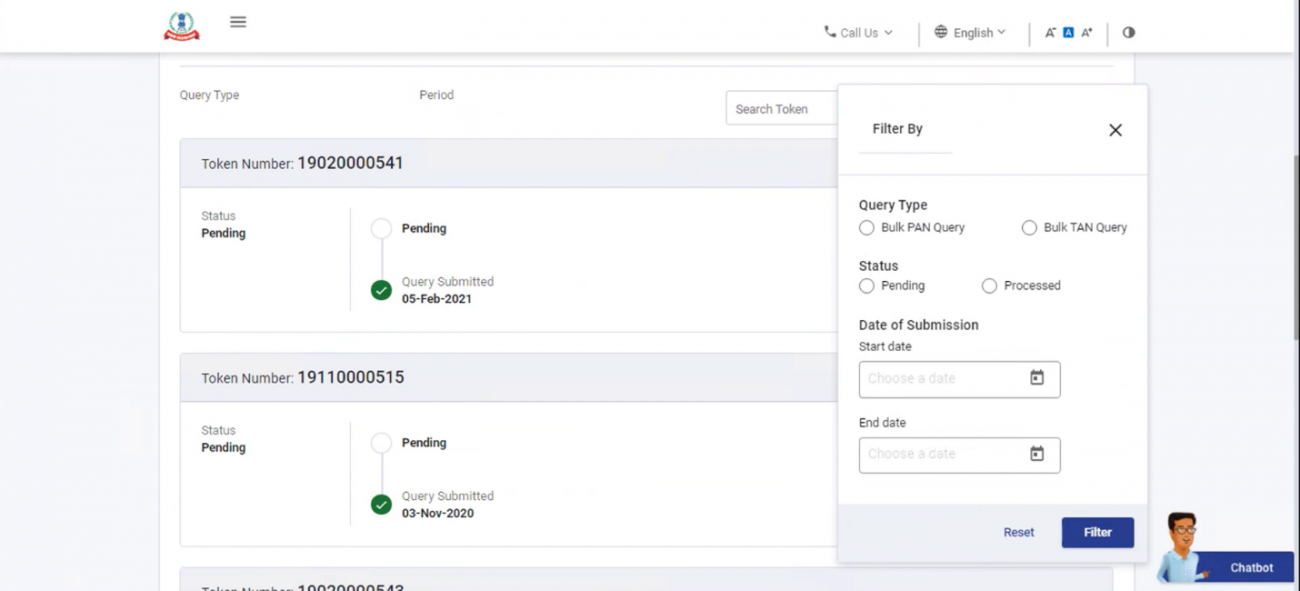

Step 1: To see the information and status of tokens generated, tap on the Previous Token information.

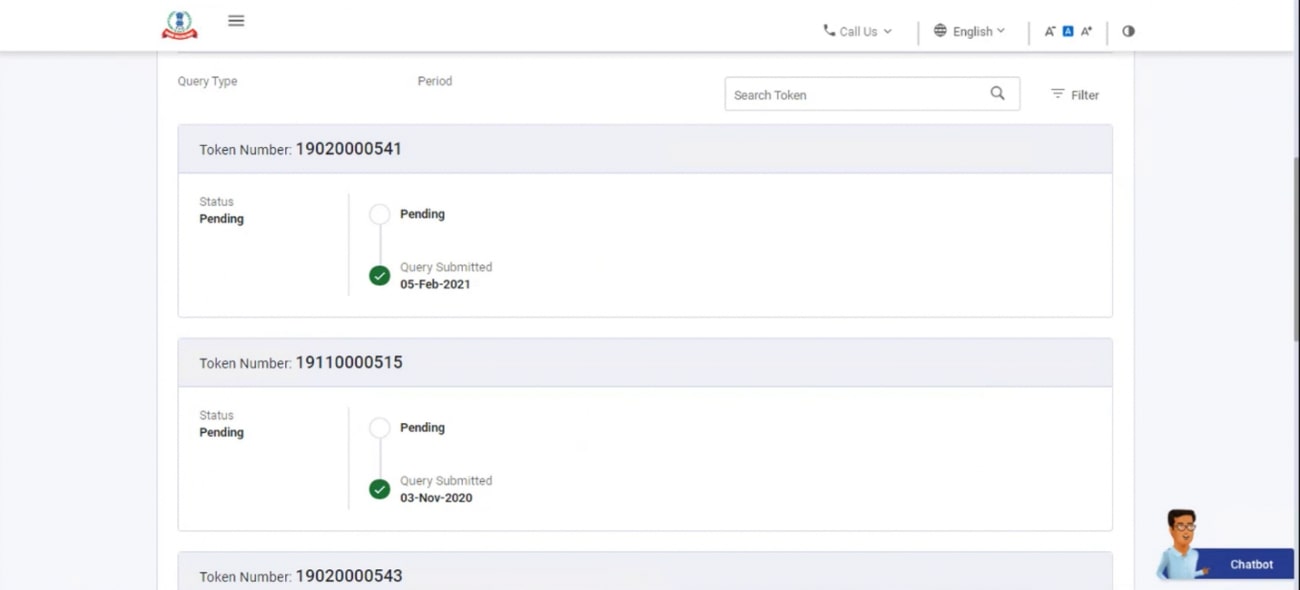

One shall be enabled to see the life cycle of the tokens (Query Submitted / Query Processed), including the current status (Processed / Pending).

- Note: you are enabled to filter out your issues by tapping the button within the funnel symbol upon the top-right corner mentioned above the token listing information.

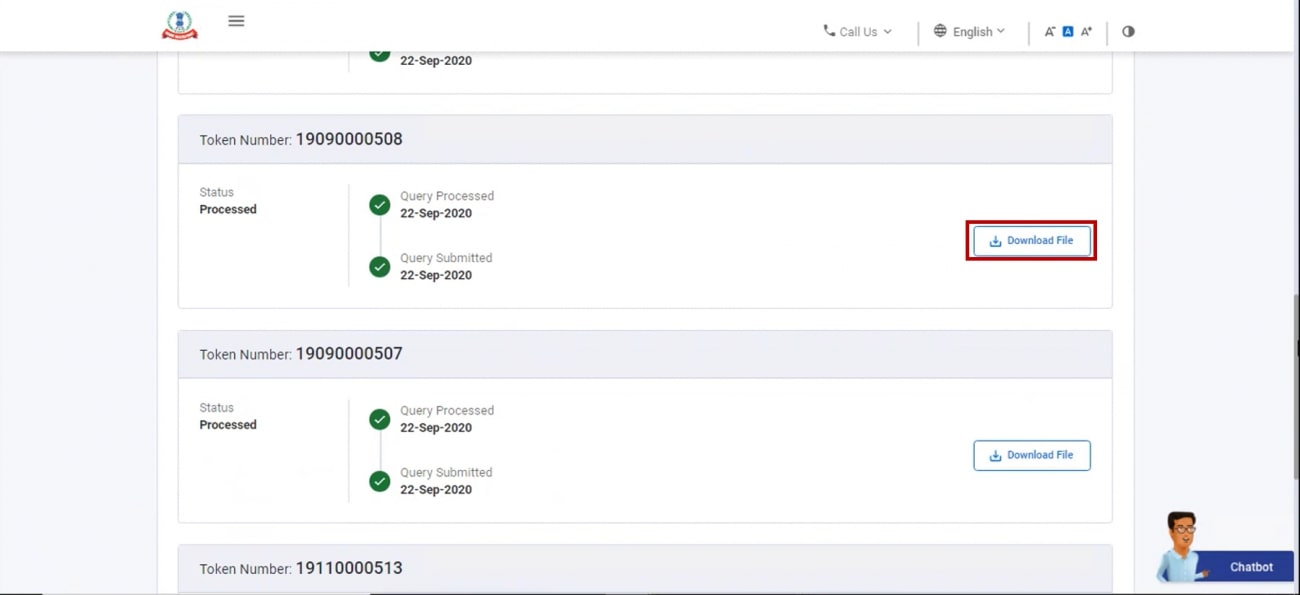

Step 2: when one needs to download the validated information for the specific query, tap to Download File up on the token. You shall obtain the .csv format file downloaded on your computer.

The information through the bulk PAN / TAN query you uploaded shall be validated through the information in the official CBN database, and recorded in a .csv file for every token. In the .csv file you download, you shall be enabled to view which features match and if the PAN / TAN exists in the database.

General Queries on Bulk PAN and TAN Verification

Q.1 – If I am a private company/entity or a single assessee, do I claim to Verify Bulk PAN/TAN service?

No, the same service is for some specific external firms. Moreover, firms are required to get enrolled upon the e-filing portal as an external firm post to the furnishing of the additional proofs for instance signed requisition letter and could practice the services which are available to external firms after the permission through the DGIT systems

Q.2 – What makes the Verify Bulk PAN/TAN service permit the firms to execute?

Through verification of bulk PAN or TAN service, external agencies can:

- Upload bulk PAN/TAN issues templates to verify PAN/TAN on the new return e-Filing 2.0 portal

- View past token information upon the e-Filing portal

Q.3 – Do I upload the bulk PAN and TAN issue at a time in the same file or template?

No, you are required to choose either any kind of issue you need to upload at one time: Bulk PAN Query or Bulk TAN Query. There is no choice but to execute both at a single time; you are urged to upload both the templates separately beneath the Bulk PAN Query and Bulk TAN Query.

Q.4 – Do I upload a PDF/XML of Bulk PAN/TAN Query?

No. You need to download the separate templates for PAN and TAN individually mentioned in the e-Filing portal (Login > Verify Bulk PAN/TAN > Download template). You are required to use the template which is linked with each kind of query and you cannot practice any other file format. Fill in a maximum of 100 issues in the template then tap validate so that the mistakes can be revised. After that, generate the JSON towards uploading on the e-filing portal.

Q.5 – What is the highest number of doubts in one bulk verification furnish?

You can add the highest of 100 doubts in one bulk verification file.

Q.6 – ITD furnishes what kind of replies in the procedure of validating the bulk PAN/TAN query?

The information from the uploaded PAN or TAN query shall be validated through the information in the CBN recorded of database in a .csv file for every token. For PAN queries, the features confirmed are PAN, First Name, Middle Name, Last Name, Incorporation DOB/Date, Gender, Organization Name (if suitable). For TAN queries, the information validated is TAN, First Name, Middle Name, Last Name, Name of Organisation, Organisation PAN.

A reply will be yes or no value with respect to every information such as name, gender, etc. which shows whether it matches with the database. For instance, if an agency enters the PAN or TAN in the query matches with the PAN or TAN master the number shows “Yes”. if there is no similarity with the PAN database then you shall obtain the message “PAN does not exist.” relevant to it, if the first name, date of birth, and name of the firm do not match there shall be a “No” output response with respect to the information.

Q.7 – Is there a daily limit towards the number of PAN/TAN verifications upon the e-Filing portal?

No, there will be no limit on a daily basis. You can upload up to 100 PAN or TAN queries at once, then upload the other 100 next to that and so on.

Q.8 – Towards what time does the validation of the bulk PAN/TAN service valid when enrolled as an external agency?

Once it is enrolled on the e-filing, the verified bulk PAN/TAN service is legitimate and further registration as an external agency is legitimate.