If your company has moved to a new area, you must be need to update your address on the GST portal within 15-day time period. Failing to do so may result in tax compliance problems or information from authorities. This 2025 guide describes the latest procedure, documents required, and approval timeline to update your GST registration smoothly.

A previously enrolled assessee might need to update the GST profile that is required to revise their GST registration certificate. GST alterations are directed to any amendment made to the information of the GST registrations.

If the main place of business address needs to be changed or if the new principal place is to be added, then GST form REG-14 should be submitted. To change the address of the businesses, the GST registration revision application should consist of the confirmation of the new address.

Step-by-Step Process to Change GST Business Address

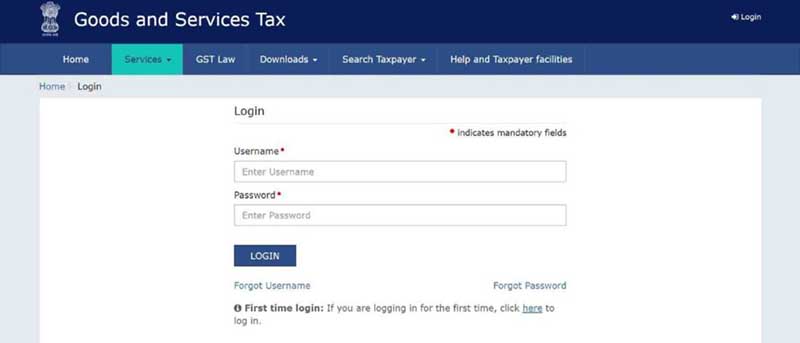

Step 1: Log in to the GST Portal

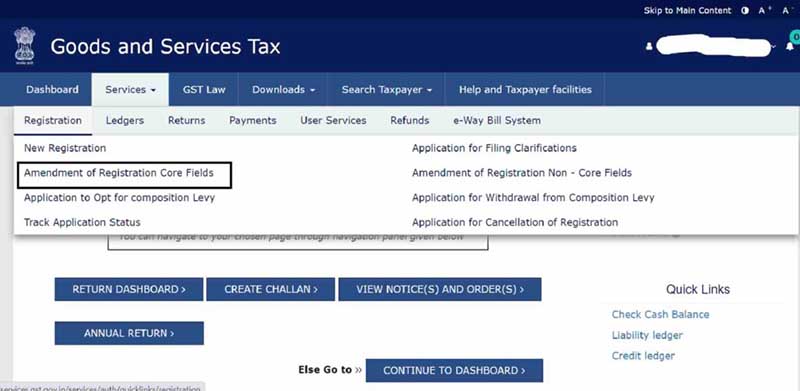

Step 2: Go to Services > Click on Registration

Step 3: Edit button, prefer the field that you need to change

Step 4: Choose the revisions for the Registration Core Fields

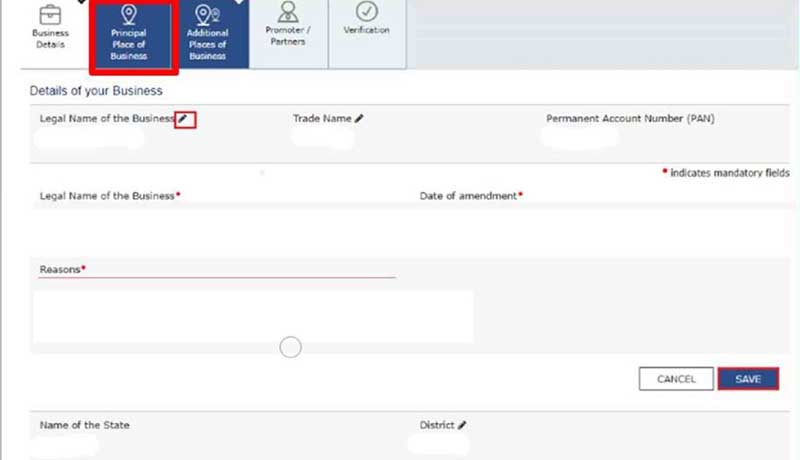

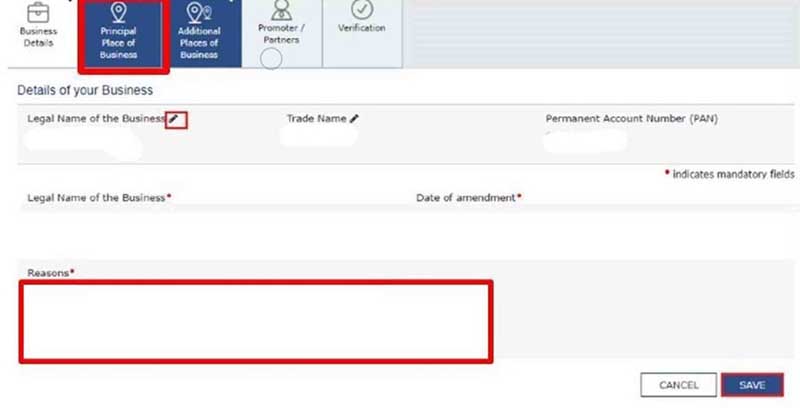

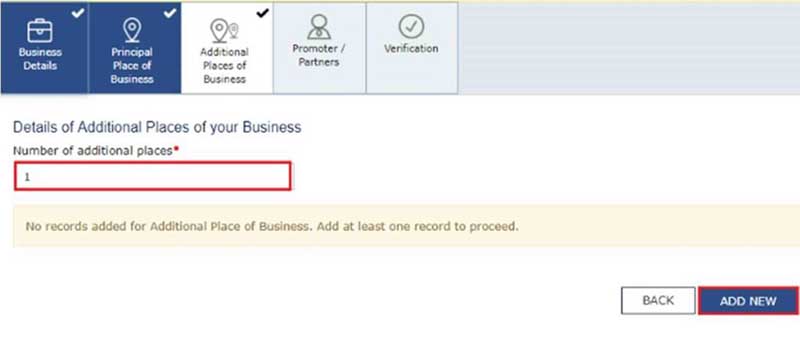

Step 5: Choose the tab ‘Principal Place of Business or ‘Additional Place of Business

Step 6: Provide the cause for the revision of the same, and then confirm it.

Step 7: REG-14 of the GST. To amend the GST, you should furnish the same form.

The GST officer in 15 days, verifies the form GST REG-15 and makes it approved by the GST officer. All these changes will be implemented on the mentioned date.

Step 8: Choose an authorised signatory, enter a location, and sign the application using DSC, E-sign, or EVC.

A message on the screen shall be prompted, mentioning a success message and a copy of the considered is sent to the enrolled email and mobile phone.

GST Portal: Should the PAN Number and the State be Amended or Updated?

No, the PAN number for the particular GST enrollment shall not be amended. There might be an error in the PAN number or the amendment in the PAN because of the revisions in this business’s constitution towards the same case, such as proprietorship to the partnership. The petitioner shall have no option but to enrol for fresh registration, practising the GST REG-01 form.

What Type of Proof of GST Registered Business Address is Accepted?

- The documents that prove the ownership of the property, like the most recent Property Tax Receipt, a copy of the Municipal Khata, or a copy of the Electricity Bill.

- The latest copy of the rent or lease agreement, including the document that proves the lessor’s ownership of the space, like the most recent Property Tax Receipt, a copy of the Municipal Khata, or a copy of the Electricity Bill.

- An affidavit to that effect, as well as any document proving possession of the premises, such as a copy of the electric bill.

Who Can Furnish the Revisions of the Enrolled Applications?

Below are the mentioned GST-registered people who are required to furnish the change of the enrolled applications:

- New Registrants & Normal Taxpayers

- TDS/ TCS Registrants, UN Bodies, Embassies & Other Notified Persons having UIN

- Non-Resident Taxable Person

- GST Practitioner

- Online Details and Database Access or Retrieval Service Provider

FAQ’s for GST Address Changes

Q1. Is it possible to change the state in GST registration?

No. Changing the state requires applying for a new GST registration, as each state operates independently under the GST framework.

Q.2 What happens if the GST officer doesn’t respond?

If the officer fails to respond within 15 working days, the amendment request is deemed approved as per GST rules.

Q.3 Do I need to reapply for GSTIN after shifting my business location?

No. You don’t need to reapply for GSTIN unless you are moving to another state or Union Territory (UT).

Q.4 Can I add multiple branches under one GST registration?

Yes. You can add multiple branches by entering each location separately under the “Additional Places of Business” section in your GST application.