If your company has moved to a new area, you must be need to update your address on the GST portal within 15-day time period. Failing to do so may result in tax compliance problems or information from authorities. This 2025 guide describes the latest procedure, documents required, and approval timeline to update your GST registration smoothly.

A previously enrolled assessee might need to update the GST profile that is required to revise their GST registration certificate. GST alterations are directed to any amendment made to the information of the GST registrations.

If the main place of business address needs to be changed or if the new principal place is to be added, then GST form REG-14 should be submitted. To change the address of the businesses, the GST registration revision application should consist of the confirmation of the new address.

Step-by-Step Process to Change GST Business Address

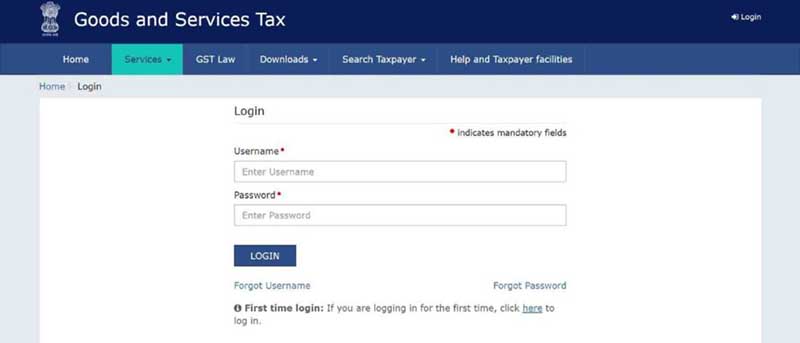

Step 1: Log in to the GST Portal

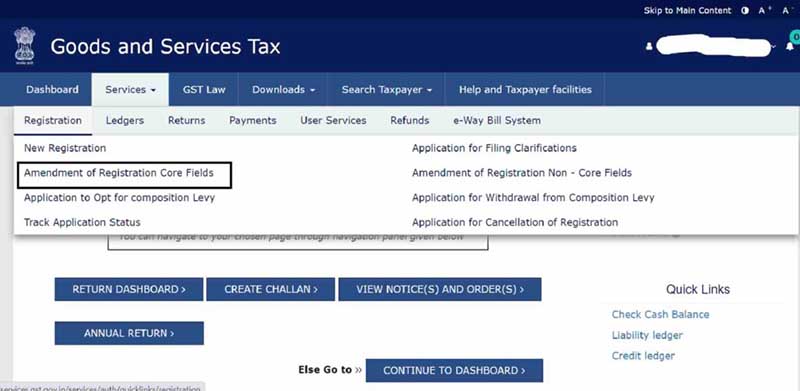

Step 2: Go to Services > Click on Registration

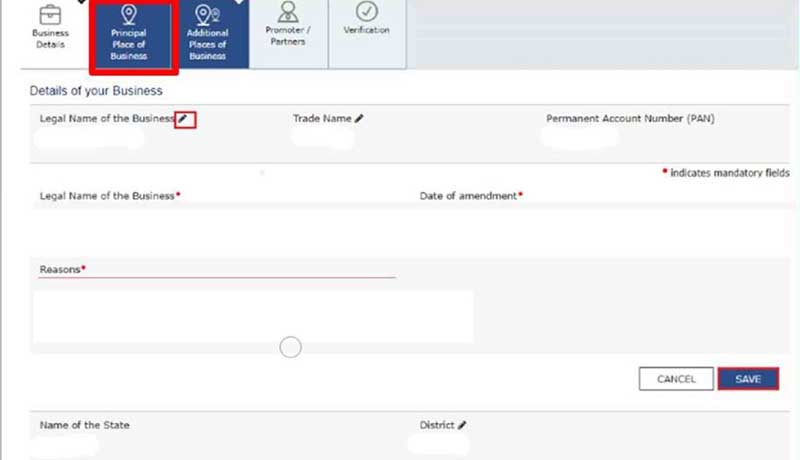

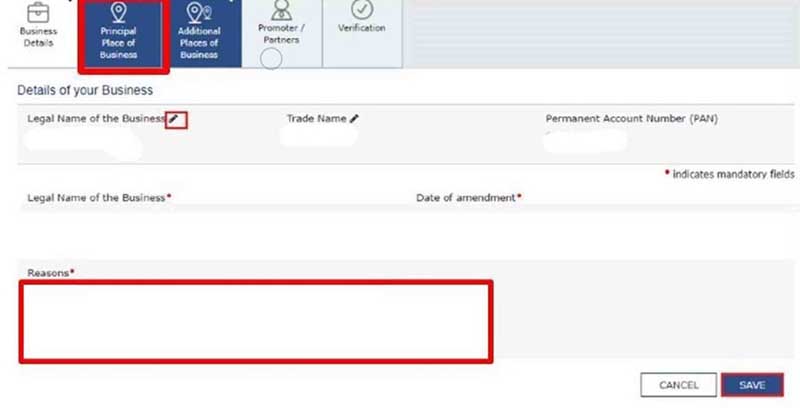

Step 3: Edit button, prefer the field that you need to change

Step 4: Choose the revisions for the Registration Core Fields

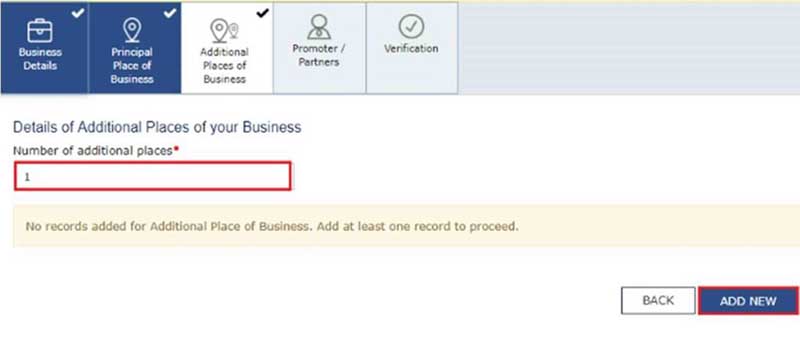

Step 5: Choose the tab ‘Principal Place of Business or ‘Additional Place of Business

Step 6: Provide the cause for the revision of the same, and then confirm it.

Step 7: REG-14 of the GST. To amend the GST, you should furnish the same form.

The GST officer in 15 days, verifies the form GST REG-15 and makes it approved by the GST officer. All these changes will be implemented on the mentioned date.

Step 8: Choose an authorised signatory, enter a location, and sign the application using DSC, E-sign, or EVC.

A message on the screen shall be prompted, mentioning a success message and a copy of the considered is sent to the enrolled email and mobile phone.

GST Portal: Should the PAN Number and the State be Amended or Updated?

No, the PAN number for the particular GST enrollment shall not be amended. There might be an error in the PAN number or the amendment in the PAN because of the revisions in this business’s constitution towards the same case, such as proprietorship to the partnership. The petitioner shall have no option but to enrol for fresh registration, practising the GST REG-01 form.

What Type of Proof of GST Registered Business Address is Accepted?

- The documents that prove the ownership of the property, like the most recent Property Tax Receipt, a copy of the Municipal Khata, or a copy of the Electricity Bill.

- The latest copy of the rent or lease agreement, including the document that proves the lessor’s ownership of the space, like the most recent Property Tax Receipt, a copy of the Municipal Khata, or a copy of the Electricity Bill.

- An affidavit to that effect, as well as any document proving possession of the premises, such as a copy of the electric bill.

Who Can Furnish the Revisions of the Enrolled Applications?

Below are the mentioned GST-registered people who are required to furnish the change of the enrolled applications:

- New Registrants & Normal Taxpayers

- TDS/ TCS Registrants, UN Bodies, Embassies & Other Notified Persons having UIN

- Non-Resident Taxable Person

- GST Practitioner

- Online Details and Database Access or Retrieval Service Provider

FAQ’s for GST Address Changes

Q1. Is it possible to change the state in GST registration?

No. Changing the state requires applying for a new GST registration, as each state operates independently under the GST framework.

Q.2 What happens if the GST officer doesn’t respond?

If the officer fails to respond within 15 working days, the amendment request is deemed approved as per GST rules.

Q.3 Do I need to reapply for GSTIN after shifting my business location?

No. You don’t need to reapply for GSTIN unless you are moving to another state or Union Territory (UT).

Q.4 Can I add multiple branches under one GST registration?

Yes. You can add multiple branches by entering each location separately under the “Additional Places of Business” section in your GST application.

Disclaimer:- "All the information given is from credible and authentic resources and has been published after moderation. Any change in detail or information other than fact must be considered a human error. The blog we write is to provide updated information. You can raise any query on matters related to blog content. Also, note that we don’t provide any type of consultancy so we are sorry for being unable to reply to consultancy queries. Also, we do mention that our replies are solely on a practical basis and we advise you to cross verify with professional authorities for a fact check."

My office space is rented to a company who has GST number and wants to update its GST address. We have rent agreement / lease agreement in place, what document is required by tenant to update GST address

Latest rent agreement

Hi Sir,

I am trying to upload new documents for address proof on the Amendments of Non core fields, but do not see the edit option in Principal address section.

Kindly help.

Hii sir,

I am Pravesh, I want to change my principal place of address because the last address was rented but it expired some days ago. So I take new address for pincipal place of business too rented. show I want How can explain my proper reason on GST Portal For address amedment.

You should quote genuine reason for changing principal place of address.

sir ,

my additional place of business is own premises and principal place of business is rented property, we are vacate rented property. how to change principal place of business address that additional place of business.

Greetings !

We have shifted to anew res-cum-office and need to change address in GST portal. We have my adhar card in the new address. But no rent agreement, as the owner lives overseas and is not visiting for some time. We can do a rent agreement, but can only get a scanned copy. Cannot be registered.

Plas advise.

As we are shifting the business place from rented place to another rented place, shall we register our own house as business place and our rental place as godown

Yes

YES

We have filed application for additional place of business and it is under process, can we transfer stock to our new business place and start invoicing from new place of business before it is approved by the department.

Yes

We have to shift to new premises .We have applied for this change .Can we start shifting while the approval is awaited ?

Yes

Hi

We need to change the GST address. Currently we are having a rented office. But the contract will be expiring within 1 week and we need to find another space and shift since the owner is not interested to extend the contract period. So if we are using the GST without agreement until we find a new place and change the address what will be the impact ?

No Impact will be there you can change the same later

If we are renting a cabin at co-working space, does the premise need to be a GST registered in order for us to obtain our GST number?

I want to change my principal business address, and shift to other place in this city,,(property rental),,but the owner of property, providing me, lease agreement, adhar card,and house tax receipt, only

He has not transferred electricity bill to his name, till,, and he has not pan card also,

Can I apply for the change of my business address in GST,, please guide

we want to change business premises east delhi to north delhi . my question is that how many days before i have applied for amendmend ? can i shift in new address than aply the same?

plz suggest…

Yes, you can apply for changing the address after shifting

How can i update only the PIN code of the additional place of Business? as there is only view option available.

You can change the same under amendment in Non core field section

Principal business address need to change

Property owner provided

Rent agreement

House tax receipt

Adhar card

Property paper

Noc documents

He has not pan card and not changed his name on electricity bill

Can I apply for the change of my business address in GST.

i have added warehouses to gst portal

I need to select warehouse/depot for additional warehouse but i selected bonded warehouse.

will that be problem for me?

And can we do domestic sales in bonded warehouse??

Please Clarify….

We submit for update my address from Rohini Delhi to bawana delhi. If approval is under process . May I start manufacturing in new premises. I have stopped manufacturing on old premises

Yes

We filed application for change the principal address but still not changed by GST officer, can we start billing from new address

If my business place is changed from Haryana to Uttarakhand, I will have to take a new GST number but what to do with my old GST number?

You need to cancel the same

Hi am veerendra from karnatak , I have gst on my home adress , now changed to small shop is that necessary to change address on my gst also .

Yes

sir, my question is that, i’ve a gst no. in delhi state but its principle place of business changed from delhi to haryana.. so is my GSTIN should be changed or i’ve to apply for new one..?

Since State is changed in Principal place of Business Hence you need to take new GST registration for the same and cancel the old one

Sir

Our Client has taken GST No- at Borivali west ,Now he want to change the principal place of Business from Borivali to Darukhana Reay Road My question is Gst number will remain same or it will change ,what document are required for same

Mahendra Shah

GST number will remain the same, current address proof is required for the same.

Ham apna GST me address change karne ke liye

9/08/2023 submit kiye lekin 17 din ke bad bhi change nhi hua

Please raise a ticket on the GST portal