The Goods and Services Tax Network (GSTN) is the special draft formed under the previous UPA regime in order to set up the information technology framework for the indirect tax regime, replacing local levies.

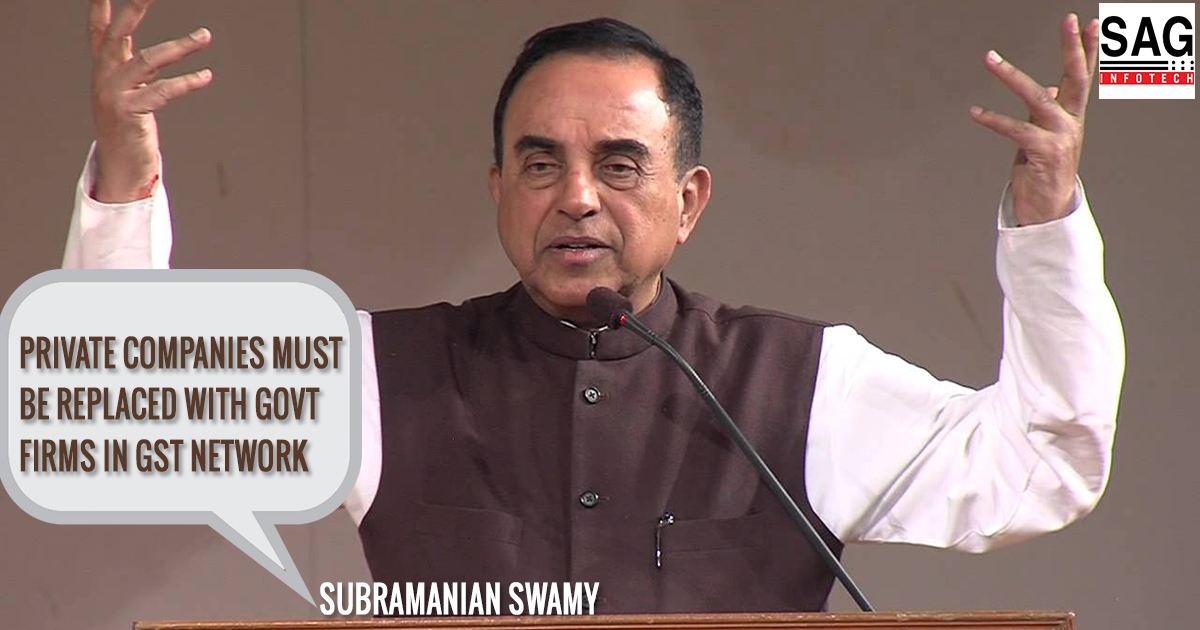

Swamy accused the then Finance Minister P Chidambaram on the failure of obtaining the important security clearance while proposing GSTN, Swamy told that the Supreme court may halt the entire process.

Speaking at a book release event, he said that in the “normal” course security clearance from the Ministry of Home Affairs must have a obtained security clearance on GSTN as it is about handling the important tax data.

The government of India holds 24.5 per cent stake in GSTN while state governments hold another 24.5 per cent. The non-government financial institutions, like HDFC Bank, HDFC Ltd, ICICI Bank, NSE Strategic Investment Corporation and LIC Housing Finance hold the 51 percent stake.

“GSTN cannot take off unless you first get security clearance,” Swamy said while pointing out that even the Rajya Sabha Select Committee that scrutinized the GST Bill had said that presence of private companies, with significant foreign holding, in GSTN is not “desirable”.

“It (GSTN) will not be able to pass the Home Ministry security clearance until the Rajya Sabha Select Committee unanimous recommendation is implemented and HDFC Bank, NSE, LIC Housing Finance and ICICI Bank are all removed and replaced by (public sector banks) because tax data is sensitive. It is confidential. We cannot allow foreigners the right to get this data,” Swamy said. The MP is also looking ahead to raise the issue in the parliament through a special resolution.