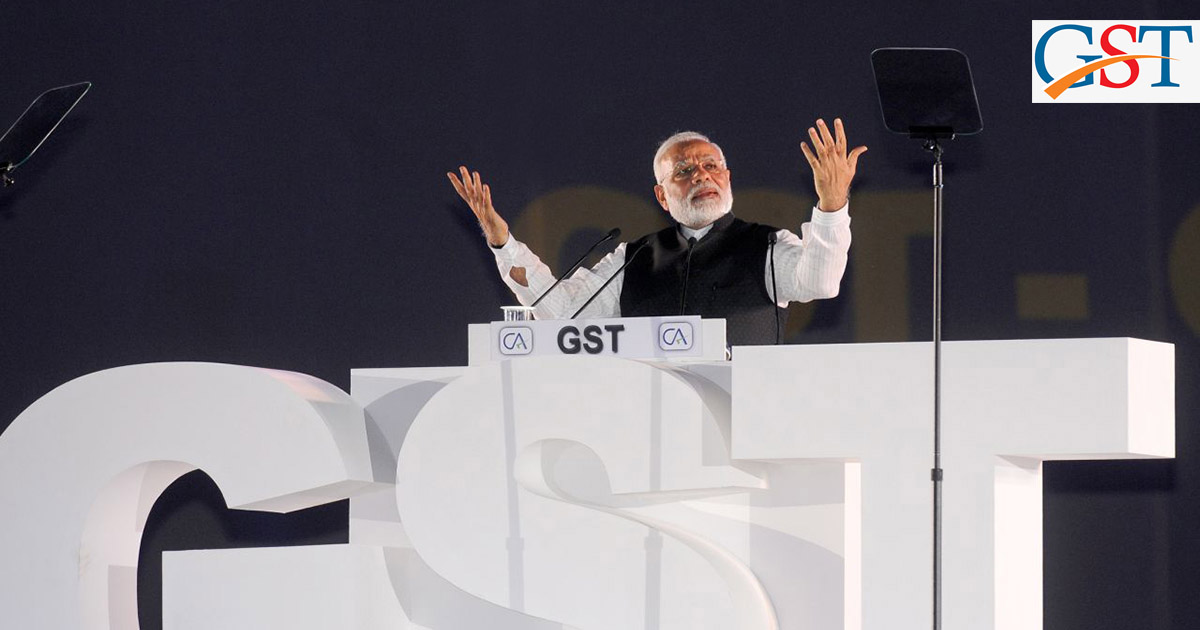

PM Narendra Modi, while addressing at the 2-day event of ‘Rajswa Gyan Sangam’ focused on GST issues and encouraged the system to provide a strong IT system who can free the taxmen from hurdles they are facing now in uploading the details. So, the masses can get the benefits under GST regime without any glitch.

After GST implementation, 72 lakh indirect taxpayers shifted into new GST system and 20 lakh newly registered under GST regime which doesn’t account as a healthy response to the government initiative. In the second edition of annual gatherings of tax officers, PM addressed the meeting and gave important recommendations. He directed the six crore taxpayers with private businesses to come under the ambit of GST. Further, he said, there are six crore private businesses, out of which only 92 lakh taxpayers are paying taxes and the government expects at least half of them to bring into GST net.

Supporting the statement, the main idea is to put a static system which can deal with data exchanges between Central Board Of Direct Taxes(CBDT) and Central Board Of Excise And Customs(CBEC). By forming a system like this reaching people on basis of income tax and the exchange of real-data between the indirect tax system and direct tax system will become more convenient.

In favor of taxpayers, the PM reviewed the GSTN system and with the prevailing issues in invoice uploading the GST Council has extended the due dates for filing the monthly returns. Now the due date for filing GSTR-1 for July month is 10 September, for GSTR-2 is 25 September and for GSTR-3 is 30 September.

Furthermore, the luxury car manufacturer companies urged to the finance minister to reconsider the ordinance on increased tax on luxury and SUVs. The GST Council is paying heed in the matter seriously and we can expect the directives in coming future.