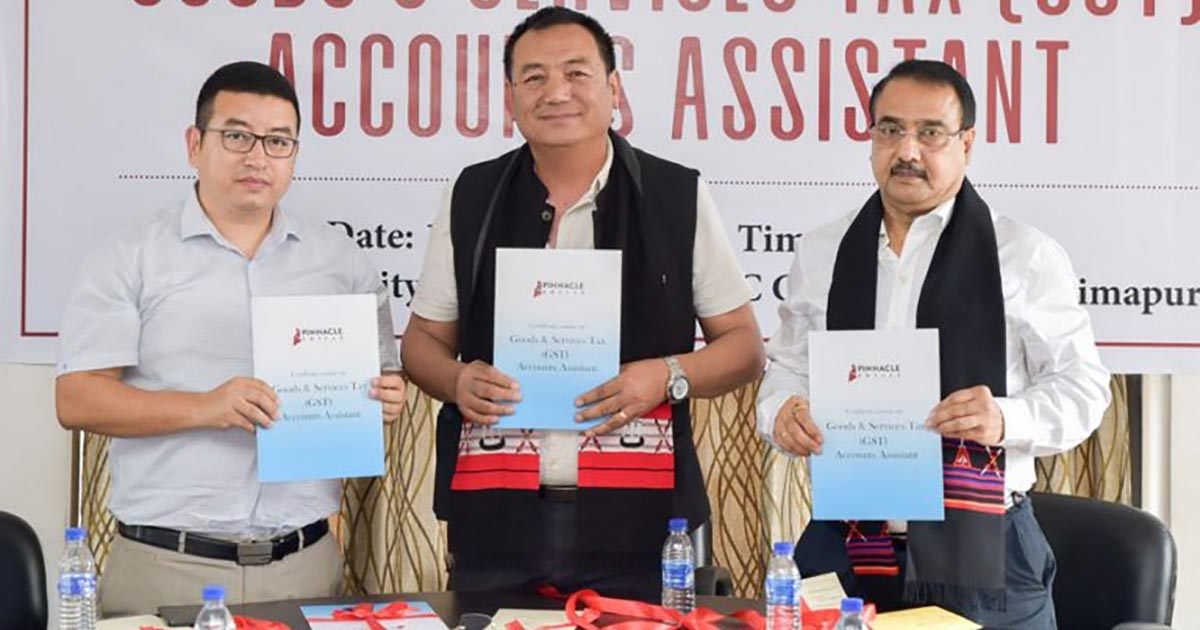

Dimapur-based Pinnacle Skills training institute has launched Goods & Services Tax (GST) accounts assistant course at a launch event organized at Westcity conference hall, DC court junction, Dimapur, on March 16. The programme was accosted GS Paul, assistant commissioner of GST, Government of India, and Wochamo Odyuo, additional commissioner of taxes, Government of Nagaland, as chief guests.

Pinnacle skills training institute is one of the leading skill development centre & division of SEED, equipped with theory rooms and computer labs. The division has now introduced a new course of GST to impart GST knowledge and skills through experienced trainers and executives with industry experience.

The programme gathered appreciation by Wochamo Odyuo, when he praised the efforts initiated by Pinnacle Skills while motivating the commerce graduates to take advantage of the course to further leverage their account and GST skills that will open more doors for their better careers in the industry.

Odyuo also laid attention on the fact that 10,000 or more businesses of the state are now GST registered but only about 50% of them duly files GST returns on a monthly basis and this gap could be furnished through proficient GST executives who would help & motivate the traders to file the GST returns properly and regularly.

GS Paul, while talking about the technical aspects of GST filing, stated that the course would serve a potent base for executives & assist them to become GST professionals.

Pinnacle Skills’ chief executive, Dr Yan Murry, while declaring that 100 hours course duration would be brought in Dimapur and Kohima, also publicized the aims behind introducing this course that the course will raise excellent GST executives who will make the GST returns filing process -an effortless, easy and regular process.

Read Also: Free Download Gen GST Software for E-Filing, E Way Bill & Billing

The new initiative by Pinnacle skills training institute on March 16 will surely bring more and more skilled GST professional and will bridge the gap of GST return filings.