Individuals with income exceeding more than the basic exemption limit are required to file an Income Tax return within the due date, and if the person fails or misses the due date, then there are certain provisions of penalty under the Income Tax Act of 1961.

The assessing officer may contact the individual through a notice to furnish reasons for not filing the return within the due date. Not filing the return within the due date may lead to a levy of penalties up to INR 5,000.

It is well known that the last date to file your ITR for the financial year 2024–25 is July 31, 2025, for non-audit cases. However, as per CBDT’s new press release, the deadline has been extended to September 16, 2025, for non-audit cases and October 31, 2025 10th December 2025 for audit cases. If you do not file your ITR on time can prompt a penalty, but there are additional consequences and inconveniences with the delay and penalties, and today we are exploring the same here:

- Penalty for Late Filing u/s 234F

- Reduced Time for Revising Your Return

- Payment of Interest

- Carry Forward of Losses is not allowed

- Delay in Receiving Refunds

Penalty for Late Filing Income Tax Return Under Section 234F

As per the modified rules notified under section 234F of the Income Tax Act, that is already been in action from 1 April 2017, filing your ITR after the due date can make you liable to pay a maximum penalty of ₹ 5,000.

Let’s understand it more clearly. If you file ITR after 31st July 2025 (Non-audit) and 31st Oct 2025, 10th December 2025 (Audit cases), you will be liable to pay a penalty of ₹ 1,000. Total Income is more than Rs 5,00,000, then the penalty will be expanded to ₹ 5,000.

| Late Income Tax Filing Fee Details | ||

|---|---|---|

| E-Filing Date | Total Income Below INR 5,00,000 | Total Income Above INR 5,00,000 |

| Before Revised 16th September 2025 Due Date (Non-audit) and | ₹ 0 | ₹ 0 |

| After 16th September 2025 (Non-audit) and | ₹ 1,000 | ₹ 5,000 |

Final due date (with late fee): 31st December of the Assessment Year 2025-26 (unless CBDT extends further).

Reduced Time for Revising Your Return

Suppose you are filing your ITR and you wind up making a mistake. Then, according to the changed rules, you just have time till three months before the end of the relevant Assessment year to make the change (for ITRs from FY 2021-22).

Prior to this modification, taxpayers had a 2-year-long window to do corrections (revise) and resubmit an erroneous ITR. The same is now being reduced to three months before the end of the relevant assessment year. Thus, the earlier you file, the longer the window available to you for performing all the corrections or revising your returns to rectify errors, if any.

Payment of Interest

In any case, if you failed to file income tax returns on or before the deadline, you would be required to pay interest at the rate of 1% for each month, or part of a month, on the amount of unpaid tax according to section 234A.

Carry Forward of Losses is Not Allowed

If you faced any losses during the year, such as a loss under the head Capital Gains or any loss in your business, make sure you file your ITR on or before the last date. Not filing ITR on time will deprive you of carrying forward all your losses in the next years to set off against income in future years.

Postponement in Receiving Refunds

In cases where you are qualified to receive a refund from the government for excess taxes you have paid, you should file your return before the due date to get the refund at the earliest.

We have engraved here some very important and must-know facts about the consequences and inconveniences of the Late Filing of Income Tax Returns. We hope you will find it beneficial and informative. No one likes a penalty or punishment, so make sure to keep track of all the GST due dates and fill the ITR before the due date.

List of Penalties for Default in Payment of Taxes or Disclosing the Information

- Default in making payment of taxes:- This amount of penalty is decided by the government however, the amount does not exceed the amount of tax in arrears.

- Underreporting/ Misreporting of Income:- If the assessee has not filed his return of income and his income exceeds basic limits set by the government, or if the return is filed and the income assessed is greater than the income reported, then the penalty would be 50% of tax payable on such under-reported income. 200% of tax payable if under-reporting is from the misreporting of income.

- Not maintaining Books of Accounts: The penalty will be Rs 25,000. However, if the assessee has entered into an international financial transaction, then the penalty will be 2% of such transaction amount.

- False/omitted entries:- Penalty would be equal to the sum of such false/ omitted entries.

- Penalty on undisclosed Income:-

| S.No. | Conditions | Penalty | Conditions Where Penalty Not Charged |

|---|---|---|---|

| 1. | Income includes undisclosed Income | 10% of such undisclosed income | The income included in the ITR and tax is paid before filing of return |

| 2. | Search is initiated on/after 01/07/2012 but before 15/12/2016 | 1. If undisclosed income is admitted during the search, a 10% penalty 2. If undisclosed income is not admitted during the search but disclosed in the return of income, and taxes are paid, 20% 3. Other cases – 60% | |

| 3. | Search is initiated after 15/12/2016 | 1. If undisclosed income is admitted during the search, 30% as a penalty 2. In other cases – 60% |

Be Cautious While Filing Income Tax Return

Many taxpayers invest in recurring deposits, fixed deposits, bonds, etc., in the name of the minor child. They also get interested in such sorts of investments. Taxpayers think that the investment is in the name of the minor, and so it is not required to mention such investments. It is mandatory to provide details regarding such investment in the name of the minor child under the income tax laws.

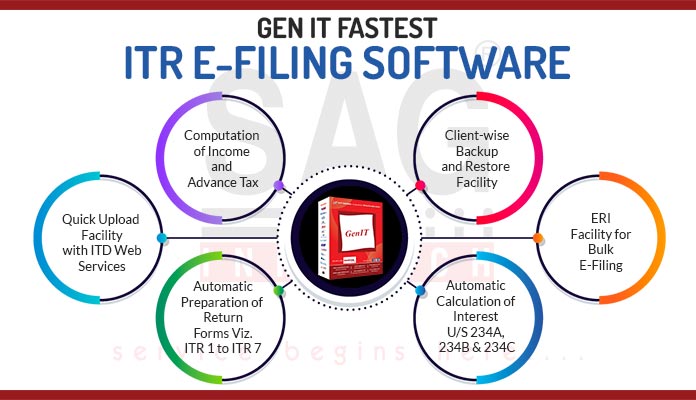

To file income tax returns correctly, Gen IT serves as a purposeful source. The software helps in fulfilling requirements such as Self Assessment Tax, Advance Tax, Income Tax computation, and calculation of interest under sections 234A, 234B, and 234C.

It is a useful software “For those who can’t afford to make errors”. It is a perfect tool to prepare returns and directly do e-filing to upload them correctly. GenIT is a subsidiary of the renowned Genius software in the taxation industry.

Detailing On Income

When taxpayers file ITR in a hurry, sometimes they forget to mention the things that are exempted from the income tax criteria. This income consists of interest earned on the provident funds, long-term investments, etc. The income tax department asks for details regarding such incomes.

If the taxpayer is 40% differently abled and is certified by the medical authority, then he is eligible to claim up to Rs. 75,000 under section 80U. However, Section 80U also defines the person suffering from severe disability, i.e. suffering 80% disability (either from one or multiple ailments) and will be eligible to claim Rs 1,25,000 under Section 80U.

Many taxpayers are not aware of how to save on insurance premiums. The saving on insurance premiums comes under section 80D. Taxpayers sometimes forget to claim tax-saving deductions.

Under section 80TTA, they forget to claim interest on savings bank account,s but in Genius software if you just Put Saving Bank Interest in Other Income you will get a deduction under section 80TTA and under section 80C they miss claiming over tuition fees etc. and under section 80C, they miss claiming over tuition fee etc.

Check Form 26AS, AIS, TIS

It is advisable to avoid mistakes while filing Form 26AS. These mistakes further increase the extra liability to serve taxpayers. Before filing the income tax return, it is necessary to check the 26AS form, AIS and TIS. It will help to sort out the problems in the coming times. In the Gen Income Tax Return Filing software, you can directly import 26AS, AIS and TIS, which helps to avoid mistakes in filing the TDS/TCS/ Advance Tax details/Income Details.

Claim Processing Fees Under Section 24

Many people are not aware that the processing fee for reimbursing home loans is also eligible for claim under Section 24. Under section 24, you can be eligible to claim many more deductions such as pre-construction interest, Home loan Interest, etc.

Interest In Completing 3 Months

The taxpayer gets Rs. 10,000 relief on interest that was credited by the bank in the taxpayer’s savings bank account every three months under section 80TTA.

8 Mistakes To Avoid Before Filing ITR Forms

- Do not claim fake deductions in the ITR to reduce income tax liability.

- If the income is more than the basic exemption limit, filing of a return is mandatory.

- Mention your accumulated income earned from all the employers, if you have changed jobs.

- When you select the wrong ITR form, you may get an income tax department notice mentioning under-reporting income, as an incorrect form, you will miss some information to file.

- A taxpayer is also required to make sure that the data fed into the ITR is from Form 26AS. In any discrepancy, the department can ask for an explanation.

- It is required to either e-verify the ITR form or send it to CPC, Bengaluru, for verification. If the assessee fails to e-verify his return, then the return will be considered as an invalid form.

- It is required to mention every single detail regarding the income in the ITR.

- When you are filing the ITR form late, pay the late filing fees as well to avoid the notice from the income tax department.

Hello Pradeep,

When I’m trying to file the ITR for FY 20-21 on 02-08-2021, I’m seeing a penalty of 5000 (taxable income is greater than 500000) even though the last date for filling has been postponed to 30-09-2021.

Am I supposed to see this penalty? Or is this the new ITR website issue that would be resolved?

Sir, I want to know any trust if they have transitioned within ২০০০ thousand the have to must audit?

I have filed my income tax return of 2014-15 (AY 2015-16) but forget to e verfy. later i e verified on March 2018. on May 2018 I got a message that condonation has rejected. what should I do?

Usefull and Good Explation.