The Punjab & Haryana High Court in relief for India Inc., has stayed a circular that is within the corporate guarantees furnished via holding companies for the advantage of their subsidiaries, to GST.

The High Court in an interim order has stayed the Central Board of Indirect Taxes and Customs (CBIC) issued circular. As per the circular, a corporate guarantee delivered by a holding company to a bank or financial institution for sanction of credit facilities to its subsidiary shall be a ‘supply of service’ as per the GST.

It cited that the tax incidence shall emerge when no consideration is engaged. The case pending in the High Court comprises a contest to the corporate valuation guarantees.

India Inc. through the same stay for now which is staggering beneath the show cause notices and GST demand orders running into distinct hundred crores – could live simply. On the foundation of the same circular the companies that have obtained the Show Cause Notice(SCN) are enabled to approach the HC for quashing that.

On the holding company, the demands have been raised if the same is in India. If the holding company stands overseas then the Indian subsidiary (for whose benefit the corporate guarantee is furnished) is facing the demands of GST.

Post circular the issue of the SCN, followed by demands, intensified. Industries in all sectors ranging from FMCG to infrastructure, obtained these notices.

The High Court has granted a pan-India stay on the circular that deemed corporate guarantee as a supply of service subject to GST. The circular led to tax officials assuming that every corporate guarantee transaction, except for personal guarantee by a director, was taxable without proper assessment. Mannat Waraich, who represented Acme Cleantech Solutions, argued that the circular was a foregone conclusion and did not consider the merits of each transaction.

Also, she cited that based on the circular if a company has obtained a SCN then the same must approach the jurisdictional high court to quash it. The company ought to approach the appellate authority or the high court asking to quash the same if the order asking for a GST demand has been issued. The same shall be the quasi-judicial authorities/courts to quash the demand or keep the same in suspension.

The same interim order aims to implement that we have a fundamental separation of power (under our constitutional construct) between the executive and the judicial wing of authority. In this case, the executive wing being the tax administrator (i.e. CBIC) cannot secure the adjudicatory and appellate powers of the quasi-judicial authorities, Sujit Ghosh, senior advocate, Supreme Court, who led the arguments for the company quoted.

Waraich stated that they have challenged Rule 28(2) of the CGST Rules (amended). This rule mandates the payment of GST at a rate of 18% on 1% of the value of the guarantee or the actual consideration, whichever is higher. They have challenged these rules on the grounds that they are arbitrary, discriminatory, and confiscatory in nature.

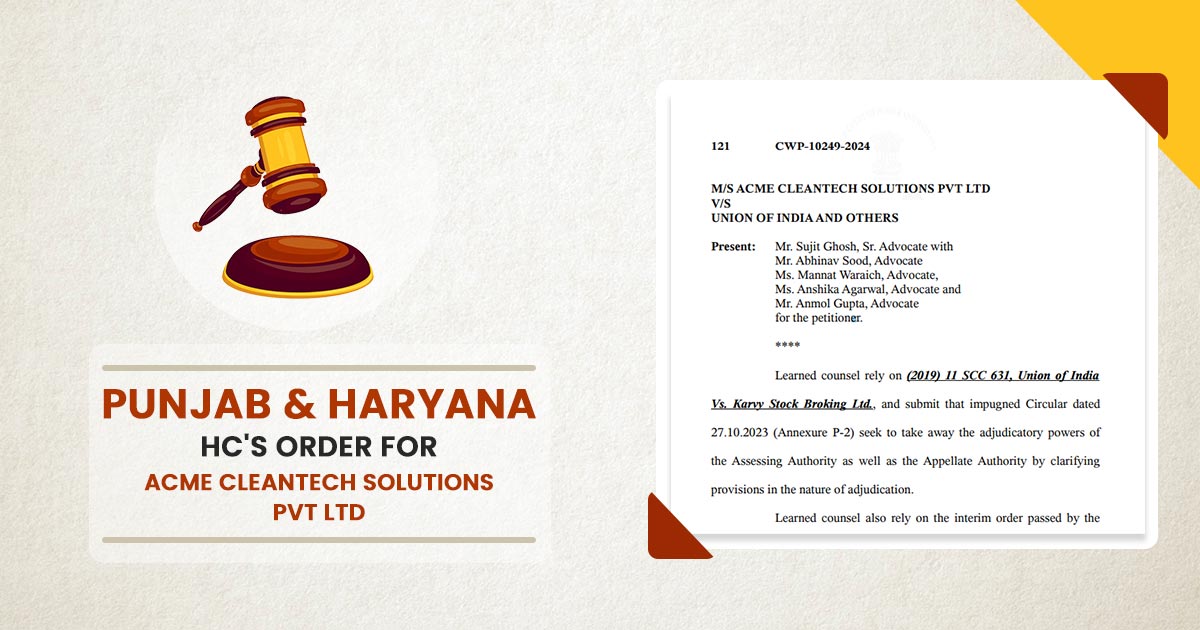

| Case Title | M/s Acme Cleantech Solutions Pvt Ltd Vs Union of India and Others |

| Citation | CWP-10249-2024 |

| Date | 03.05.2024 |

| Present By | Mr Sujit Ghosh, Mr Abhinav Sood, Ms Mannat Waraich, Ms Anshika Agarwal, Mr Anmol Gupta |

| Punjab & Haryana High Court | Read Order |