The Patna High Court has quashed the tax orders against a contractor, holding that the show cause notice (SCN) issued under Section 74 of the GST Act, 2017, was invalid since he had already filed his GST returns and paid the taxes.

Parvinder Singh, the applicant, has asked to quash the assessment order dated 15.01.2021, on 25.03.2025, the appellate order, as well as the consequent demand raised through DRC-07, while also requesting protection from coercive recovery measures.

The petitioner’s counsel presented the case that the petitioner had consistently submitted tax returns, including one for March 2020. In this return, the petitioner reported that the Central Goods and Services Tax (CGST) and State Goods and Services Tax (SGST) were appropriately deducted as tax at source on supplies amounting to ₹10,25,422 provided to the Local Area Engineering Organisation in Katihar.

Read Also: Patna HC Quashes GST Demand, Citing Non-Compliance with BGST Act and CrPC Inspection Rules

On December 7, 2020, a tax return was filed; however, the respondent authority issued a Show Cause Notice (SCN) on December 10, 2020, under Section 74, categorising the petitioner as a defaulter. It is important to note that the SCN was only made available under the Additional Notices tab on the GST portal and was not properly communicated via email or SMS.

As a result, the petitioner did not respond to the notice, leading to the imposition of tax, interest, and penalty under Section 74(9). This culminated in the issuance of demand order DRC-07.

From the GST portal, authorities were unable to validate that the return and the tax payment had been filed earlier, the applicant claimed. Formally, the business of the applicant was closed dated 30.09.2021 with the GST department itself certifying that no tax dues were left.

As per the state counsel (SC-1), the return was submitted late, and the applicant is unable to intimate the adjudicating authority via Form DRC-01B as mandated under the law.

No interest was filed on the late payment, explaining the issuance of SCN u/s 74. The counter affidavit considered that if intimation has been filed in Form DRC-01B by the applicant, then no additional proceedings u/s 73 or 74 shall have been executed.

As per the court, the applicant has submitted the return dated 07.12.2020 before the issuance of the show cause notice, and that the whole proceeding was triggered merely because of the non-communication in the specified form.

The Bench concluded that the case facts did not explain the initiation of proceedings u/s 74, based on the admission in the State’s counter-affidavit.

Therefore, the assessment order has been set aside by the Patna High Court dated 15.01.2021, the appellate order on 25.03.2025, and the demand thereafter. The writ petition of the applicant has permitted providing relief to the applicant against the coercive recovery.

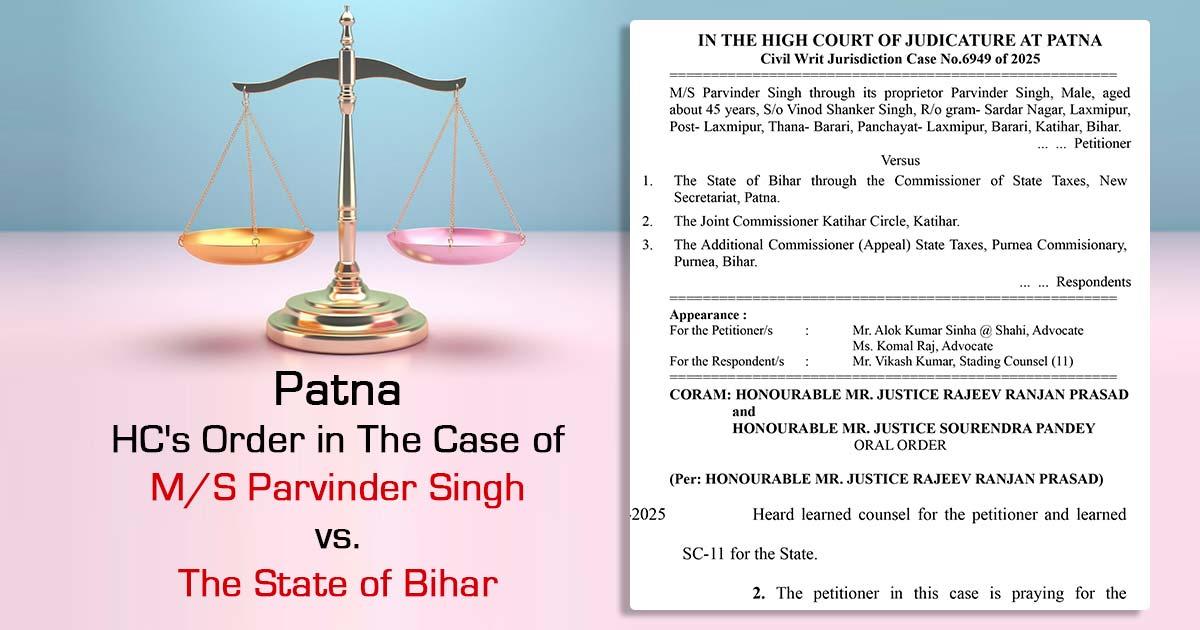

| Case Title | M/S Parvinder Singh vs. The State of Bihar |

| Case No. | No.6949 of 2025 |

| For the Petitioner | Mr. Alok Kumar Sinha, and Ms. Komal Raj |

| For the Respondent | Mr. Vikash Kumar |

| Patna High Court | Read Order |