The Patna High Court, the demand order u/s 73(10) of the GST ( Goods and Services Tax ) Act should be issued within 3 years from the filing date of the annual return and not the extended due date.

The bench of Chief Justice K. Vinod Chandran and Partha Sarthy carried that the extension given u/s 44(2) applies to the return filing, rather than the proceedings under section 73(10) of GST legislation. The applicant claimed that under Rule 80 of the Central Goods and Services Rules, 2017, the deadline for submitting the annual return is December 31 following the end of the financial year.

As per Section 73(10), any proceedings should be initiated within 3 years from the last date for filing the annual return. Concerning the case, the petitioner claimed that the three years for the 2018-19 assessment year ended on 31.12.2022, as the return was filed before 31.12.2019.

Though, the Assistant Solicitor General (ASG) said that the due date had been extended twice first to 31.10.2020, and then to 31.12.2020 because of the order of the Supreme Court extending the limitation period for fillings affected by the COVID-19 pandemic. Under this extension, the ASG asserted that the three-year period would lapse dated 28.05.2022, and the proceedings begun in April 2024 were still valid.

It was cited by the court that the 3-year duration u/s 73(10) is computed from the original deadline of annual return filing, not from any extended due dates.

It remarked that the extension notification that the commissioner issued does not hold the power to extend the regulatory duration for filing the returns u/s 44(2).

It is indeed observed by the court that the proviso under sub-section (2) furnishes the government the authority to furnish a notification, however, the notification shown to the court on 28.10.2020 was furnished via the commissioner, who does not hold that authority.

Read Also: Patna High Court Dismisses a Petition Questioning the Legality of Council

Under the proviso to Section 44(1) of the GST Act, the issued notification permitted the commissioner to waive specific groups of registered individuals from annual return filing. The same does not furnish the commissioner the authority to extend the deadline for annual return filing or the duration permitted under sub-section (2) for filing those returns.

On the GST assessment order, the court granted an interim stay and asked that any counter affidavits be filed within 3 weeks. The case has been postponed to October 26th, 2024 for additional consideration.

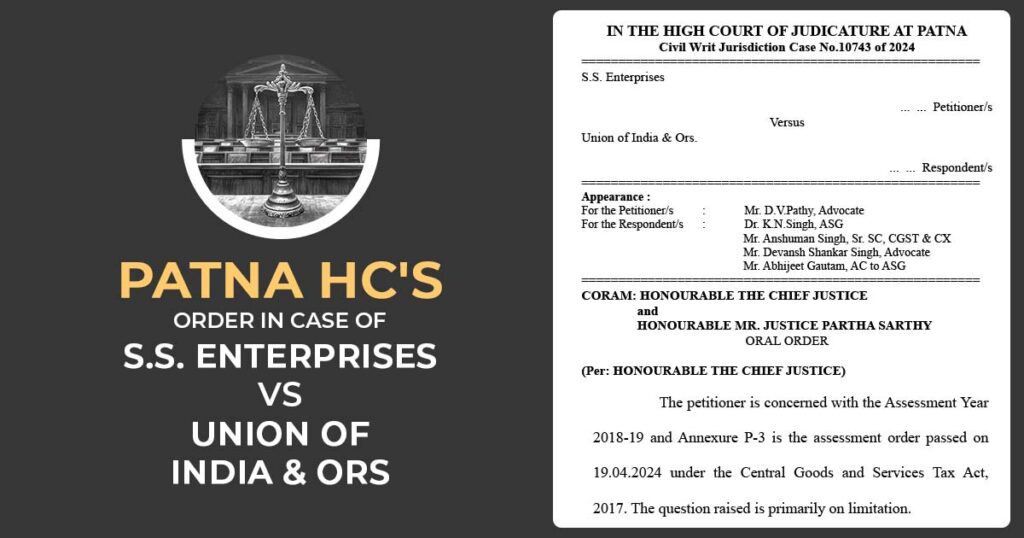

For the petitioner Mr. D.V.Pathy, an Advocate appeared and for the department Dr. K.N.Singh, ASG, Mr. Anshuman Singh, Sr. SC, CGST & CX, Mr. Devansh Shankar Singh, Advocate, and Mr. Abhijeet Gautam, AC to ASG appeared.

| Case Title | S.S. Enterprises Versus Union of India & Ors |

| Citation | Civil Writ Jurisdiction Case No.10743 of 2024 |

| Date | 11.09.2024 |

| Counsel For Appellant | Mr D.V.Pathy, Advocate |

| Counsel For Respondent | Dr K.N.Singh, ASG, Mr Anshuman Singh, Mr Devansh Shankar Singh, Mr Abhijeet Gautam |

| Patna High Court | Read Order |