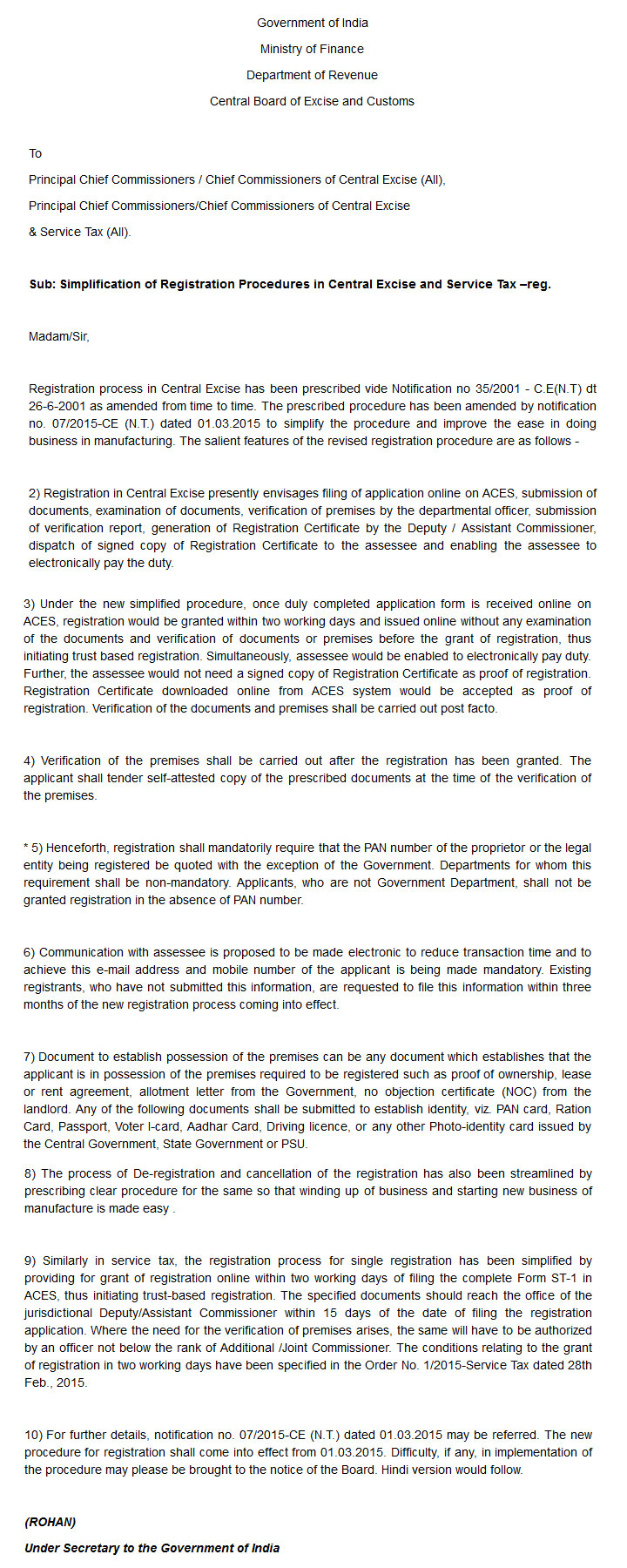

It is mandatory to mention the PAN number along with mobile number and email address while registering for the service tax. Without the Permanent Account Number, the application will not accept.

“Applicants, who are not government departments shall not be granted registration in the absence of PAN,” according to an order issued by the Finance Ministry.

Once the application form is filed through the Automation of Central Excise and Service Tax (ACES), then the completed application would be accepted online within two days.

If you are managing the private firm, then it is compulsory to mention the PAN number while filing the Service Tax.

Here is the format of service tax registration.

Source: http://www.caclubindia.com/news/pan-mandatory-for-service-tax-registration-14776.asp#.VQwTZdIsDfI