There are various furnished software available for TDS return preparation. But NDSL furnished their own software which is easier to practice. You can practice the same for filing the TDS return. If the taxpayer had furnished the online enrollment on the website of income tax site then the whole process shall convert to online. The benefit of that is we can furnish the return online from anywhere at any time for free of cost. See the attachment elaborating on the process.

Easy Process to Download & View Challan Status on NSDL RPU Portal

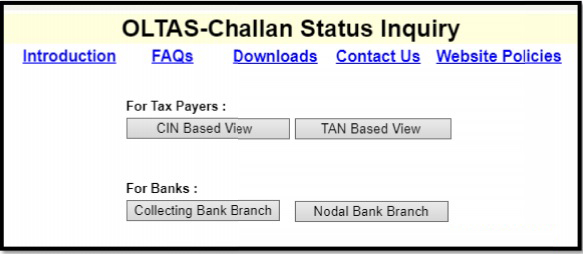

Step 01: Acknowledging the status of challan: https://tin.tin.nsdl.com/oltas/

Step 2. Tap on TAN based view

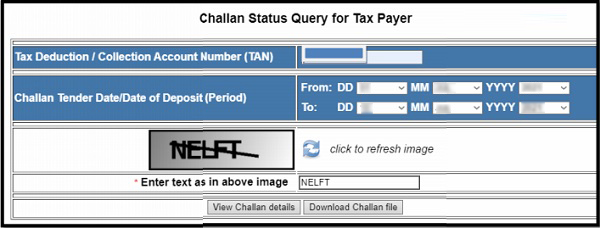

Enter the information as below (Date Range 2/3 days before or after the challan date)

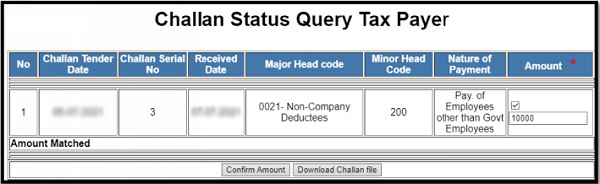

Step 3. See the information on the challan.

Enter the challan amount then tap on the confirm amount. The result shall be displayed as the amount resembled. Download the challan file which shall be practised for TDS return filing

Step-by-Step Guide of e-Filing TDS Return on NSDL RPU Web Portal

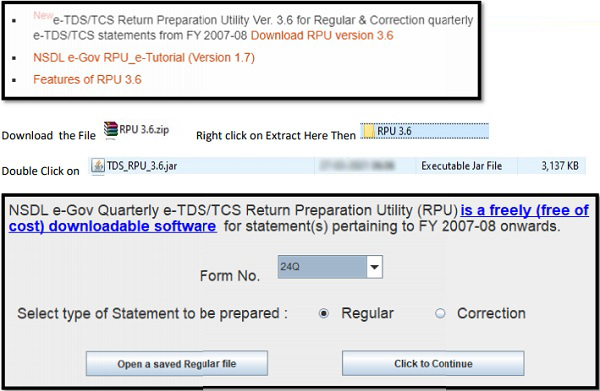

Step 1: Downloading the NSDL RPU utility

https://www.tin-nsdl.com/services/etds -etcs/etds-rpu.html

Step 2: Then tap on continue

Step 3: Fill in the details in the needed fields

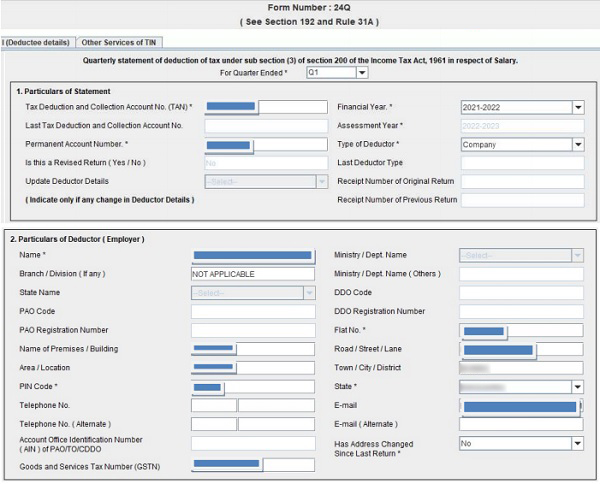

Given is the 1st page in the Form in which the ordinary information is required to be entered as below.

For case revised return receipt number of the original return is important.

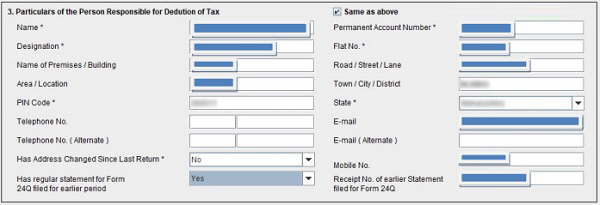

Step 4: Receipt no of earlier TDS Return is RRR number

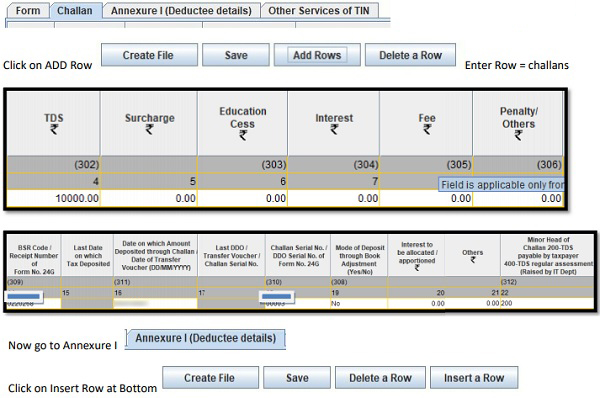

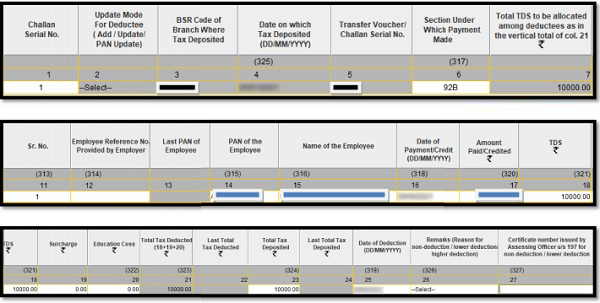

Step 5: Then now go to challan

The number of row orders is according to the Deductee Entries to be fixed towards Challan.

Step 6: For instance, there are two Challans.

TDS of one Deductee / Employee / One Pan Entry paid against Challan – 1

TDS of Three Deductee / Employee / Pan Entry paid against Challan – 2

Then Insert Row will be as Challan – 1 = 1 Row and Challan -2 = 3 Rows.

In the case of Huge data, a summary can be made in Excel then the equivalent can be used for Copy – Paste into Utility.

Formatting Date Cell [ DD-MM-YYYY ], Number Cells as General Format with 2 Digits Ex. 10000.00

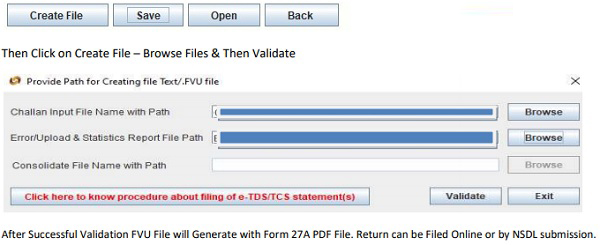

Step 7: Tap to Form and save the draft file that CSI furnishes (step 1) Downloaded and saved.

Reasons to Pick up Gen TDS E-filing Software

Gen TDS is effective TDS software that furnishes an easier and user-friendly interface that is simply made for furnishing the TDS and TCS returns online according to the laws of TRACES and CPC India. Gen TDS Online Return filing software which is an innovative tool will enable you to find out the TDS amount, Make TDS returns, determine interest and penalty along with late furnishing of the fees all at one stop.

Our software is an authorised TDS software that is listed on the government of India’s official tax information network website. Indeed we have posted the highest rank in India in FY 2012-13 in the Indian government’s authorized TDS filing software list.

We have filed 26q, but on filing, forgot to mention year and and form type 26q, now on acknowledgement not showing detail, not what should we do?