The Central Board of Direct Taxes (CBDT) made a significant change in July 2022 by making it mandatory to electronically file Form 10F. Initially, non-residents without Permanent Account Number cards were given a relaxation, but this grace period has now ended. Starting from October 1, 2023, anyone seeking treaty benefits must electronically file Form 10F, regardless of whether they have a PAN card or not.

Fill Form for ITR & TDS Compliance Software

Easy Steps to File Online Form 10F for NRIs

To assist non-residents in navigating the electronic filing process for Form 10F, here is a step-by-step guide:

Step 1: Access the E-Filing Web Portal

- Go to the e-filing web portal at https://eportal.incometax.gov.in/

- To begin the registration process, click the “Register” button located in the upper right-hand corner of the webpage.

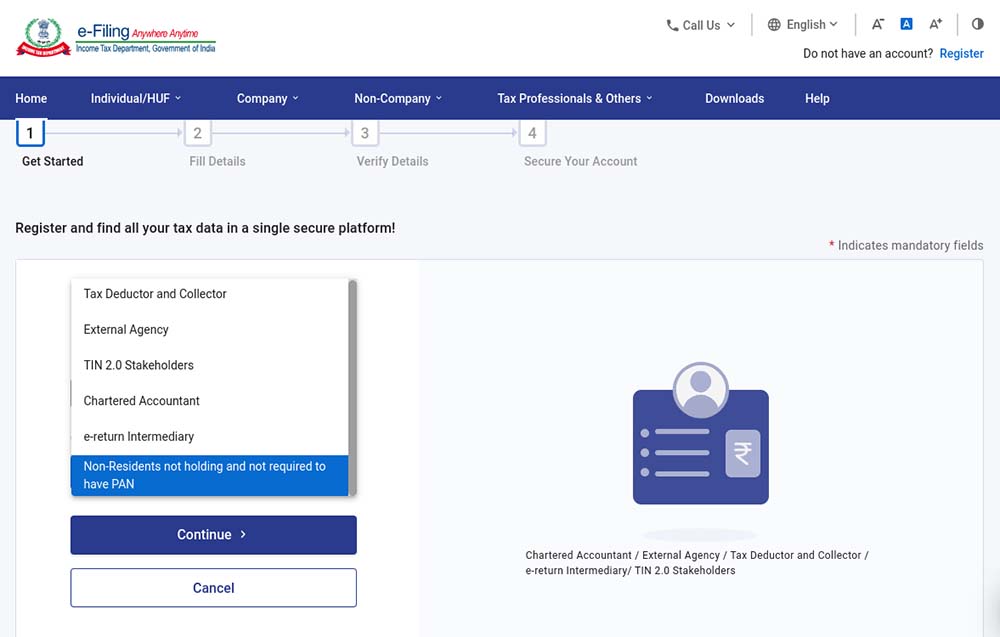

Step 2: Registration Category

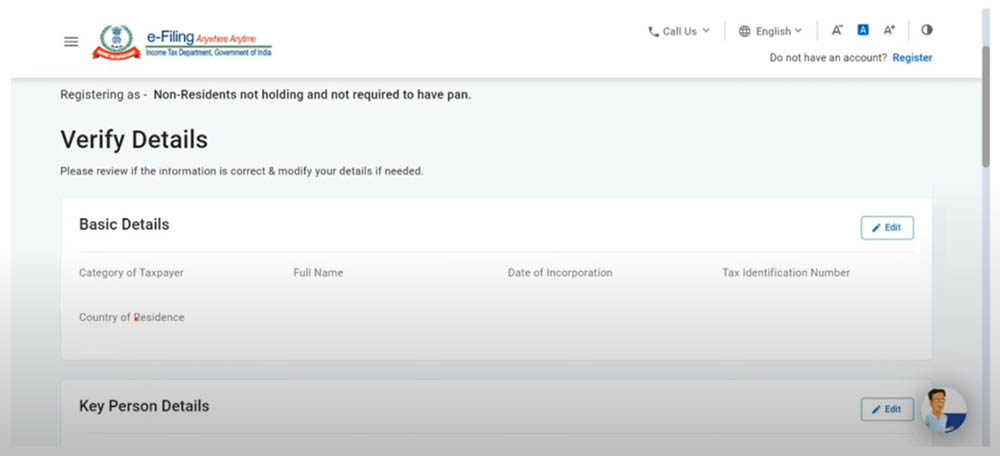

- Choose the “Others” option and click on “Non-residents not holding and not required to have PAN” from the provided list of choices in the drop-down menu.

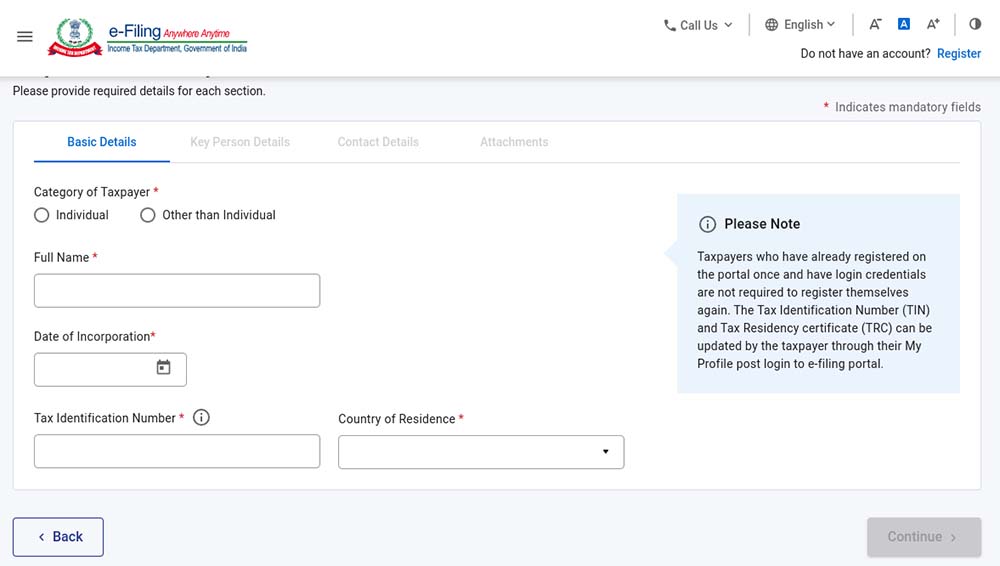

Step 3: Taxpayer Information

- Fill in the necessary details, including your full name, date of incorporation/birth, tax identification number, and country of residence.

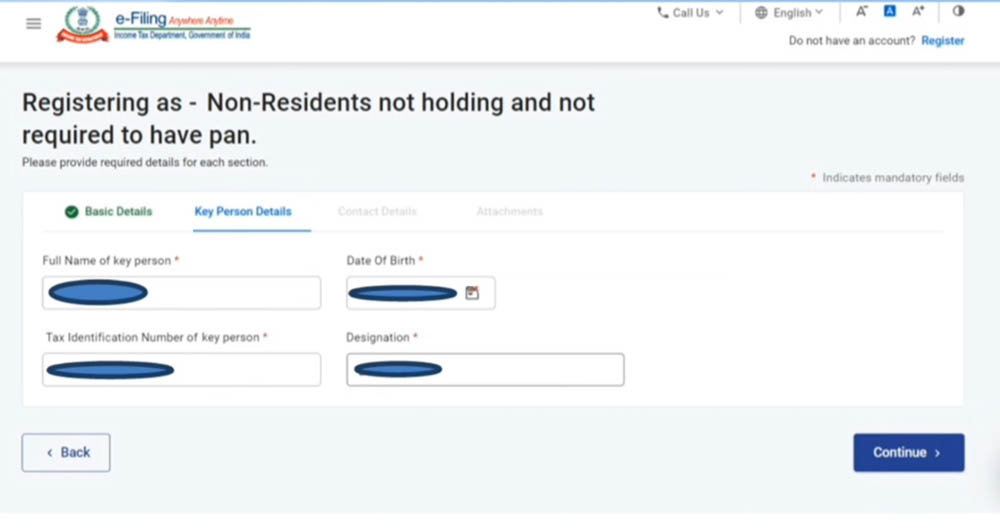

Step 4: Key Person Details

- Furnish the relevant information concerning the key person, which includes their full name, date of birth, tax identification number, and designation.

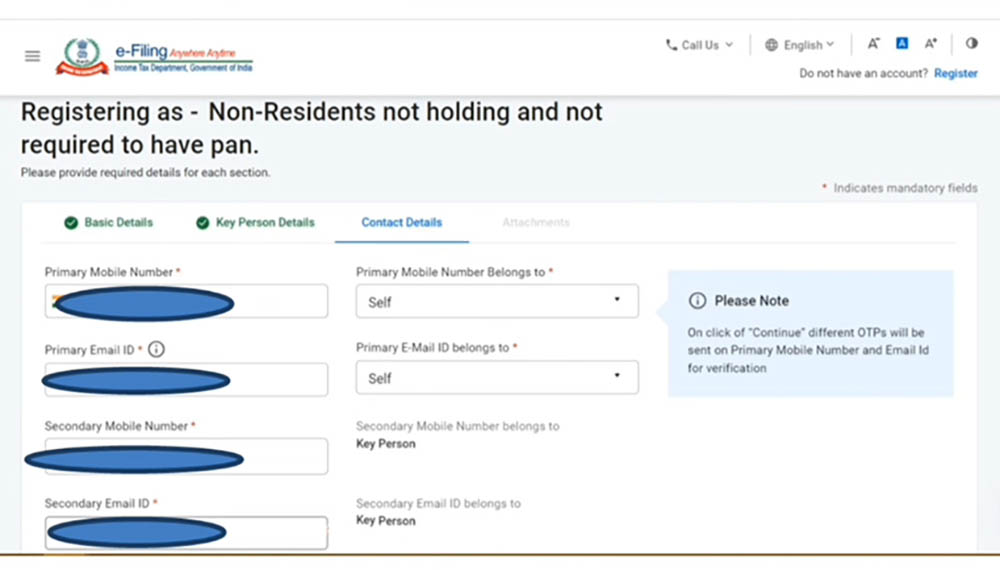

Step 5: Contact Information

- Provide contact details for the key person, including a secondary email address and additional contact information. Keep in mind that you will receive a one-time password (OTP) on your primary mobile number and email ID.

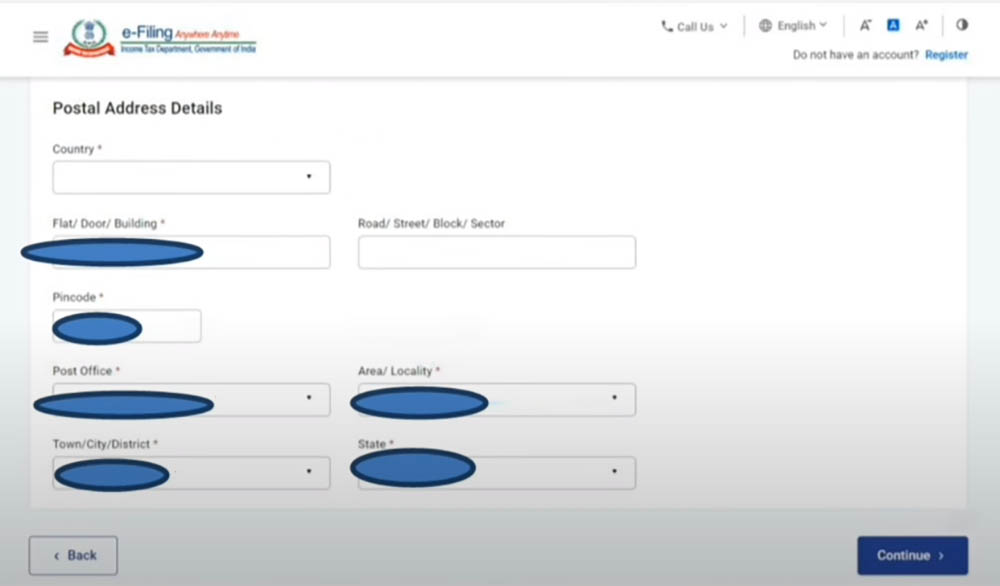

Step 6: Postal Address

- Enter the company’s postal address.

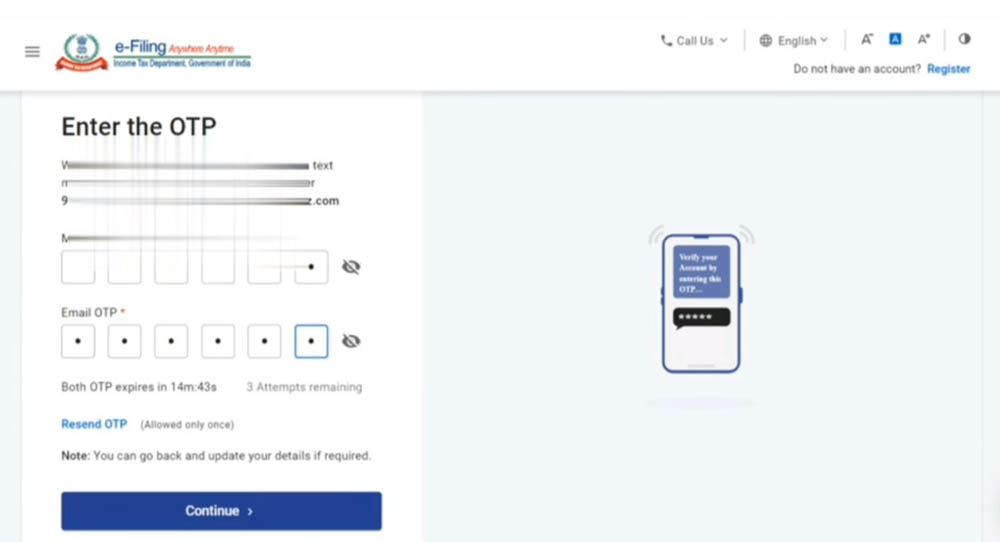

Step 7: OTP Confirmation

- Enter the One-Time Password (OTP) that you have received on your main email address and primary mobile number.

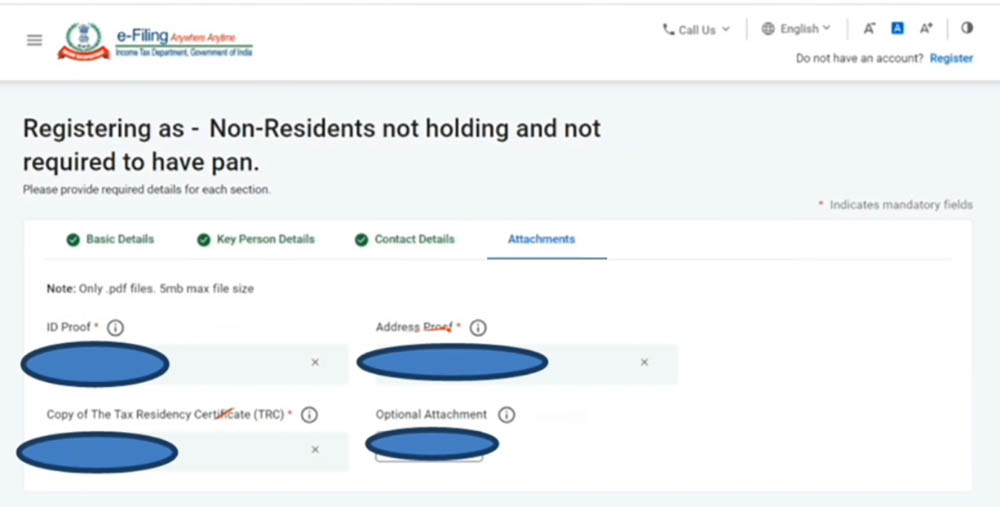

Step 8: Document Attachments

- Attach the necessary documents, such as the Tax Residency Certificate, as required.

Step 9: Submission

- Once you have completed all the previous steps, submit the Form.

By following the aforesaid instructions, non-residents can effectively submit their Form 10F on the Income Tax Portal. E-filing of Form 10F is crucial for availing of Tax Treaty benefits, and this guide provides a hassle-free process for fulfilling all the necessary prerequisites.

For foreign suppliers who doesnot have indian mobile number, how they can generate form 10F online as the portal doesnot allow non indian mobile number. How this situation to be handled?

For foreign suppliers who doesnot have indian mobile number, how they can generate form 10F online as the portal doesnot allow non indian mobile number. How this situation to be handled?

after successful registration i did not copy ID no how can i get it?

the otp for email and mobile doesnt come

We are based in the UK. The verification code that is sent to our UK mobile number does not come through. Please can you advise me what to do?

I don’t receive SMS OTP. What Should I do instead?

While filling form 10F, it shows an error message as “INVALID FORMAT FOR ARN” after getting OTP. How to solve it?

I didn’t receive user id after registering as “Non-Residents not holding and not required to have pan”

How to get the same ?

1.Verify Registration Completion.

Ensure that you completed all required fields during registration, including:

2.Check Your Email

3.If you still haven’t received the user ID, reach out to the Income Tax Department’s e-Filing helpdesk.

Which is my USER ID after registration complete.

User ID is your PAN number.

There was an error while registering in Form 10F, namely in the name. Is it possible to correct the name?

Hello, I’ve submitted the 10F for A.Y.2022-23, 23-24 and 24-25. The status on the income tax website says file verified. What’s next? How do I get the tax that was withheld in the prior years?

Check the Status of Refund- Go to the “Refunds” section to check if a refund has been issued or is under process. If the refund is in process, it will typically show the expected date.

Verify TDS Credit-Ensure that the TDS deducted by the payer is reflected in your Form 26AS. This is a record of all the taxes deducted on your behalf.

Track Your Refund-If the refund is approved and you’re eligible for one, it will typically be credited to the bank account linked to your Income Tax records. If there are any discrepancies, you might need to raise a grievance through the e-filing portal or contact the Income Tax Department for clarification.

Do you need to create a password to submit Form 10F without PAN. Can we change email address and mobile phone for the OTP if someone has left the company?

Don’t need a password for Form 10F submission without a PAN. If someone has left the company, the email and mobile phone for OTP verification can be changed, but it will typically require updating the contact information in the Income Tax portal.

I filled out the form as correctly as I could. (No idea what to insert for “Post Office” or “State” for a Country where there isn’t one). I Even got thru the OTP’s. Then I get a message that says, “INVALID FORMAT FOR ARN”. I figured out ARN was Acknowledgement Receipt Number. But that was not requested anywhere, nor do I have any idea what that is. How do I get by this? Thank you.

How did you get through OTPs?

I managed to receive OTP using Singapore mobile number. Which country are you from and have you manage to get the OTP yet?

How did you solve it?

We couldn’t receive the OTP for contact details verification from phone. What can we do?

Indian Income Tax will not send OTP to foreign mobile phone numbers. It is an Indian way of doing “gotcha” and “you are screwed.”

OTP Send to Indian mobile number only which is linked to Aadhaar number.

Please advise on the format of a Kenyan number. I can’t receive an OTP in all the formats that I have tried.

Thanks,

Sharon.

Cannot get the otp on foreign mobile number what can be done.

We do not have Indian number.

I am not receiving OTP, what should I do? I am using a foreign mobile number as primary contact number.

OTP generate on mobile number which is linked with Aadhaar number.

What is Aadhaar number? This instruction is for Companies with no PAN, how companies without PAN and indian mobile number link to Aadhaar number

“Aadhar number is 12-digit unique identification number issued to Indian residents by the Unique Identification Authority of India (UIDAI).

Companies without a PAN cannot directly link to Aadhaar. They should apply for a PAN through the Income Tax Department.”

who is the key person

Hello, I can´t receive the OTP number on my mobile. I have tried with different numbers but nothing, what can I do?

Contact to income tax portal

You can’t file a grievance on the income tax portal if you don’t have an Indian mobile.

We have not received OTP what do we do?

We couldn’t receive the OTP for contact details verification from phone. What can we do?

We couldn’t receive the OTP for Contact details Verification from phone. What can we do?

Filling 10 ff form