The Odisha State GST AAAR has issued a decision regarding the taxation of leasing e-bikes/EVs. It determined that leasing e-bikes without an operator falls under a specific category related to financial services. Consequently, as per the central tax rate notification No 20/2019- CT(R) issued in September 2019, this service is subject to an 18% Goods and Services Tax (GST).

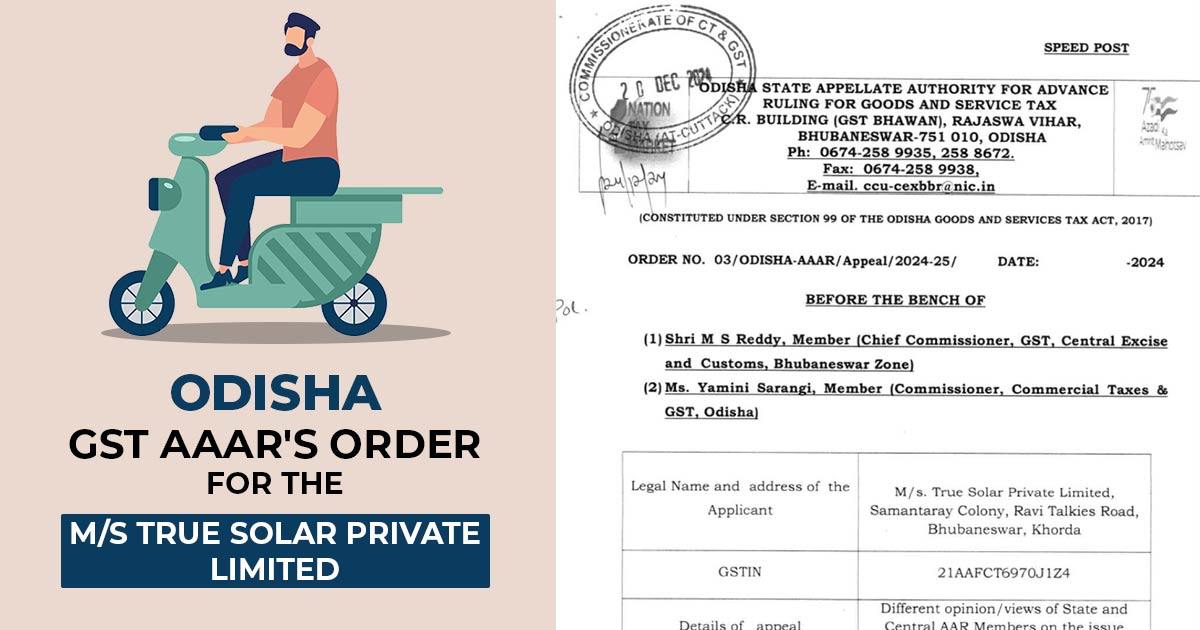

The petitioner, M/s True Solar Private Limited, is a company that is in the supply of goods and services. The petitioner asked whether lasing of electronic vehicles (E-bikes/EVs) without an operator can be classified under the heading 9973- ” leasing or rental services without operator as per the amended Notification No 20/2019- CT(R) dated 30th September 2019.

Read Also: A Deep Analysis of GST Framework on EV Charging Services

The applicant had implemented a vehicle lease agreement under the name of M/s Techsofin Private Limited of Bhubaneshwar for the supply of electric vehicles without an operator on a lease basis.

It was argued by the petitioner that their transactions consisted of the transfer of the right to use the goods which fulfilled the Apex court conditions in the case of BSNL. It was claimed by the appellant that it is SL. No.17 (iii) is not applicable; their matter shall still be entitled under SL.No 17(viia), mandating them to file the tax at the applicable rate to supply identical goods.

The submission of the applicant was analyzed by the Authority for Advance Ruling (AAR), Odisha, and the relevant rules and amendments were considered. The two AAR members proposed two distinct views. The SGST member categorised the service under heading 9971 which means it comes beneath financial and pertinent services with the tax rate matching the supply of identical goods involving title transfer.

The CGST member has placed the service under the heading 9971 though under a distinct sub-entry claiming an 18% GST rate. As of such incompatible views, the case was transmitted before the Appellate Authority of Advanced Ruling (AAAR) provided Section 98(5) of the CGST Act, 2017.

It was noted by AAAR that it is crucial to analyse the nature of the lease agreement if it comprises a financial lease or an operating lease agreement. From the submissions, it was noted that the petitioner has entered into a financial lease agreement with the lessee and is in the supply of financial leasing services/ financial and pertinent services. It was noted that the relevant heading towards the same shall be 9971.

It was claimed by the two-member bench consisting of Yamini Sarangi ( Member (State Tax) and M Sreedhar Reddy ( Member (Central Tax) ) that the leasing of electric vehicles (E-Bikes) without operator is categorized under the heading 9971 that is financial and services under entre SL No. 15 (ii) of Notification No. 20/2019 dated. 30th September 2019, and the tax rate will be identical as applicable on the supply of goods engaging the transfer of title in goods.

| Applicant Name | M/s True Solar Private Limited |

| GSTIN of the applicant | 21AAFCT6970J1Z4 |

| Date | 07.11.2024 |

| Applicant | Jiban Pradhan, Advocate |

| Odisha GST AAAR | Read Order |