The Orissa High Court reminded tax authorities not to harass practising lawyers with notices regarding GST and service tax levies.

Consequently, Chief Justice Harish Tandon and Justice B.P. Routray set aside the notices issued to a Bhubaneswar-based lawyer, which demanded service tax of ₹2,14,600 along with a penalty of ₹2,34,600 and applicable interest.

It noted that, “in view of the admitted fact that the Petitioner is a practicing lawyer…the Department the Petitioner is exempted from levy of service tax for such income he derived from his legal service as a Lawyer.”

Must Read: Allahabad HC: GST Commissionerate to Stop Issuing Tax Notices to Lawyers Rendering Law Services

As the applicant is an individual legal practitioner, the applicant must restrain the respondent authorities from taking action against him.

While the department stated that a show cause notice (SCN) was issued before the applicant for the breach of the Finance Act.

Guidelines must be considered by the HC which has been issued via the GST commissioner, citing that services given via an advocate or a partnership firm of advocates furnishing legal services before any person apart from the business entity and to a business entity holding a Rs 10 lakhs turnover in the preceding fiscal year are waived from imposing the service tax.

Read Also: Essential GST Terms Every Business Taxpayer Should Know

The High Court, concerning this, has set aside the notice “to the extent it relates to the demand of service tax from the income of the Petitioner from his profession as an individual lawyer.”

It lay on a Coordinate Bench ruling, which stated that practising advocates must not face harassment, based on the department issuing the notices asking them to pay service tax/ GST. “No notice demanding payment of service tax/GST will be issued to lawyers rendering legal services and falling in the negative list, as far as the GST regime is concerned…” it was ruled therein.

Orissa High Court, before the department granted liberty to proceed concerning the income from house property as revealed by the applicant, to impose the service tax as per the law.

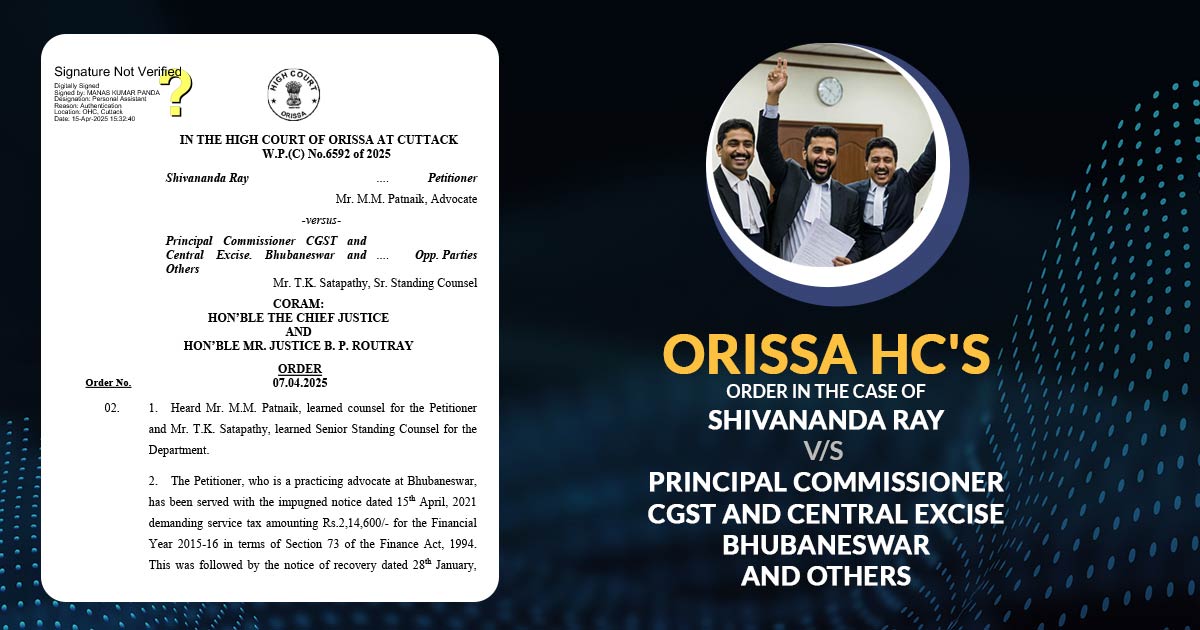

| Case Title | Shivananda Ray vs. Principal Commissioner CGST and Central Excise Bhubaneswar and Others |

| Citation | W.P.(C) No.6592 of 2025 |

| Counsel For Appellant | Mr. M.M. Patnaik |

| Counsel For Respondent | Mr. T.K. Satapathy |

| Orissa High Court | Read Order |