Here we will go through all the latest tax collected at source (TCS) provisions as listed by the tax department. The department has made clear all the points in detail. The Finance Act 2020 has launched three new provisions under Tax collected at source

TCS on Foreign Remittance Through LRS

The individual liable to manage

- Any approved merchant (“AD”) as specified under FEMA

When the tax should be collected

- AD obtains an amount or a total of the value of INR 700,000 or higher in a fiscal year

From whom the tax should be raised

- From a customer of the overseas currency sent out of India below the LRS

Price of Collection

- Rate of the collection is 5%

- In no PAN or Aadhaar case rate shall be 10%

Non Applicability in the following Cases

- If the customer is liable to subtract TDS

- If a client is a Government, ministry or high commission

TCS on Wholesaling Overseas Tour Packages

An individual liable to accumulate

- Trader of abroad travel packages and involves costs for travel, hotel visit or boarding or similar interests.

When the tax should be raised

- No financial deadline defined, the tax should be obtained irrespective of the cost

From whom this tax should be solicited

- From any person who buys such package

Charge of Collection

- Rate of the collection is 5%

- In no PAN or Aadhaar case rate will be 10%

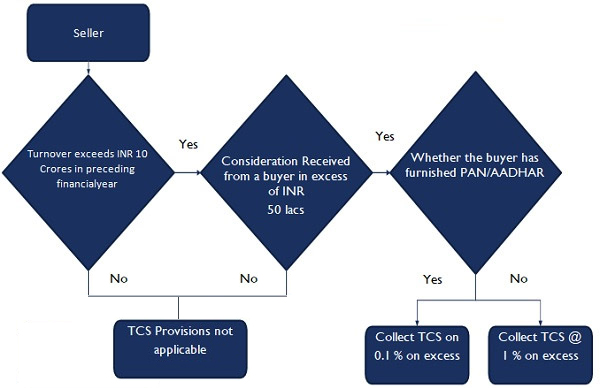

TCS on the Selling of Any Goods(1/3)

The person responsible to collect

A dealer whose turnover surpasses INR 10 Crores in the directly preceding financial year

When the tax should be collected

At sales time the product other than tendu leaves, timber, scrape, toll ticket, cars or goods responsible to TDS

From whom the tax should be collected

Value or aggregate amount of compensation received surpasses INR 50 lacs through.

Rate of Collection

- Percentage of the collection is 0.1%

- In no PAN or Aadhaar case rate will be 1%

Non Applicability in the below Cases

- If the consumer is likely to subtract TDS

- If a buyer is Government, ministry or high

TCS on the Selling of Any Goods (2/2)

TCS on the Selling of Any Goods (3/3)

One has tried to address the practical aspects to initiate the provisions through the FAQ:

Q.1 – How to collect tax from the buyer?

The invoice includes the amount of TCS that the seller needs to raise. But until the amount gets collected there is no concession arises on the collection of the amount.

Q.2 – How to conclude the applicability of these prerequisites?

The law cannot make important to the Act continuously when the seller is required to follow that means the applicability has to be laid on a year to year foundation.

Q.3 – Is TCS applied to the sale of the property?

Trade of property is narrated distinctively beneath the procurement of section 194IA for a value exceeding INR 50 Lakhs.

Q.4 – Whether TCS should be refunded in case of sales returns?

No, simply initial sales amount has to be returned as the amount of TCS would have been credited as prepaid taxes and will appear in form 26AS of the customer. Though the amount should not be settled or net settlement has to be done after settlement of return then on before-mentioned net remuneration TCS will be collected.

Q.5 – Whether the consideration will include the amount collected towards GST?

The term plan has not defined. Under the section 145A irrespective of the practice in books of accounts, the number of sales will be including GST.

TCS Payment and Return

- The TCS collection required to be paid for the next month in 7 days

- The quarterly TCS return has to be submitted i.e Form 27EQ

- The due date of tax in a quarter is divided

| Quater | Due Date |

|---|---|

| April-June | 5th July |

| July-September | 15th October |

| October-December | 15th January |

| January-March | 15th May |

Way Forward & Scope Forward

Way forward

We shall assist in determining the applicability of the above provision, depending on the nature of business and each business transaction. The value on which the tax has to be obtained and the amount of payment for all the transactions.

Scope Forward

An illustration of the global pandemic COVID – 19, We should not reflect the present improved rates as the government recommended. Although for the purpose of finishing the rates has been diminished in comparison to sales of goods the reduction is about 0.075% for a buyer who has PAN/Aadhaar for the present financial year.

Are applicable TCS Provisions for Cooperative Society

Please clarify the section of TCS.

in Which Section and payment Code TCS on Goods sale will be paid

Please clarify the issue then only we will be able to describe the section.

Dear

How we can make the E Waybill after adding TCS in the invoice? There is no column in e way portal for TCS

Please suggest

How to make e way bill after adding TCS in the invoice? there is no column in e way portal for tcs

You can show the same amount by adding it in the taxable value as there is no separate column for TCS in the e-way bill.

Sir, TCS @ 0.075% will be applicable on gross invoice value Rs. 118/- (Basic + 185 IGST).

However, upon supply, a consideration I will receive in the current financial year is only Rs. 108/- and balance Rs. 10 I will get in the next financial year i.e. after demonstration of 1-year warranty/guarantee period. In a given scenario TCS is chargeable in invoice whether on Rs. 118/- or Rs. 108/-. since I will receive consideration only Rs. 108/-.

if the Invoice is raised by the seller then the TCS will be charged by the seller on Invoice value, however, if upon supply seller received any advance consideration then TCS will be charged in advance and then adjusted afterward when the invoice is raised

Sir. Is TCS applicable to builders also? Let be think the cost of a Flat is Rs. 55 Lac then we have to charge TCS @0.075% or not.

Section 2016C(1H) is applicable on the Sale of goods on an amount exceeding Rs 50 lakhs @.075%.

I am a Govt servant responsible for collecting TCS on sales. Please clarify:-

1. TCS to be calculated on sale value with GST or Without GST

2. On what head the Govt organizations will collect TCS

3. on what head the TCS to be deposited

Please suggest if gst applicable on tcs for eg.:

sale value 10,000.00

cgst 9% 900.00

sgst 9% 900.00

tcs .075% 7.50

————————–

TOTAL 11807.50

IS THIS CORRECT OR GST APPLICABLE ON TCS AMOUNT ?

Dear Sir,

Sale between two sister concern companies under one PAN. Whether TCS has to collect on sale between sister concern under one PAN.

Since it is a transfer from one hand to another, TCS provisions will not be applicable as ultimately the consolidated Financial Statements will reflect net sales.

if the current FY PMT received from a party more than 50 lac but the sale only 30 lac, then TCS will be applicable or not

Section 206C(1H) states that if the seller receives any amount in excess of Rs 50 Lakhs as consideration for sales of goods, shall at the receipt collect from the buyer TCS on the said amount at a sum equal to 0.075% till March 2021 and after that 0.1% of the sale consideration as income tax.

Will this benefit the Car buyers who have to pay ~10k TCS while buying car of cost > 10 Lac?

No, as the new Provisions are applicable only where there is no TCS or TDS applicability as per old provisions.

New TCS on Sale Any Goods GST EXEMPT YA GST WALI ITEM PER HAI

PLEASE REFER PROVISIONS OF SECTION 206C(1H)

Is it TCS is applicable for repair and maintenance on repairing the motor vehicle. As of now, we are having the only TDS for repairing the motor vehicle under warranty. So going forward from October is it TCS is also applicable for repairing the motor vehicle under warranty

As per section 206c(1h) is applicable on the sale of goods so please check whether repairing of a motor vehicle is covered under goods definition or not

IN CASE OF TCS ON SALES AND PURCHASE OF GOODS,

WHICH IS APPLICABLE FROM 1.10.2020, ARE EXEMPT GOODS ARE ALSO INCLUDED? FOR E.G. SALE OF MILK IF EXCEEDS 50 LAKHS TO ONE PARTY.

“AS PER SEC 206C(1H) TCS WILL BE APPLICABLE IF YOUR SALE OF GOODS (OTHER THAN GOODS COVERED IN SUBSECTION 1 OR SUB SECTION 1F OR SUB SECTION 1G) FROM A PARTY EXCEED RS 50 LAC”

What about import and export transactions? Are they liable for TCS?

As per sec 206c (1h) TCS will be applicable if your sale of goods (other than goods covered in subsection 1 or subsection 1f or sub-section 1g) from a party exceeds Rs 50 lac

Thanks for sharing important information. My question is that sir I have some transactions that already exceed Rs.50 Lakh. So on 01/10/2020, I have to collect on those transactions also. e.g. Sales up to Sept20 Rs.65 Lakhs Now I raised the bill of Rs.5 Lakh so TCS Will be applied to on Rs.5 Lakh or Rs.5 + Rs.15 (Rs.65- Rs.15)

If the Sales of goods exceed 50 lacs DURING A F.Y. and consideration exceeds 50 lacs DURING A F.Y., then on the excess of 50 lacs TCS will be applicable.

Therefore, Sales = 65+5 = 70 lacs

Therefore TCS is applicable. However, the provision would come into effect from 1/10/20, and therefore amount in excess of 50 lacs received after 1/10/20 is only eligible for TCS.

In the present case, TCS is collectible only on 5Lacs.

Hope it helps!

Provision of Section 206C(1H) states that the seller has to collect TCS if sells goods exceeds Rs. 50 lakhs or more either in single transaction of in aggregate during the financial year 2020-2021

As per sec 206c(1h) TCS will be applicable if your sale of goods from a party exceeds Rs 50 lac. There is no need to collect TCS on the first 50 lac. Above rs 50 lac TCS will be applicable, so TCS would be applied on Rs 15 lac

TCS on sales of goods – TCS is to be collected on a receipt basis. I would like to know whether TCS is to be collected on the Outstanding amount showing in books (bills raised before Oct. 2020) and payment received after oct. 2020

TCS to be applied on the taxable value of goods and services including GST, at the applicable tax rate on the date of issuing the commercial invoice.

1. sales return after issuing of invoice – TCS should not be reversed, the only customer to apply for return along with annual returns.

2. Only TDS is applicable either on an invoice or while collecting depending upon the nature of transactions under which section it is covered.

Regards

trradhakrishnan