Here is an interesting fact – Residential Status and not citizenship is the sole determining factor for imposing the tax. In other words, foreign citizens who have earned income in India are also subject to tax. However, the domain or criteria of residential status of India keeps on changing from Budget to Budget usually.

As per the law, in FY 2020-21, Non-Resident Indians (NRI) shall include Individuals of Indian Origin:

- Whose income from India is more than Rs 15 lakhs

- Who has visited India for less than 120 days

- His other income is not liable to tax in another country

‘Residents but Not Ordinary Residents’ (RNOR) shall include people of Indian origin:

- Who stays in India for more than 120 days but less than 182 days.

- Whose other income is not liable to tax in any other country

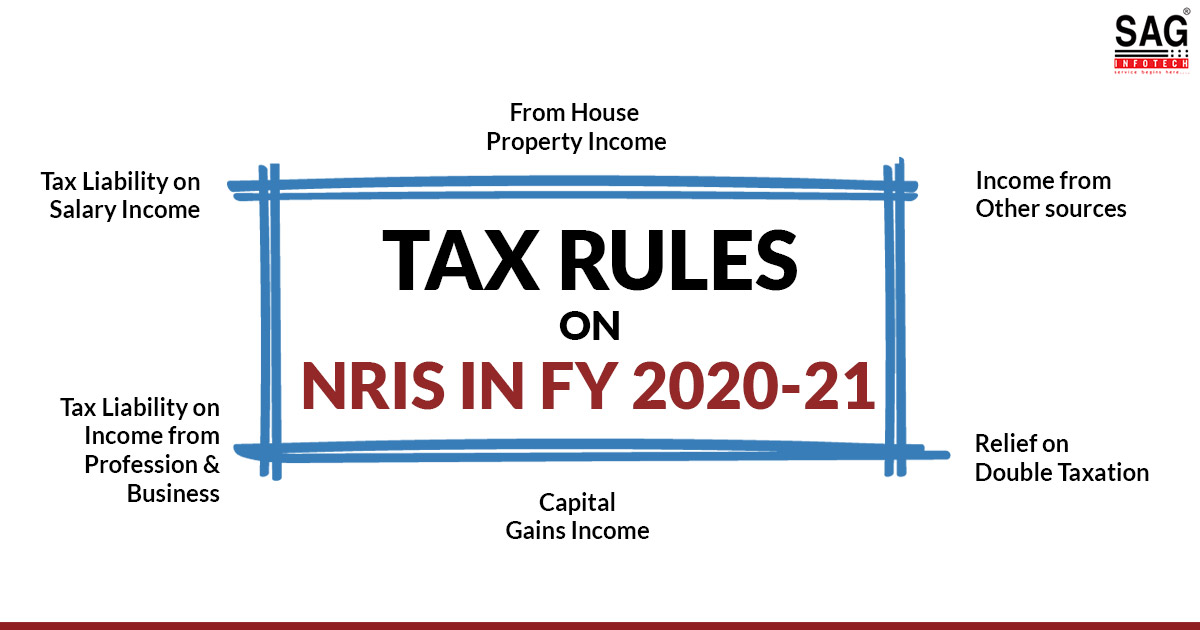

Incomes that are Liable to Tax for NRI & RNOR

Below is the list of all types of tax liabilities that apply to Non-Resident Indians’ Income in the current financial year 2024-25.

Tax Liability on Salary Income

Income from the salary that has been received in India or income for services that have been rendered in India shall be subject to Indian tax laws. If any NRI has received a salary for services rendered in India, his income shall be taxable as per Indian tax laws irrespective of the place of receipt. The rate of tax applicable shall be as per the slab rate applicable in FY 2024-25.

In the case of a citizen of India who gets any salary or income from the ‘Government of India for services rendered outside India, it shall be assumed as income that is accrued in India and shall be subject to tax even if an individual is a ‘Non-resident’.

From House Property Income

‘Rental Income received by NRI owner’ from a ‘house owned and located in India’ shall be subject to the same tax laws as applicable to residents.

NRI shall also get the benefit of:

- Standard deduction of 30%,

- Deduction of property tax paid

- Interest on a home loan and

- As per Section 80C deduction for principal repayment, registration charges, and stamp duty that is ‘paid on the purchase’ can also be claimed.

Here it is worthwhile to mention that the tenant of NRI has access to a TDS deduction at 30% under section 195. Furthermore, the tenant must fill the Form 15CA and submit it online to the income tax department.

Income from Other sources

Other sources of income like:

- A. interest that is received in savings accounts and fixed deposits held in Indian banks shall be taxable in the hands of NRI

- B. However, an interest that is earned in the NRO account is fully taxable. An NRO account is an account that is opened in the name of NRI to manage the income that is earned in India

- C. Interest in NRE and FCNR accounts is not subject to tax in India

Tax Liability on Income from Profession & Business

Any income that is earned by a Non-resident Indian from a business controlled or set up in India will be considered as income accrued in India and consequently taxable in India as per tax laws.

Capital Gains Income

Capital Assets held by NRIs like shares, house property, securities, gold and so on shall be taxable in India. In case, an NRI transfers any capital asset that is situated in India, he shall have to pay capital gain tax the same way as a resident of India pays.

However, If an NRI disposes of/sells a house property that has been owned in India for more than 2 years, the buyer has to pay TDS at the rate of 20% till 22 July 2024. If the house property has been owned for less than 2 years, TDS shall be charged at 30% till 22 July 2024.

In Budget 2024, Long-term capital gains referred to in section 112A exceeding Rs 1, 25,000 will be taxable at 12.5% from 23 July 2024 onwards. The new NRI TDS rate from July 23 is 12.5%.

Short-term capital gains in section 111A are hiked to 20% from 23 July 2024 onward. The TDS rate will be 20 % from July 2023 onwards.

In the case of capital gains that accrue to NRI on the sale of listed Indian stock and securities, the taxation rules are exactly the same as those applicable to Indian residents. However, NRIs can in no way adjust their ‘income from capital gain’ from the basic exemption limit of Rs 2.5 lakhs that applies to residents.

Relief on Double Taxation

In case NRI is taxed twice in both countries i.e. India and country of residence, tax relief from a Double Tax Avoidance Agreement (DTAA) that exists between the two countries can be sought. There are 2 ways of double taxation relief

- Exemption Method: In this case, NRI shall be taxed in only one country and exempted from another country

- Tax Credit Method: In the Tax Credit Method, tax relief can be claimed in the country of current residence of NRI

NRI Taxation